Deed Of Trust With Mortgage In Wayne

Description

Form popularity

FAQ

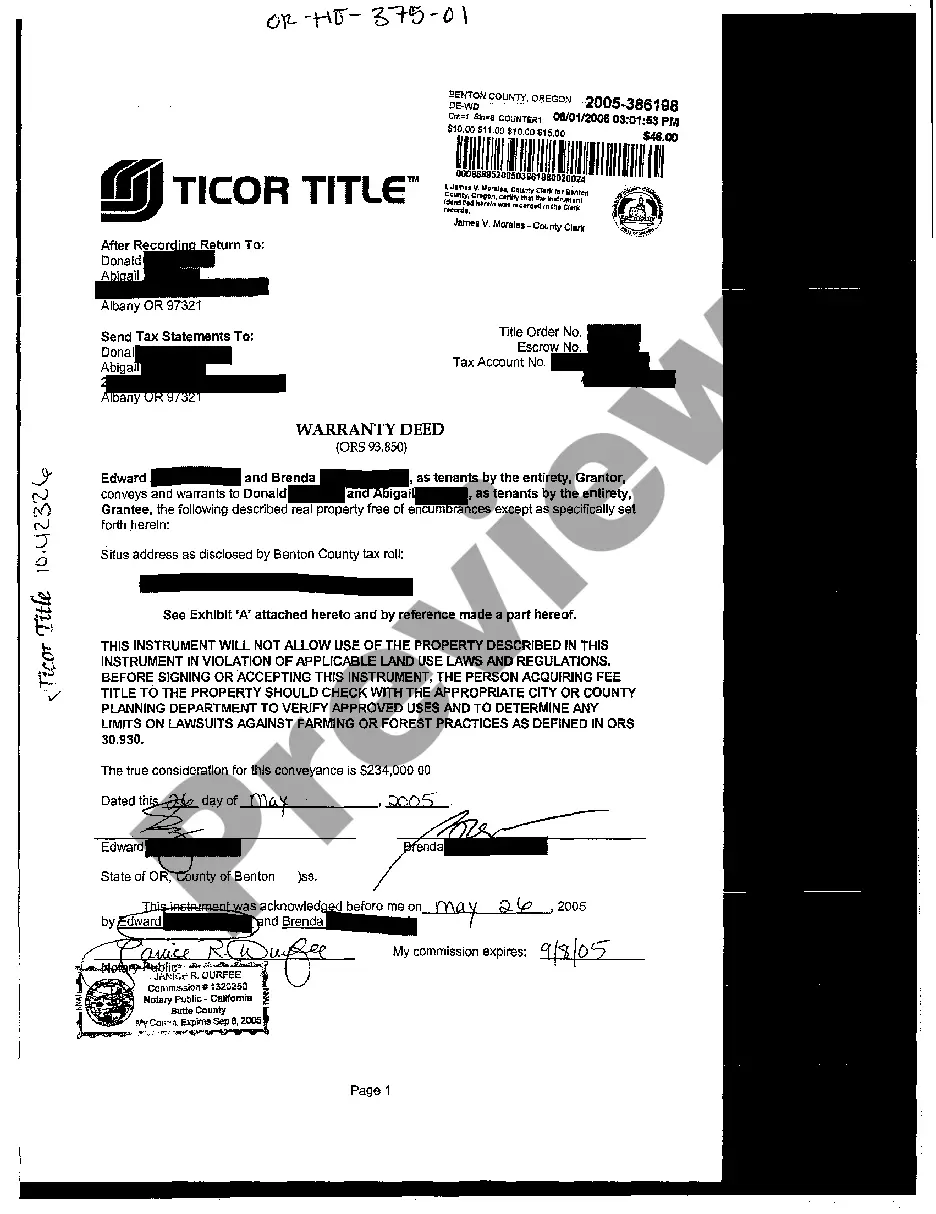

Who Holds the Deed When You Have a Mortgage Lender? The short answer is: You, the homeowner, typically hold the deed to your house, even when you have a mortgage.

If your name is not included in the title deed of the home but is included in the mortgage, this can mean that you do not have an ownership stake in the property while also being obligated to make payments to the mortgage.

A deed of trust can benefit the lender because it allows for a faster and simpler way to foreclose on a home — typically months or even years faster.

Is Indiana a Mortgage State or a Deed of Trust State? Indiana is a Mortgage state.

There are three (3) convenient ways to retrieve a document from our extensive files: Visit waynecountylandrecords - available 24 hours a day. Visit our office in historic Greektown (kiosks are now only available to be used from am - pm) Request a Search-by-Mail.

