Modification Deed Trust Format For Ngo In San Jose

Description

Form popularity

FAQ

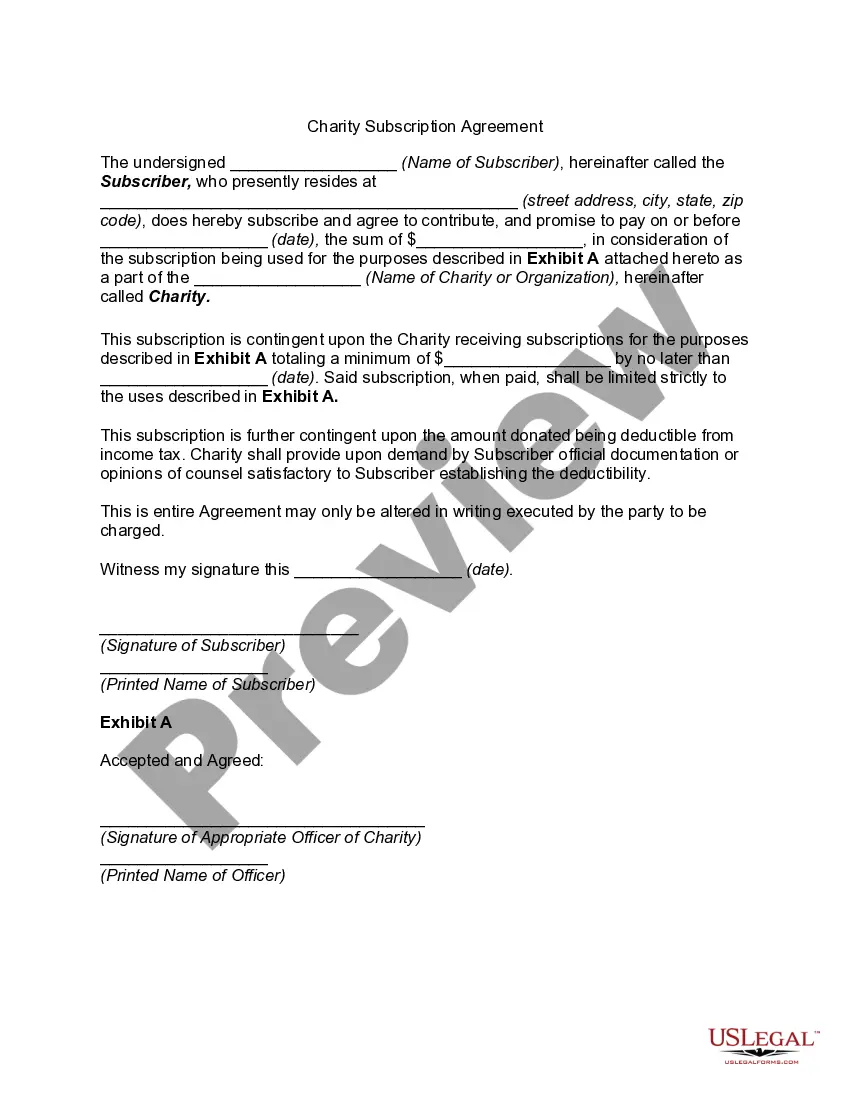

It must: Be in writing. Have an amount which matches the amount on the Note(s) Have a date which matches the date on the Note(s) Have a complete legal description of the property(s) being encumbered (street address only is not sufficient)

This Deed of Trust (the “Trust Deed”) sets out the terms and conditions upon which: Settlor Name (the “Settlor”), of Settlor Address, settles that property set out in Schedule A (the “Property”) upon Trustee Name (the “Trustee”), being a Company duly registered under the laws of state with registered number ...

Some of the most common reasons trusts are invalid include: Legal formalities were not followed when executing the trust instrument. The trust was created or modified through forgery or another type of fraud. The trust maker was not mentally competent when they created or modified the trust.

Ing to California Trust law: In order for a trust to exist there must be trust property. There must be a Grantor (sometimes referred to as a Settlor or Trustor). A Grantor is the person who transfers the property into the trust and creates the terms of the trust.

