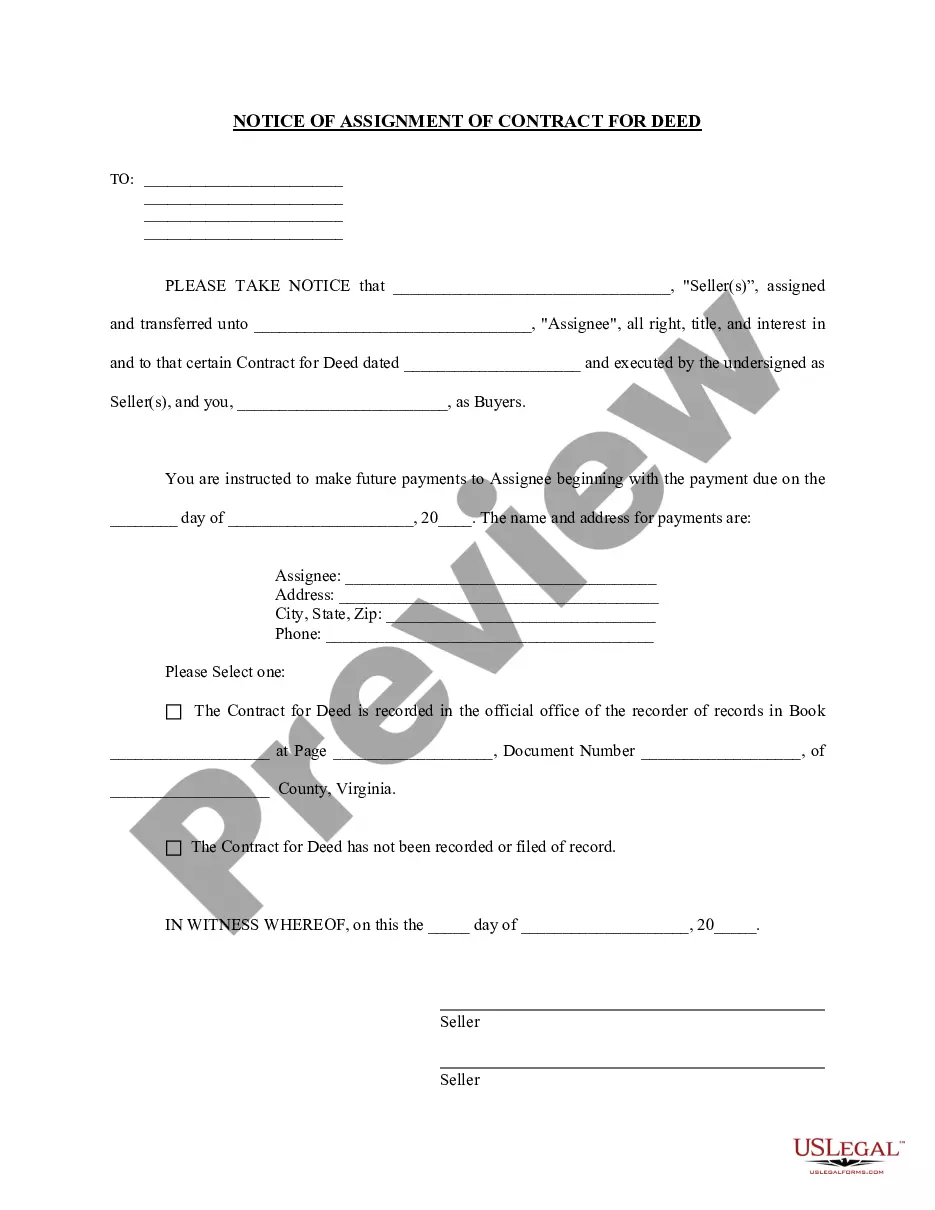

This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Deed Of Trust Records With No Maturity Date In Texas

Description

Form popularity

FAQ

You will usually be discharged after four years, but some trust deeds can last for longer. This information will be included in the terms of the trust deed. If the trust deed does not become protected, your discharge will only be binding on those creditors who agreed to the arrangement.

These trusts are for those who want to make sure that their wealth, whether it's relatively new or goes back generations, remains in the family long after they're gone. Under Texas law, a dynasty trust can last for up to 300 years.

Section 52.006 - Duration of Lien (a) Except as provided by Subsection (b), a judgment lien continues for 10 years following the date of recording and indexing the abstract, except that if the judgment becomes dormant during that period the lien ceases to exist.

No- A deed in Texas does not have to be recorded for the transfer of the property to be effective. It will always be the advice of your attorney to record the deed for the property for a whole host of reasons, but if somewhere along the lines a deed was not recorded, it is not necessarily the end of the world.

Most deed restrictions have an average life span of 25 to 30 years. Some are in effect “in perpetuity.” Many deed restrictions contain a provision for automatic renewal after the initial 25 to 30 year span, unless the owners take action to prevent renewal.

In order to qualify for a non-judicial foreclosure, the lienholder must have a deed of trust with a "power of sale" clause, giving them the authority to sell the property. These foreclosures are governed by Section 51.002 of the Texas Property Code as well as the contractual documents.