This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Change Deed Trust With Irs In Michigan

Description

Form popularity

FAQ

Disadvantages of Putting Your House in a Trust Loss of Direct Ownership. Potential Complexity and Administrative Burden. Potential for Increased Costs. No Asset Protection Benefits. Limited Tax Advantages. No Protection Against Creditors.

Use Form 8822-B, Change of Address or Responsible Party – Business PDF to report changes to your responsible party, address or location to the IRS within 60 days. Send the form to the address in Form 8822-B.

Parents and other family members who want to pass on assets during their lifetimes may be tempted to gift the assets. Although setting up an irrevocable trust lacks the simplicity of giving a gift, it may be a better way to preserve assets for the future.

Use the following steps to set it up. Step 1: Choose between individual or joint trust. Step 2: Decide what property to include in the trust. Step 3: Choose a trustee. Step 4: Decide who will be the trust's beneficiaries. Step 5: Create a living trust document. Step 6: Sign the trust document in front of a notary public.

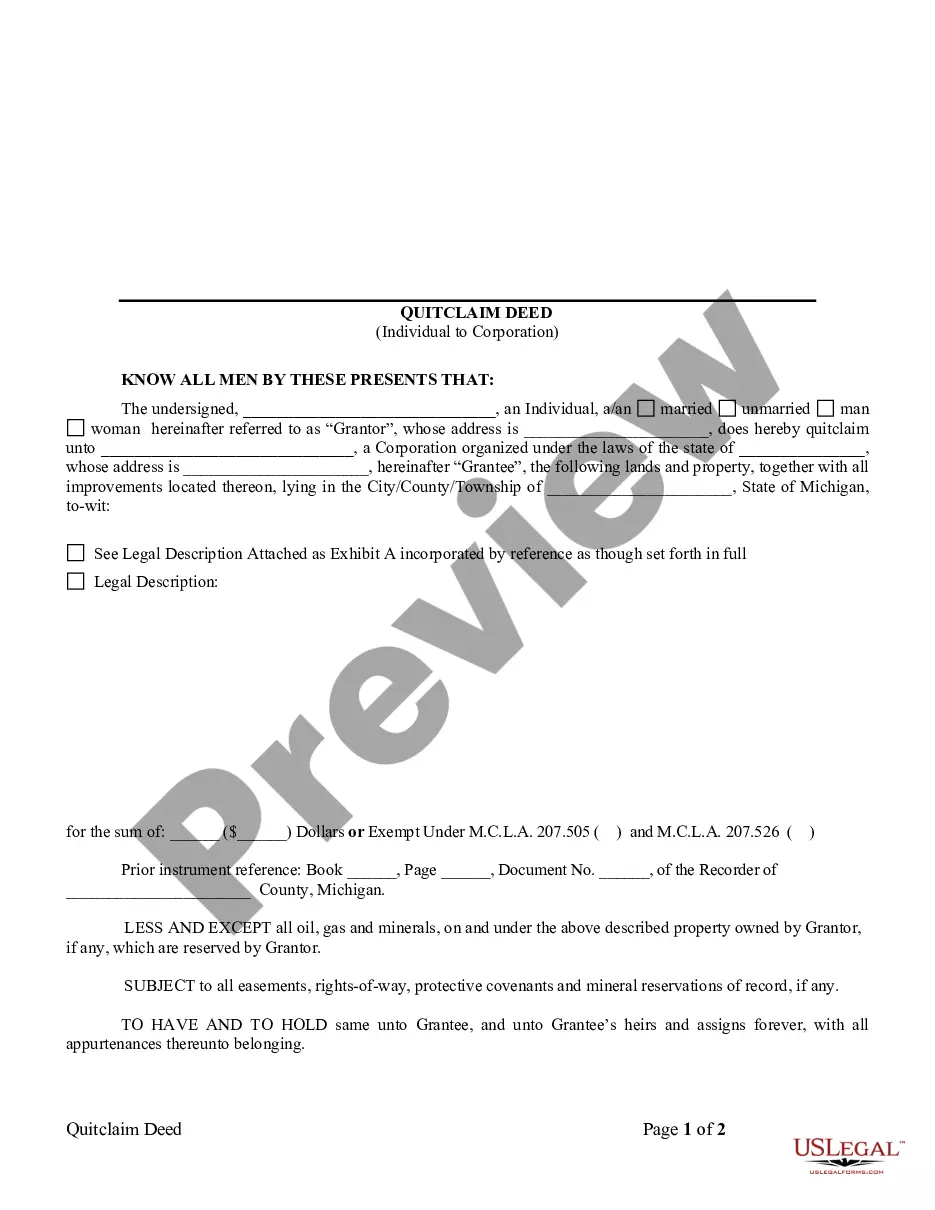

Sign and date the quitclaim deed in a notary's presence, then file it with the county Register of Deeds Office in the property's county, not the county where you live. Once the deed is filed and recorded, the transfer is deemed legal.

Summary. Placing a mortgaged property in a trust is possible and common, although key considerations must be taken into account. Some considerations to keep in mind are mortgage payments, refinancing, and the due-on-sale clause.

Currently the form cannot be filed electronically. The instructions for the Form 8822-B provide the following guidance. If you are an entity with an EIN and your responsible party has changed, use of this form is mandatory. Otherwise, use of this form is voluntary.

Ing to the IRS, estates or trusts must file Form 1041 by “the fifteenth day of the fourth month after the close of the trust's or estate's tax year.” Usually, the calendar year starts on the day of the death and ends on Dec. 31, and the Form 1041 due date of April 15 of the following year.

To change the trustee, you need to submit IRS form 8822-B, "Change of Address or Responsible Party" naming yourself as the New responsible party.