This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Deeds Of Trust Definition In Spanish In Texas

Description

Form popularity

FAQ

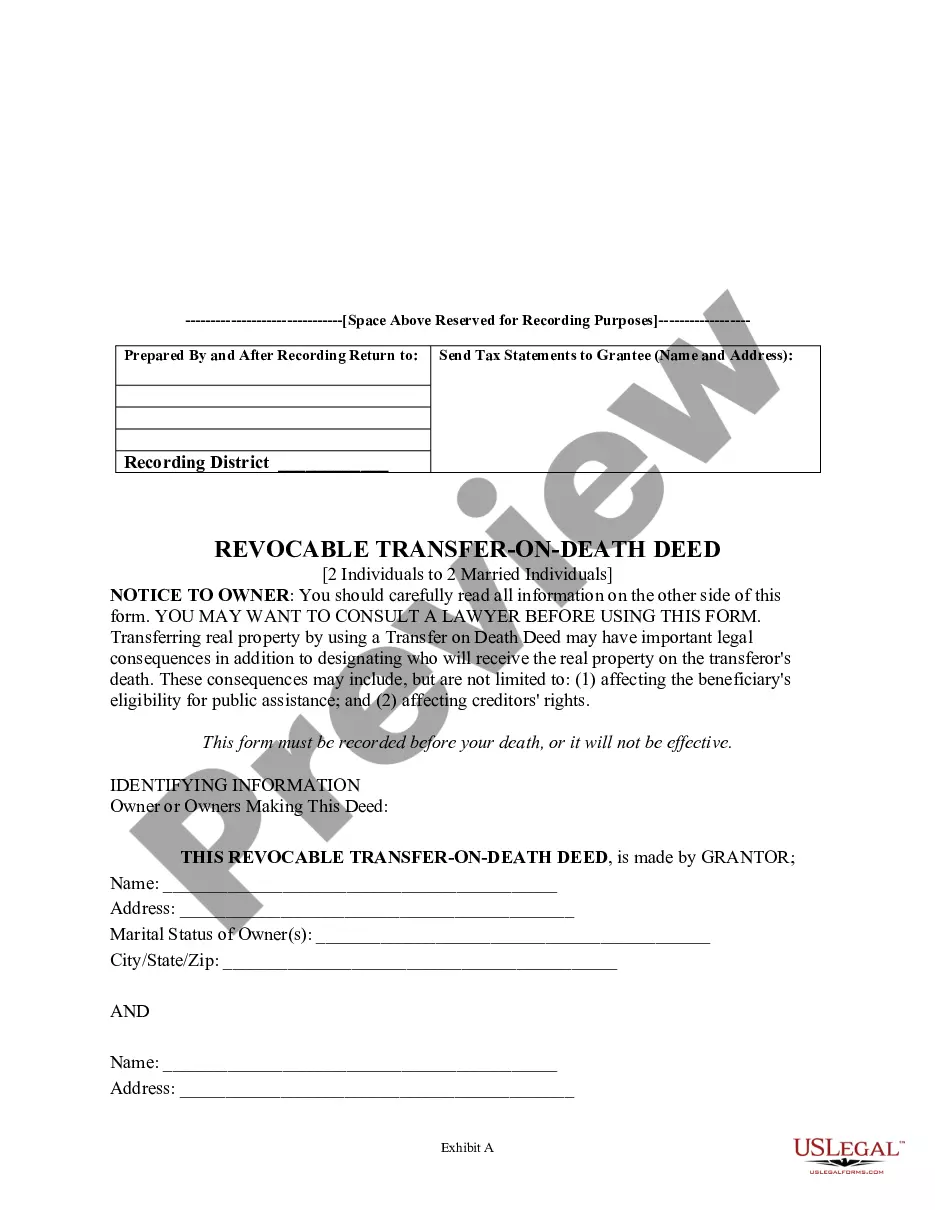

Where to Get a Deed of Trust? To get a Deed of Trust, you must file the proper paperwork with the proper court as generally outlined above. These documents must be filed with the county clerk or recorder, and the lender typically sends them to the recording office after the property closing.

Where to Get a Deed of Trust? To get a Deed of Trust, you must file the proper paperwork with the proper court as generally outlined above. These documents must be filed with the county clerk or recorder, and the lender typically sends them to the recording office after the property closing.

How to say "Trust" in Spanish (Confiar)

Yes, you can sell a home with a Deed of Trust. However, just like a mortgage, if you're selling the home for less than you owe on it, you'll need approval from the lender.

