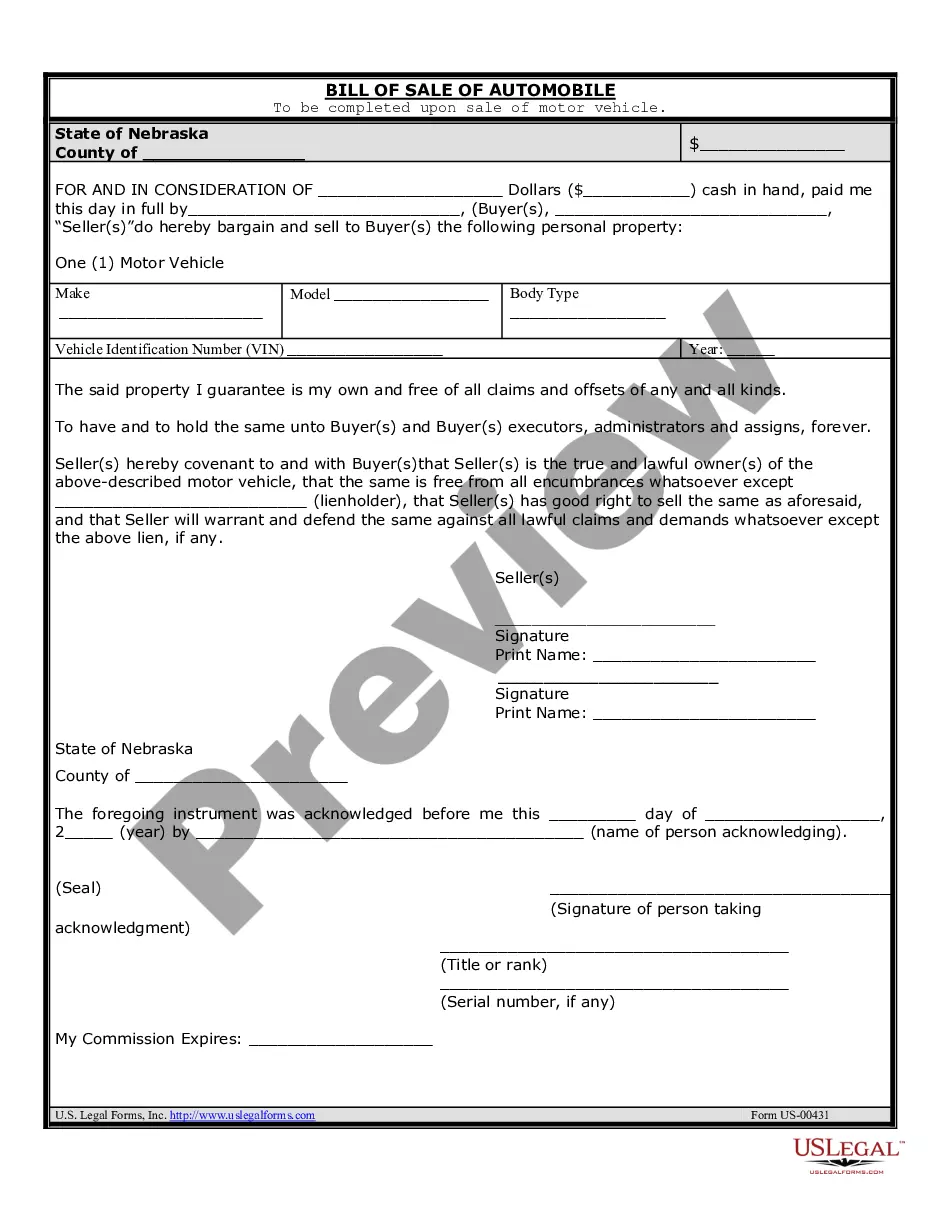

This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Deed Of Trust Modification With No Maturity Date In Miami-Dade

Description

Form popularity

FAQ

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make ...

If a deed of trust recorded in California does not contain a maturity date, then the lender has up to 60, and possibly even 64 years to foreclose non-judicially, but the longer the lender waits, the more likely it is that a borrower could successfully raise a defense of equitable estoppel or laches.

Ladybird Deeds AKA Enhanced Life Estate Deeds are Popular among Florida Seniors as an asset protection mechanism. Similar in function to other states "Transfer on Death" TOD deeds. This legal instrument is designed to avoid the pitfalls of probate, as well as spend down Medicaid.

