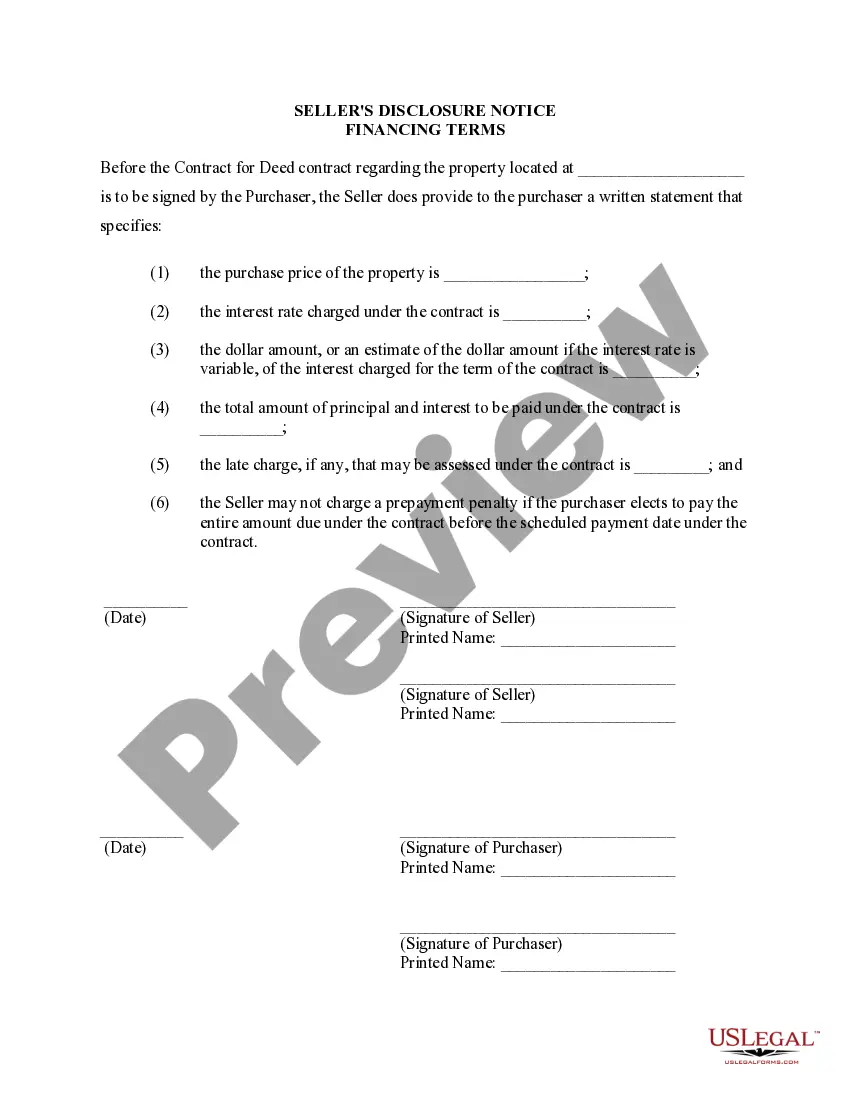

This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Change Deed Trust With Mortgage In Maryland

Description

Form popularity

FAQ

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...

Is Maryland a Mortgage State or a Deed of Trust State? Maryland is a Mortgage state and Deed of Trust state.

Maryland Security Instruments (Deed of Trust vs. Can an underwriter or title agent be designated as the trustee, and, if so, is it customary? Deeds of trust and mortgages are both acceptable under Maryland law, however, deeds of trust are used in almost every residential transaction.

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make ...

If you wish to change your name or remove a name on your property record, due to marriage, divorce, death of an owner, etc., a new deed must be filed with the local Land Records office where the property is located. You can not change a deed to a property through the Assessment office.

You can transfer a property with an existing mortgage into a living trust, and this is a common practice for estate planning purposes.

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make ...

The terms of a trust can only be validly amended when the amendment complies with the existing trust deed and rules. We assist by reviewing the existing trust rules and providing amendment documentation that ensure that the variation of trust terms remain compliant and effective. What's included: letter of advice.