In Texas, a deed of trust, also known as a trust deed, is the commonly used instrument for the purpose of creating mortgage liens on real estate. A mortgage is an executed contract in which the legal or equitable owner of the real property pledges the title thereto as security for performance of an obligation.

Deed noun C (ACTION) an intentional act, especially a very bad or very good one: do an evil deed It seems to me that a lot of evil deeds are done in the name of religion.

A written instrument legally conveying property to a trustee, such as a bank, often for the purpose of securing a mortgage or promissory note.

Ideally, an SMSF trust deed should be written in a way that doesn't require regular updating. However, the deed should be reviewed at least annually to ensure it's up to date.

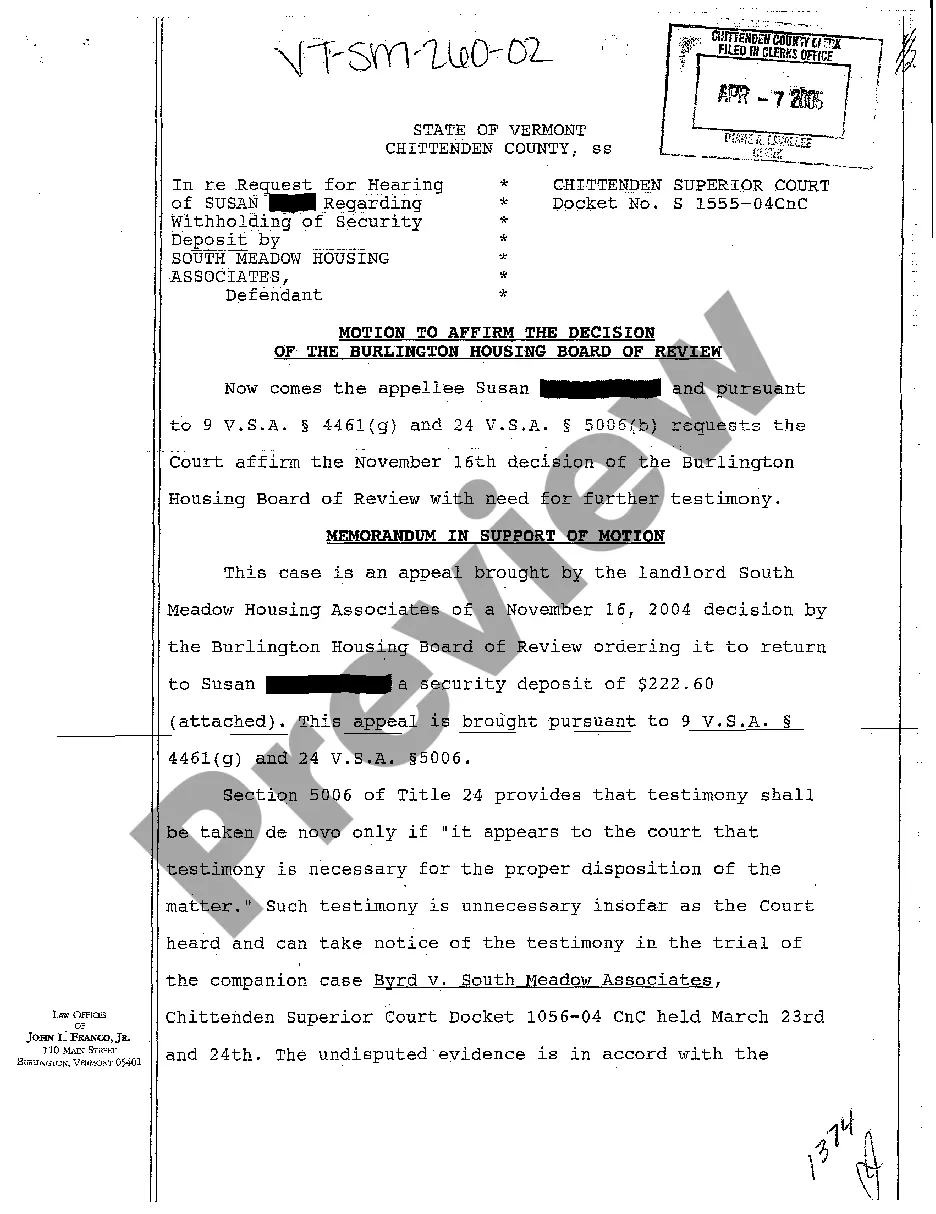

TEX. CIVIL PRACTICE & REMEDIES CODE §16.035: Deed of Trust lien becomes barred 4 years after the original or extended maturity date of the secured obligation.

(b) A sale of real property under a power of sale in a mortgage or deed of trust that creates a real property lien must be made not later than four years after the day the cause of action accrues.