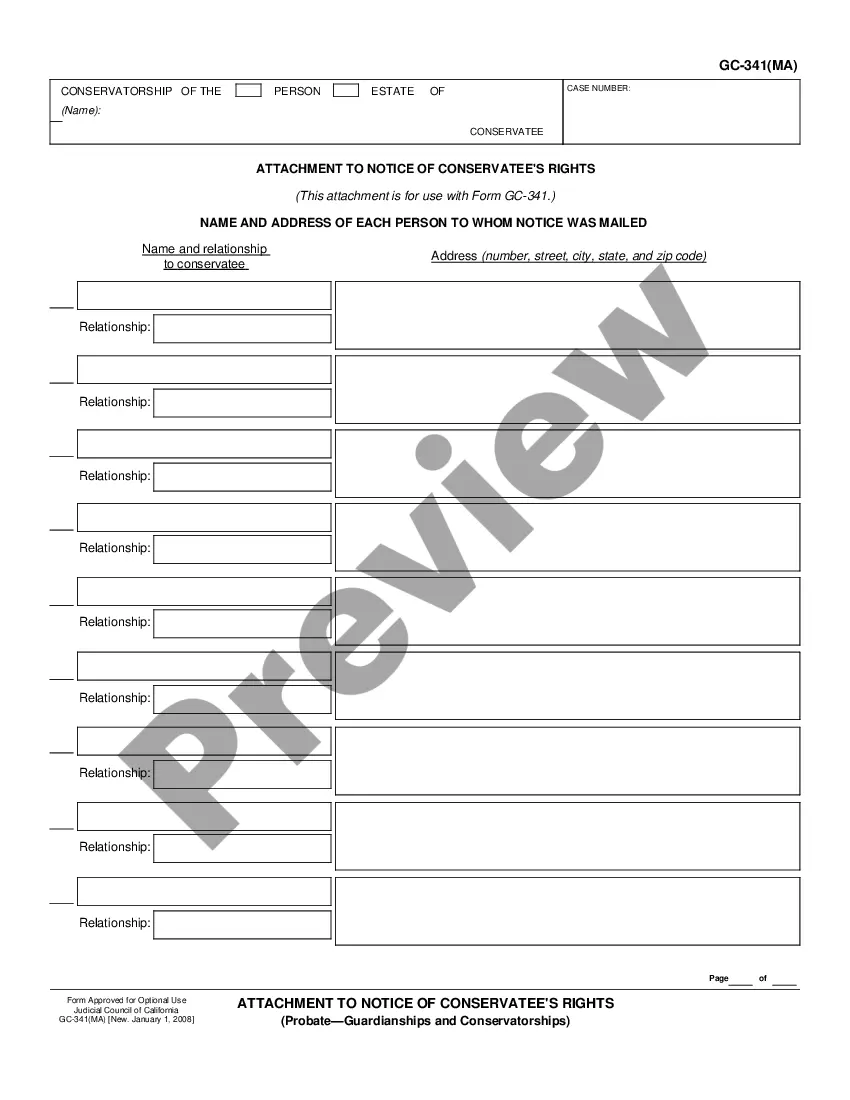

Notice of Administrative Modification is mailed to all property owners within the same radius of the zoning hearing being modified. This notice advises the neighborhood of what the applicant is proposing and explains their options for supporting or objecting to the proposal.

Miami-Dade County has updated their process and no longer requires that pro se litigants seeking to file name change petitions must either be represented by an attorney or must use the Miami-Dade County Self-Help Center. You can file your name change petition pro se using the forms you completed on this site.

All Notices of Commencement must be record via the Clerk of Courts. To view recording options available, please visit Clerk of Courts. You may eRecord your document through one of our approved vendors. With this option, you retain your original document and the recorded image is available the next day.

You may receive a Notice to Owner from subcontractors and material suppliers. This notice advises you that the sender is providing services or materials. Subcontractors and suppliers must serve a Notice to Owner within 45 days of commencing work to preserve their ability to lien your property.

Notice of Administrative Modification is mailed to all property owners within the same radius of the zoning hearing being modified. This notice advises the neighborhood of what the applicant is proposing and explains their options for supporting or objecting to the proposal.

Steps to file a mechanics lien in Miami-Dade County Step 1: Get The Right Form & Meet Margin Requirements. Step 2: Calculating Your Miami-Dade County Filing Fees. Step 3: Serve the Mechanics Lien. Step 4: File your lien with the Miami-Dade County Clerk.