Sample Charitable Donation Letter For Taxes In California

Description

Form popularity

FAQ

See Contributions of Property, later. Your deduction for charitable contributions generally can't be more than 60% of your AGI, but in some cases 20%, 30%, or 50% limits may apply. Table 1 gives examples of contributions you can and can't deduct.

How do you write a fundraising letter? Key steps Start with a personalized greeting. Explain your mission. Describe your current initiative. Outline your project's needs and what you hope to accomplish. Add meaningful photographs or infographics. Show the tangible impact associated with specific donation amounts.

Although experts advise not to make your decision to donate to a cause based on your ability to get a tax deduction, there are benefits to charitable donations. “One of the key benefits of charitable deductions is that they can help you reduce taxable income.

In response to the COVID-19 pandemic, Congress enacted a $300 charitable deduction for non-itemizing taxpayers for 2020. This non-itemizer charitable deduction was extended and expanded to $600 for joint filers through 2021. However, the provision expired at the end of 2021 and has yet to be restored.

What to include in donor acknowledgment letters? Tax-exempt status statement: Statement that the organization is a 501c3 tax-exempt organization. Name of the organization (the charity) and name of the donor. Date of the contribution: The date the donation was received. Contribution Details.

Proof can be provided in the form of an official receipt or invoice from the receiving qualified charitable organization, but it can also be provided via credit card statements or other financial records detailing the donation.

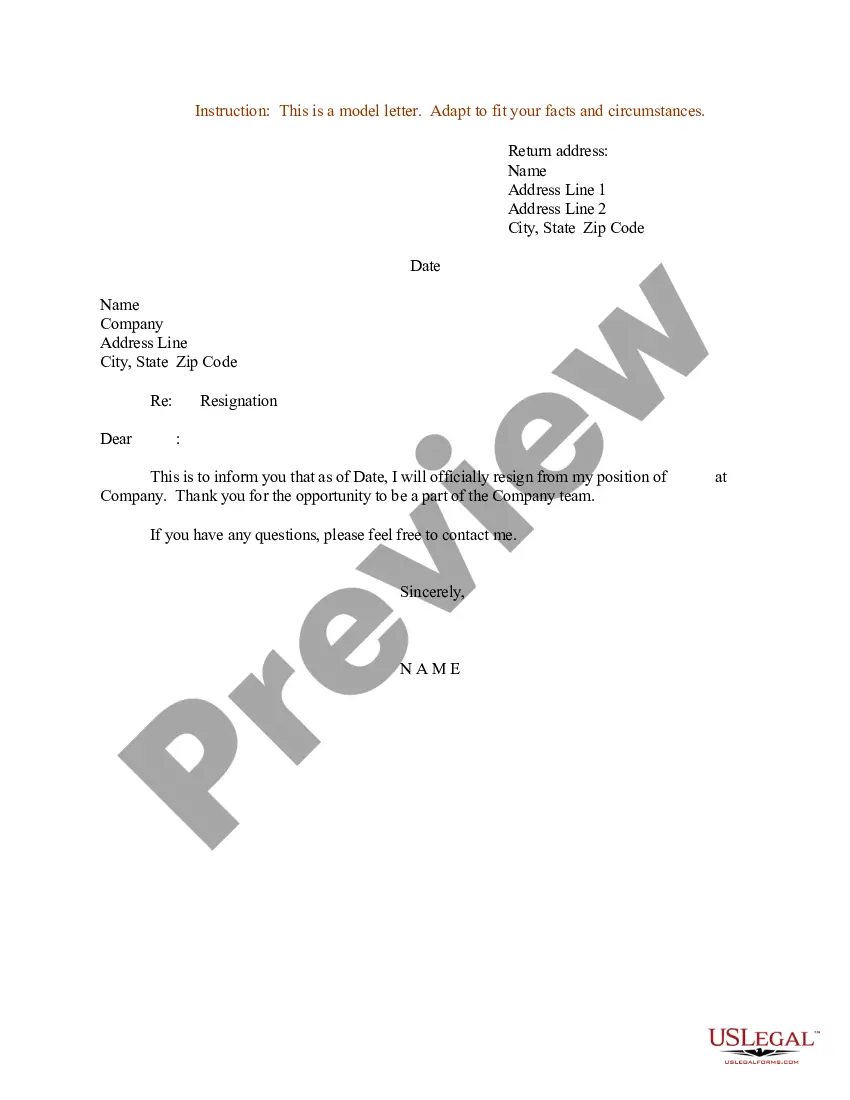

Include relevant details Start with your name and contact details. Include the date and the recipient's name and contact information. Explain the purpose of the letter. Provide the specific details of what you are acknowledging. Make a statement of appreciation. Close the letter with a polite salutation and your name.

Current federal and state law allows an individual to claim an itemized deduction for contributions to a qualified charitable organization.

Start with a clear statement of purpose. Share personal stories or anecdotes that illustrate the impact the donations will have. Quantify the need and how the donations will be used. Convey gratitude and appreciation for any amount the reader is able to contribute.

Employees make regular donations to charity. Charities appealed for donations of food and clothing for victims of the hurricane.