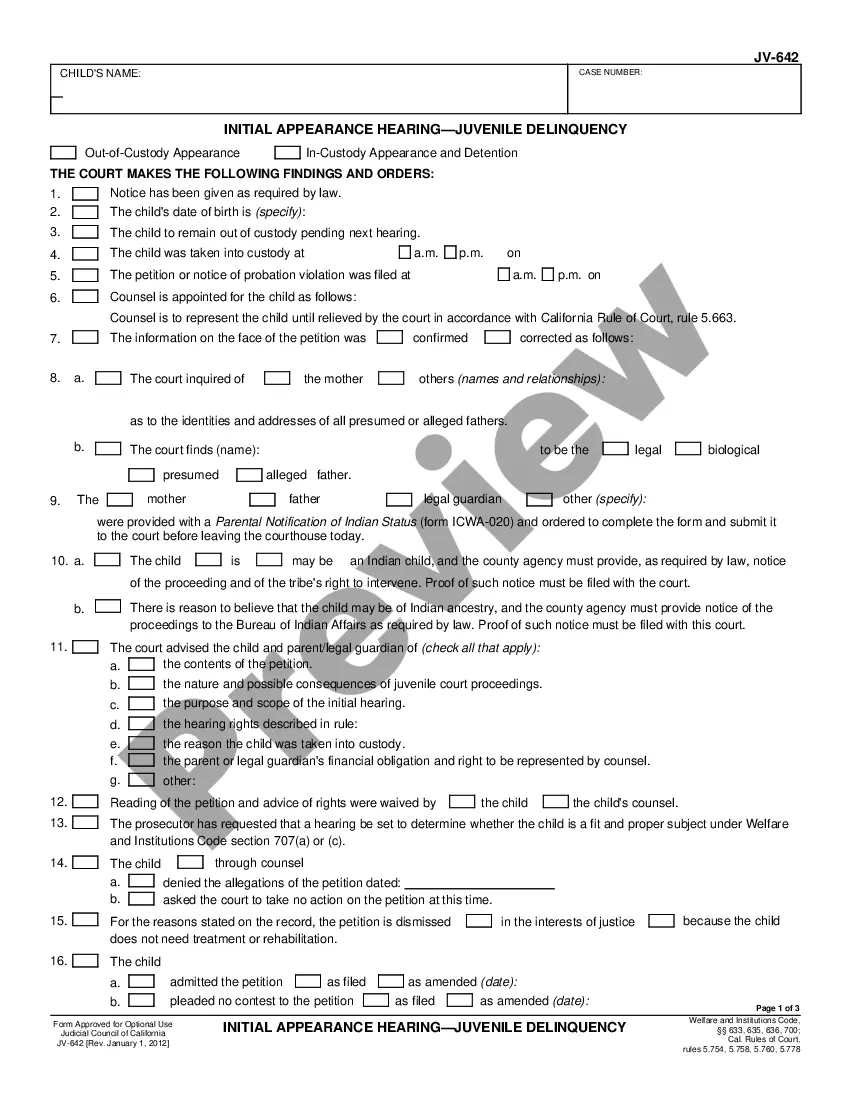

This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Change Deed Trust With Someone You Hurt In Queens

Description

Form popularity

FAQ

Once you've recorded a deed, it's a part of the public record and can't be changed. That's the bad news. The good news? You can execute a new deed called a correction deed to amend that original record.

If you wish to remove someone from a deed, you will need their consent. This can be done by recording a new deed, which will require their signature. If the person in question is deceased, you will need their death certificate and a notarized affidavit along with the new deed.

In some instances, trust deeds expressly permit trustees to vary the terms of the trust. In this case, trustees can rely on the relevant provision to effect the necessary amendments, subject to any restrictions or conditions attached. This is usually the simplest and quickest way in which to effect a variation.

Put simply, if the trust deed empowers the trustees to unanimously amend the trust deed, they may legally undertake such amendment regardless of whether beneficiaries have accepted benefits previously.

Key Takeaways. Revocable trusts offer flexibility and can be altered after they are created. Irrevocable trusts, once set up, cannot be changed, offering a different set of legal and tax benefits. Understanding the differences between these trusts is crucial for effective estate planning.

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make ...

The terms of a trust can only be validly amended when the amendment complies with the existing trust deed and rules. We assist by reviewing the existing trust rules and providing amendment documentation that ensure that the variation of trust terms remain compliant and effective. What's included: letter of advice.

You would have to record a new deed adding or removing the person(s) name. Because it is a legal document with legal consequences, we HIGHLY advise you work with an attorney to do so.

To change a deed in New York City, you will need a deed signed and notarized by the grantor. The deed must also be filed and recorded with the Office of the City Register. Transfer documents identifying if any taxes are due must also be filed and recorded with the City Register.

You would have to record a new deed adding or removing the person(s) name. Because it is a legal document with legal consequences, we HIGHLY advise you work with an attorney to do so.