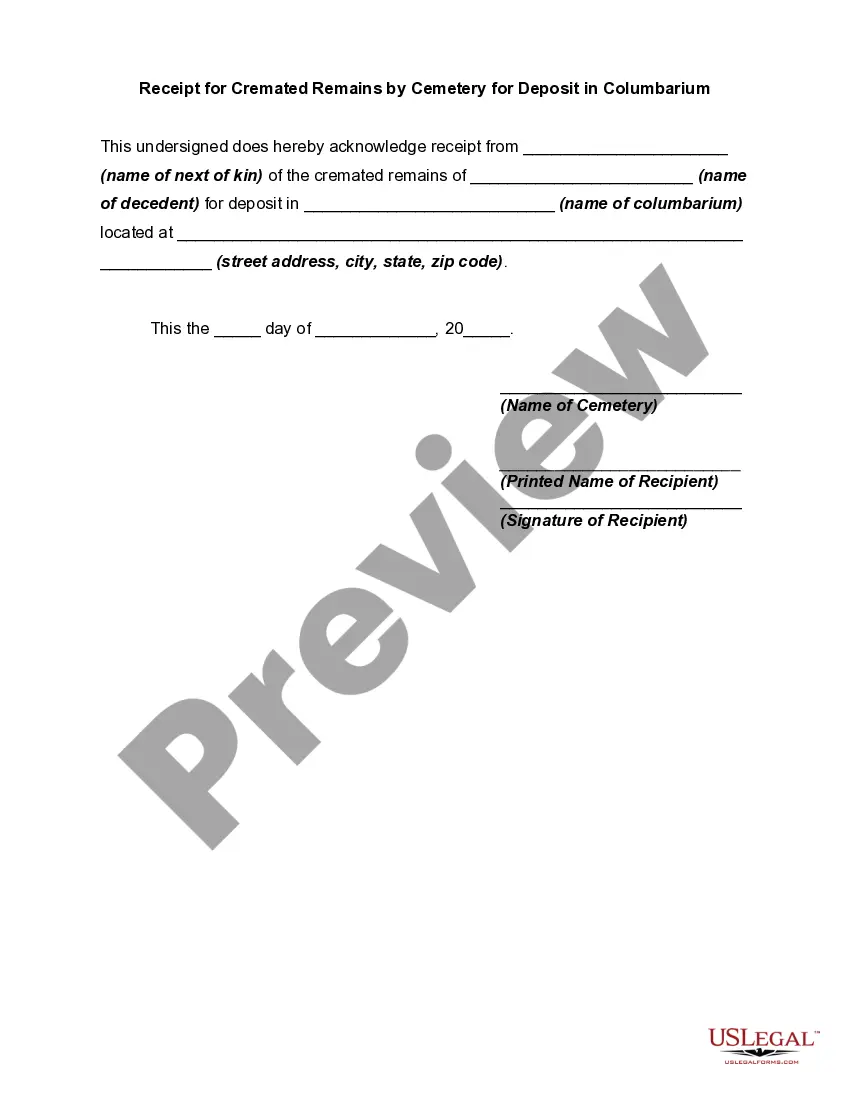

This form is an Authority to Release. The county clerk is authorized and requested to release from a deed of trust a parcel of land to the executor of the estate. The form must be signed in the presence of a notary public.

Missouri Deed Of Trust Form For Trust In Massachusetts

Description

Form popularity

FAQ

A deed of trust is the most common method of securing a lien on real estate in Missouri. Mortgages are rarely used. Deeds of trust commonly include a power of sale provision, which is a faster foreclosure mechanism (see Question 14).

States have varying tax structures affecting trusts. For example, undistributed trust income is subject to state income taxes in some states but not in others. “Establishing trust situs in a favorable state could make a big difference when selling a family business,” says Flach.

A trust “moves” by switching its situs from one state to another. Typically speaking, a revocable trust is unaffected by this. However, you could change a revocable trust's situs by modifying it. If that is not an option, you can also revoke the trust and create a new one in the desired jurisdiction.

Massachusetts is a Deed of Trust state.

Most of the law regulating the creation and administration of trusts in the United States is now statutory at the state level.

Only three states "require" trust registration, but even in those states, there are no legal consequences or penalties if you don't.

Only three states "require" trust registration, but even in those states, there are no legal consequences or penalties if you don't.

Best States For Trust Tax While states like Alaska, South Dakota, and Tennessee do not impose state income taxes, Delaware exempts trusts with non-resident beneficiaries.

While a trust does not need to be notarized in California to be valid, there are a few reasons why you may want to consider having it notarized. Notarizing a trust can increase its authenticity, reduce the risk of fraud, and make it easier to transfer assets to the trust.