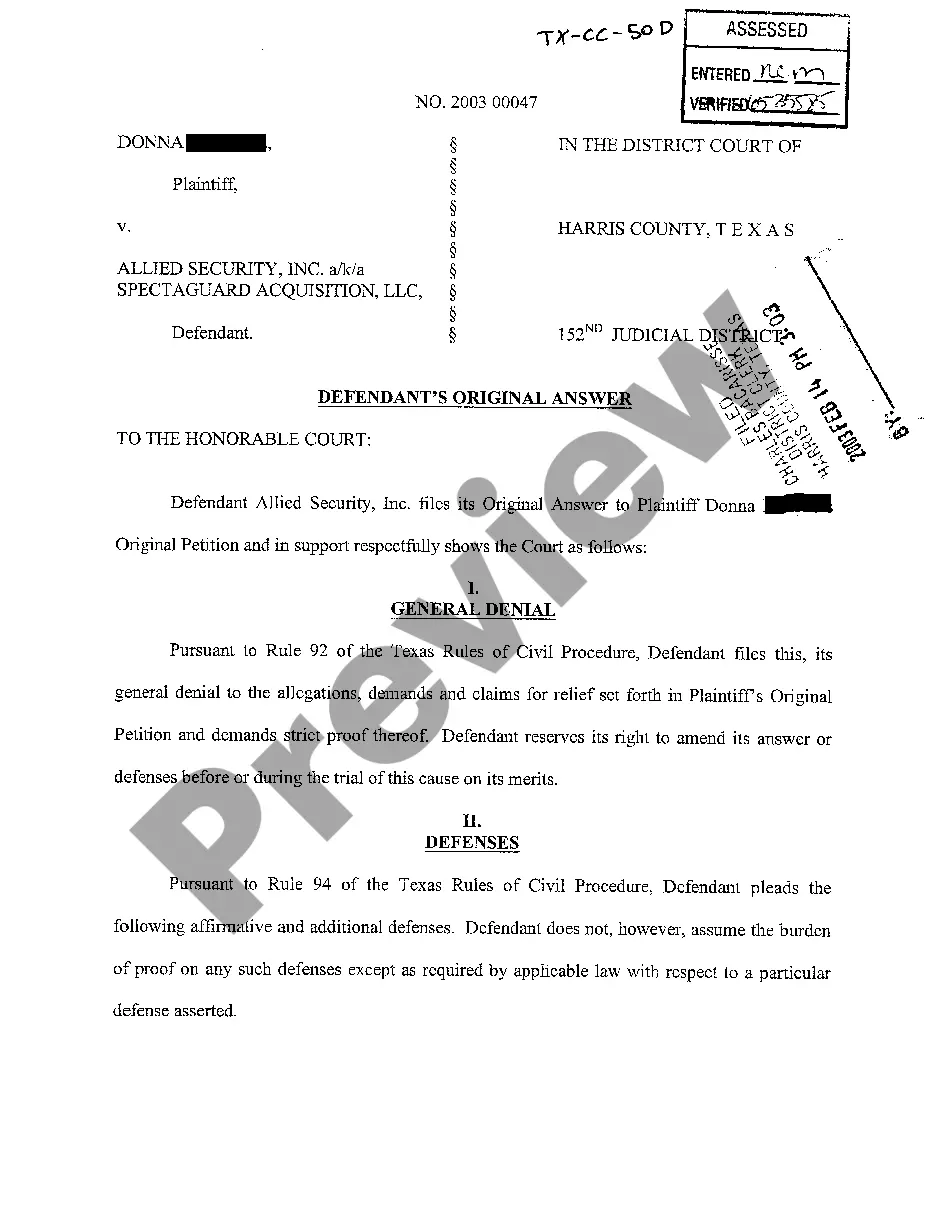

This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Change Deed Trust With Employees In Sacramento

Description

Form popularity

FAQ

Here is the rough outline: Select the trust that is best suited to your needs, such as a revocable living trust. Draft a trust deed and have it notarized so that it is legally binding. Record the deed at the county recorder's office. Notify the relevant parties, such as your mortgage lender and insurance provider.

You must choose the trust you want then draft and notarize a trust deed, record it and notify the relevant parties. The process is similar for all types of property.

In real estate law, "assignment" is simply the transfer of a deed of trust from one party to another.

If you wish to remove someone from a deed, you will need their consent. This can be done by recording a new deed, which will require their signature. If the person in question is deceased, you will need their death certificate and a notarized affidavit along with the new deed.

Transferring a property into a living trust does not typically affect its assessed value. In fact, California law explicitly states that property taxes will not be reassessed if a house is transferred into a revocable trust 3.

One disadvantage of placing your house in a trust is the loss of direct ownership. Transferring your property to a revocable living trust makes the trust the legal owner. While you retain control as the trustee, this change in ownership may affect your ability to mortgage or refinance the property.

Step-by-Step Instructions Determine the Parties to The Agreement. There will be three parties to these agreements. Prepare the Deed of Trust and Promissory Note. Get the Signatures Notarized. Record the Signed Documents at the County Recorder's Office. What Happens Next?