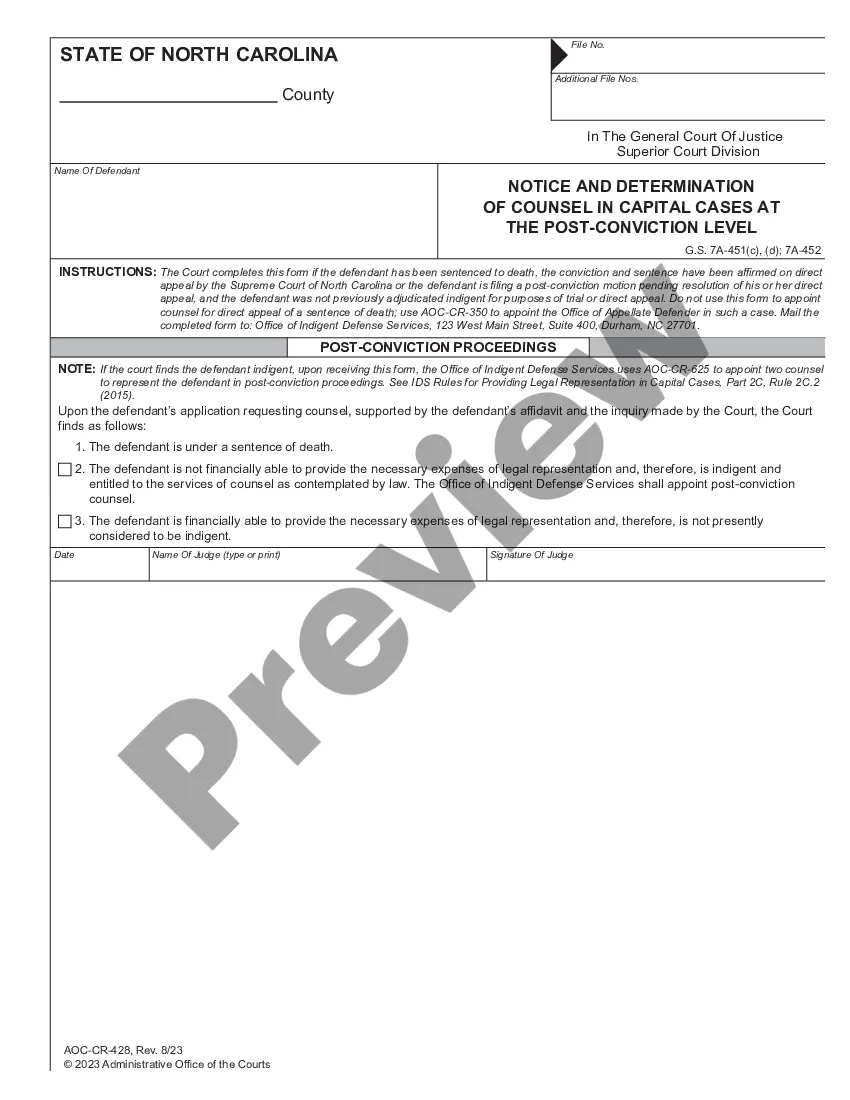

Director Appointment In Case Of Death In North Carolina

Description

Form popularity

FAQ

The Consequences of Not Filing Probate This may leave necessary assets out of reach when they are most needed. Difficulty in Transferring Ownership: Real estate and vehicles owned by the deceased will remain in their name, making it legally complex to transfer ownership without the probate process.

If you wish to be licensed only as a funeral director in North Carolina, you must successfully complete all courses in the funeral directing program, and you must be a graduate of the NC Funeral Directing program (or apply for graduation from that program).

Do All Estates Have to Go Through Probate in North Carolina? Smaller estates with probate-qualified assets valued at less than $20,000 can avoid the formal probate proceeding. If the surviving spouse inherits the whole estate, however, the estate's value can't exceed $30,000 if probate is to be avoided.

Under North Carolina law (NC General Statutes § 28A-25-1), you can opt to use a small estate affidavit instead of probate if the total value of the assets covered by probate are less than $20,000 or less than $30,000 if the spouse is the only heir.

If your loved one passed away and you are responsible for serving as the executor of the will or their personal representative, you must file the paperwork to open the estate. The general rule is that an estate should be opened within 60 days.

Within the first 60 days after the decedent passes away, you will need to file all of the necessary paperwork to become the executor of the person's estate.

What to Do Right Away When a Loved One Dies in North Carolina Determine Whether Urgent Legal Action is Needed. Locate Estate Planning Documents. Make Funeral Arrangements. Secure the House and Estate Property. Begin Collecting Important Documents. Begin Making Key Contacts. Preserve Assets and Keep Accounts Open.

If the estate is not finalized within one year, then the personal representative must file a request for the estate to remain open and file an annual account. An annual accounting must be filed every year thereafter until the final accounting is filed. G.S. 28A-21-1.

Intestate letters are called “Letters of Administration” and are granted to an Administrator. How do I begin the estate administration process and apply for letters? To formally begin the estate administration process, you will need to visit the clerk of court in the appropriate county.