Deed Of Trust Without Promissory Note In Palm Beach

Description

Form popularity

FAQ

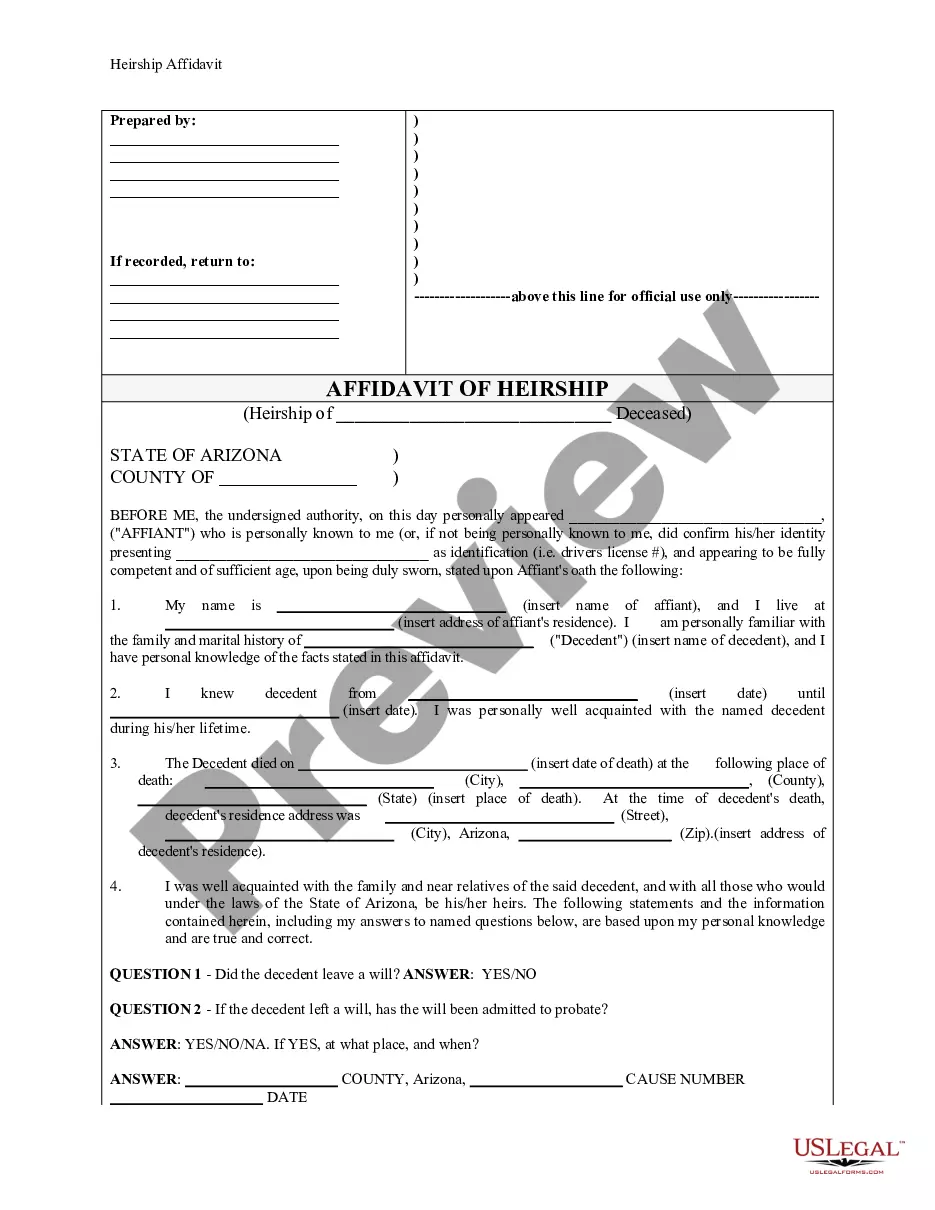

An attorney licensed to practice law in Florida must prepare deeds, powers of attorney, and other instruments that are to be recorded. General closing documents that will not be recorded can be prepared by a non-attorney provided they are not contractual in nature.

In response to a change in Florida law, the following is required when recording deeds: Government-issued photo identification of grantees and grantors. Mailing addresses noted below each witness name or signature on the document.

For more information on receiving copies of your public records, please contact the Records Service Center at (561) 355-2932.

3 legal requirements for a valid deed in Florida The signatures of the owners. The most important component of any deed is the signature of the current owner. Notarization. Given the power that deeds have and the value of real estate, there is plenty of incentive for fraud. Two witness signatures.

Recording a Deed Must present a photocopy of a government issued photo identification for each grantor(s) and grantee(s) listed on the deed. "Prepared by" statement (name and address of the "natural" person preparing the Deed) Grantor(s) (Sellers-Party Giving Title) names legibly printed in the body of the deed.

Florida law stipulates that a deed must be signed by the parties involved and witnessed by two individuals. If a deed lacks the requisite witnesses, it faces legal challenges. This can result in difficulties during property transfers and land record disputes.

A deed of trust will include the same type of information stated in a mortgage document, such as: The identities of the borrower, lender, and trustee. A full description of the property to be placed in trust. Any restrictions or requirements on the use of the property while it is in trust.

In a deed of trust, the borrower (trustor) transfers the Property, in trust, to an independent third party (trustee) who holds conditional title on behalf of the lender or note holder (beneficiary) for the purpose of exercising the following powers: (1) to reconvey the deed of trust once the borrower satisfies all ...

When a deed of trust is used as a security instrument, who holds the deed and the note? The trustee holds the deed, and the lender holds the note.

Yes you can complete and record your own deed. It must b properly signed, witnessed, and notarized.