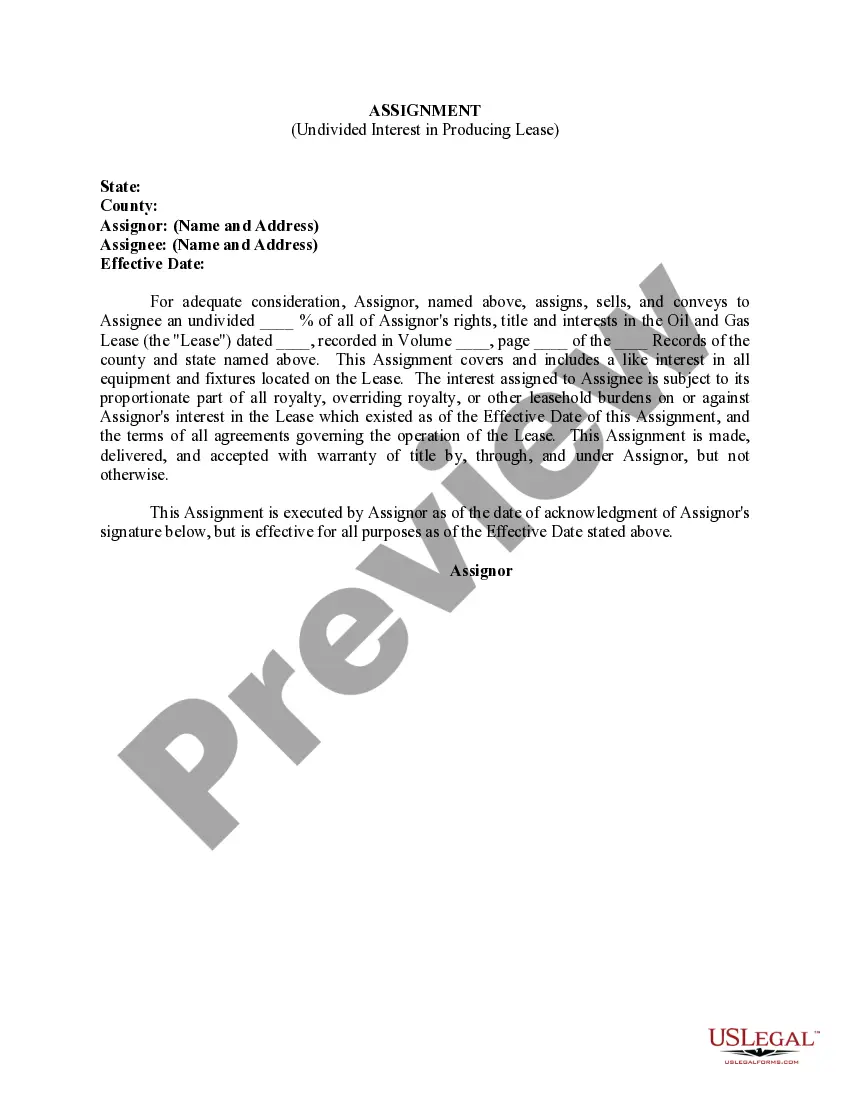

This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Deed Of Trust Records With No Maturity Date In Illinois

Description

Form popularity

FAQ

The first common requirement is that the deed must be in writing and signed by the grantor(s). 765 ILCS 5/1. Generally, deeds conveying a homestead estate must also be signed by the grantor's spouse, except where one spouse conveys to the other. A few other exceptions to this rule are set forth at 735 ILCS 5/12-904.

(d) If the trustee maintains records clearly indicating the respective interests, a trustee may invest as a whole the property of 2 or more separate trusts. (e) A trustee shall maintain or cause to be maintained trust records for a minimum of 7 years after the dissolution of the trust.

What are unreleased mortgages/deeds of trust? Unreleased mortgages or deeds of trust are legal encumbrances on a property's title that have not been properly discharged or released.

“Retain three (3) years in office, and then transfer to the Illinois State Archives for permanent retention.” NOTE: The term “permanent,” when used for archival and retention purposes, means forever. Using the term permanent to define a record's retention means that it has lasting value.

The general rule is to retain those records for at least the past five years. Please note that Section 1450.755 a) 4) states that employment or independent contractor agreements “shall be maintained for 5 years after the sponsored licensee is no longer associated with the sponsoring broker.”

3 Years: Such Records have a three-year retention period that commences at their creation.

Rule 1.15A - Required Records (a) For each client matter, complete records of client trust account funds and other property must be kept by the lawyer and must be preserved for a period of seven years after termination of the representation.

A trust deed expires and is extinguished from the record: 10 years after the entire debt becomes due; or. 60 years after the trust deed is recorded if the due date cannot be ascertained by records of the transaction.

A trust deed remains on your credit file for six years, a timescale that exceeds the term of most trust deeds which are generally completed in three or four years.