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make ...

The deed of trust must then be recorded with the county where the property is located, and each of the parties (the trustor, trustee, and lender) should keep a copy of the recorded document.

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make ...

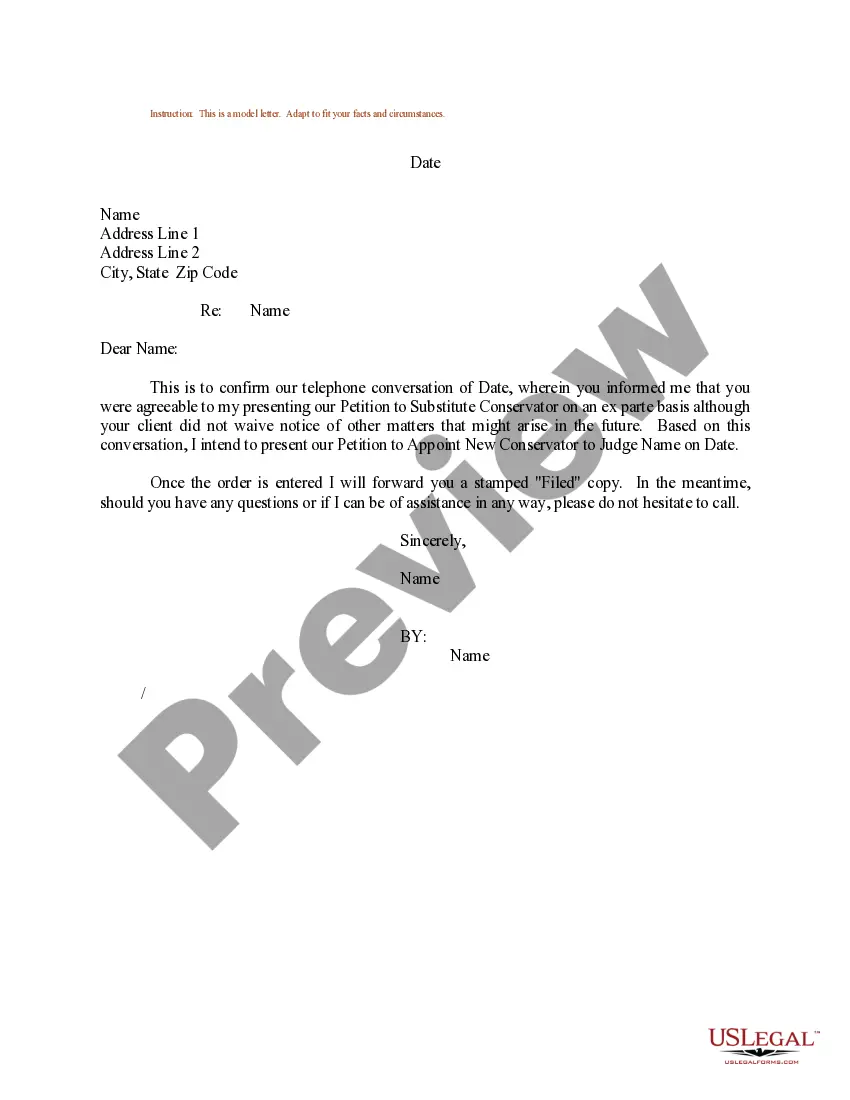

Here is the rough outline: Select the trust that is best suited to your needs, such as a revocable living trust. Draft a trust deed and have it notarized so that it is legally binding. Record the deed at the county recorder's office. Notify the relevant parties, such as your mortgage lender and insurance provider.

Here is the rough outline: Select the trust that is best suited to your needs, such as a revocable living trust. Draft a trust deed and have it notarized so that it is legally binding. Record the deed at the county recorder's office. Notify the relevant parties, such as your mortgage lender and insurance provider.

The short answer is that a living trust is a private document and does not need to be recorded in California. The only time a trust is in a public record is when it contains real estate.