Trust Deed Format In Tamil In Kings

Description

Form popularity

FAQ

A trust is a legal structure that holds and uses funds, property or other assets for its beneficiaries. Trusts are managed by trustees. Only trusts supporting a charitable purpose that meet legal meaning of charity and our requirements for registration can register as charities with the ACNC.

The following elements are essential for the formation of a Charitable Trust: An Author or Settlor of the Trust. The Trustee. The Beneficiary. The Trust Property or the Subject Matter of the Trust. The objects of the Trust.

Examples of charitable trust are grant-making foundations. Unlike some other forms of non-profit organisations, charitable trusts are not established to specifically undertake action to fulfil a purpose, but to distribute funds in a considered way that enables other organisations to pursue their purpose.

Registration in Tamil Nadu Identity proofs of the settlor, trustee, and beneficiaries. Passport size photo. Address proof. Property documents related to the assets transferred to the trust. Affidavit of the settlor and trustee. Power of attorney (if applicable) Any other documents required by the Sub-Registrar's office.

A trust of immoveable property can be created by two ways. One by a non-testamentary document and another by a testamentary document such as a will. In other words, a trust regarding a immoveable property cannot be created orally but it must be by a document duly registered.

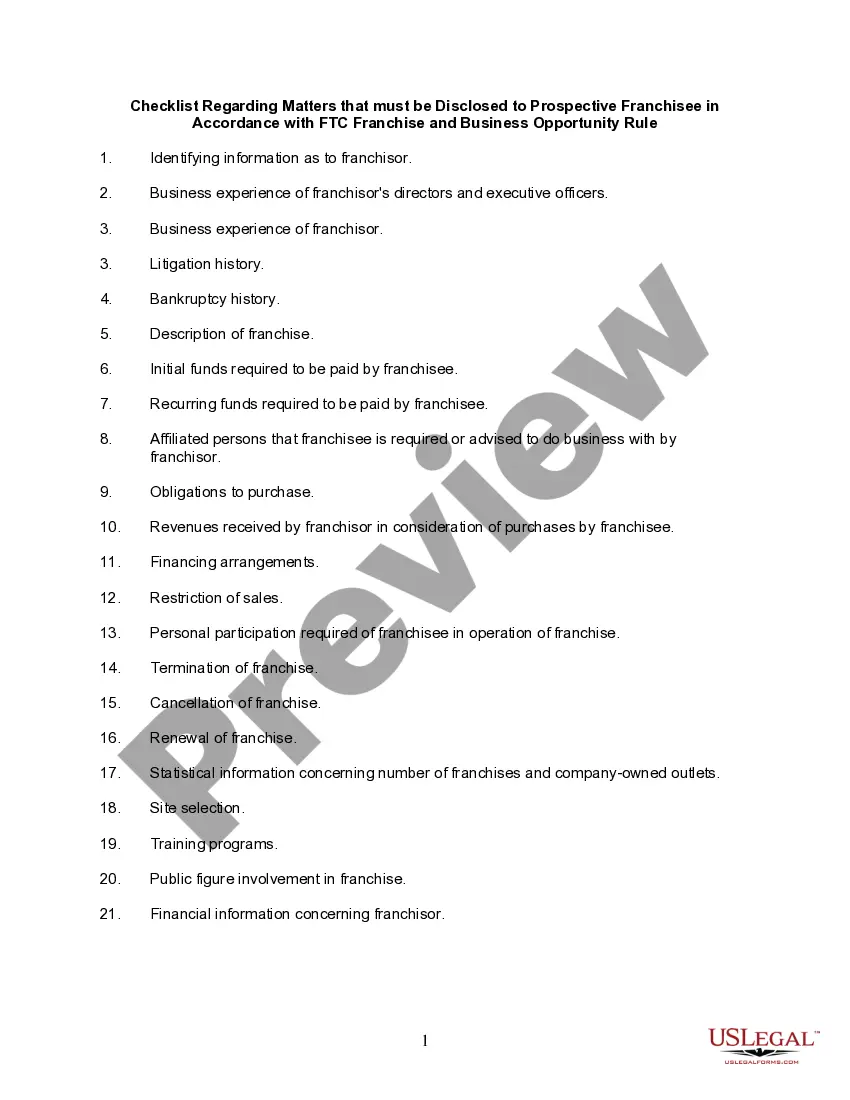

Process of Temple Registration Prepare Documents: Draft a Trust Deed and Memorandum of Association. Print on Stamp Paper: Get the Trust Deed written on non-judicial stamp paper. Submission: Submit the Trust Deed to the local Registrar's office.

A Charitable Trust is a type of unincorporated charity. It is not a legal entity in its own right; it has no separate legal personality. Business is therefore conducted in the name of the Trustees, who can then be held personally liable for any debts or obligations under contracts.

Registration in Tamil Nadu Identity proofs of the settlor, trustee, and beneficiaries. Passport size photo. Address proof. Property documents related to the assets transferred to the trust. Affidavit of the settlor and trustee. Power of attorney (if applicable) Any other documents required by the Sub-Registrar's office.