To get a copy of a recorded document in person, visit the Recorder's Office. If you have the document number, you can make a request over the phone with a credit card and receive the copy via email. Certified copies are only available in person or by mail.

If you do not have your deed, then you can get a recorded copy of it at the Register of Deeds; and a recorded copy is just as good as the original. You can come in person, send us a request by mail, or search online. Search and copy fees will apply.

If you do not have your deed, then you can get a recorded copy of it at the Register of Deeds; and a recorded copy is just as good as the original. You can come in person, send us a request by mail, or search online. Search and copy fees will apply.

Disadvantages of a Trust Deed For borrowers, if financial circumstances change, default on repayment can result in property foreclosure.

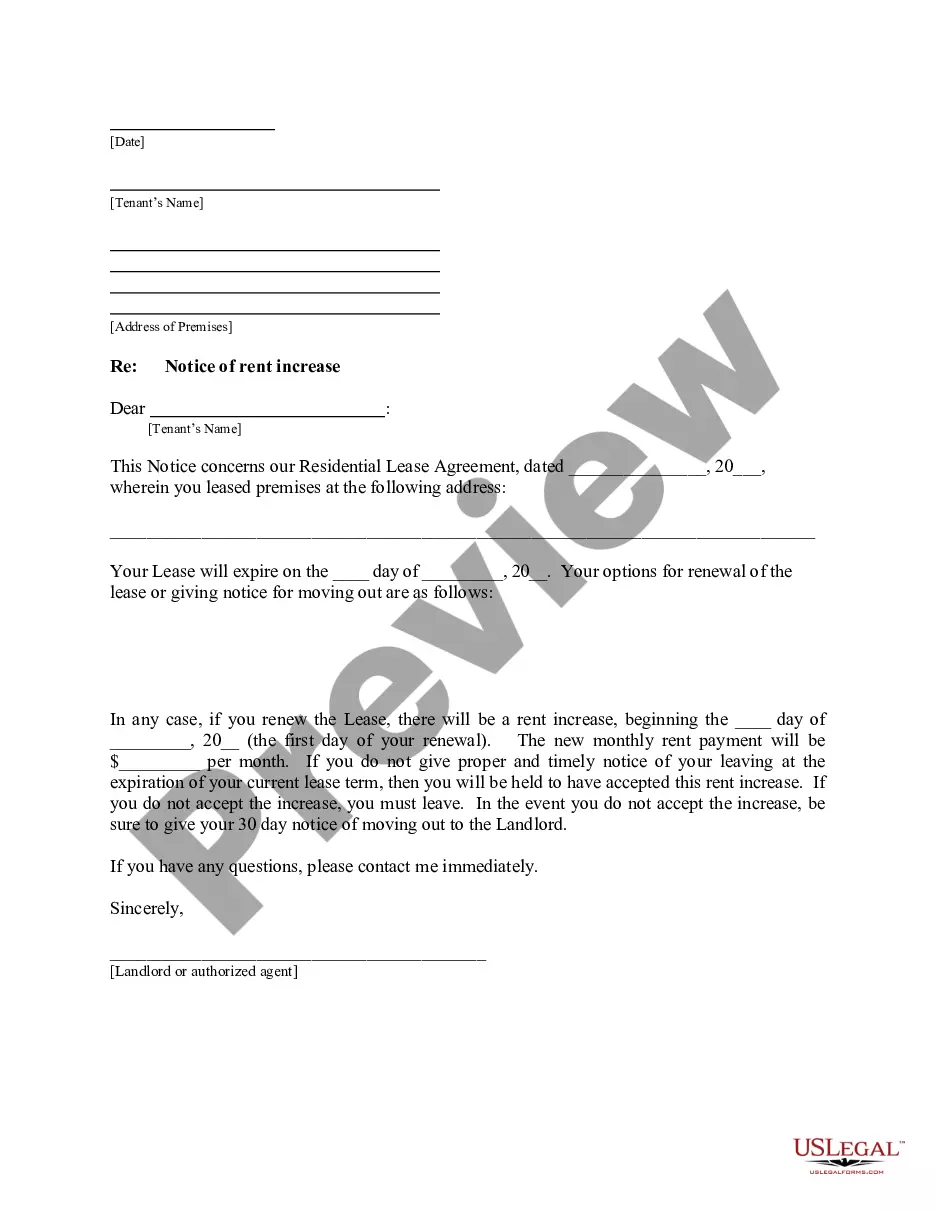

A deed of trust will include the same type of information stated in a mortgage document, such as: The identities of the borrower, lender, and trustee. A full description of the property to be placed in trust. Any restrictions or requirements on the use of the property while it is in trust.