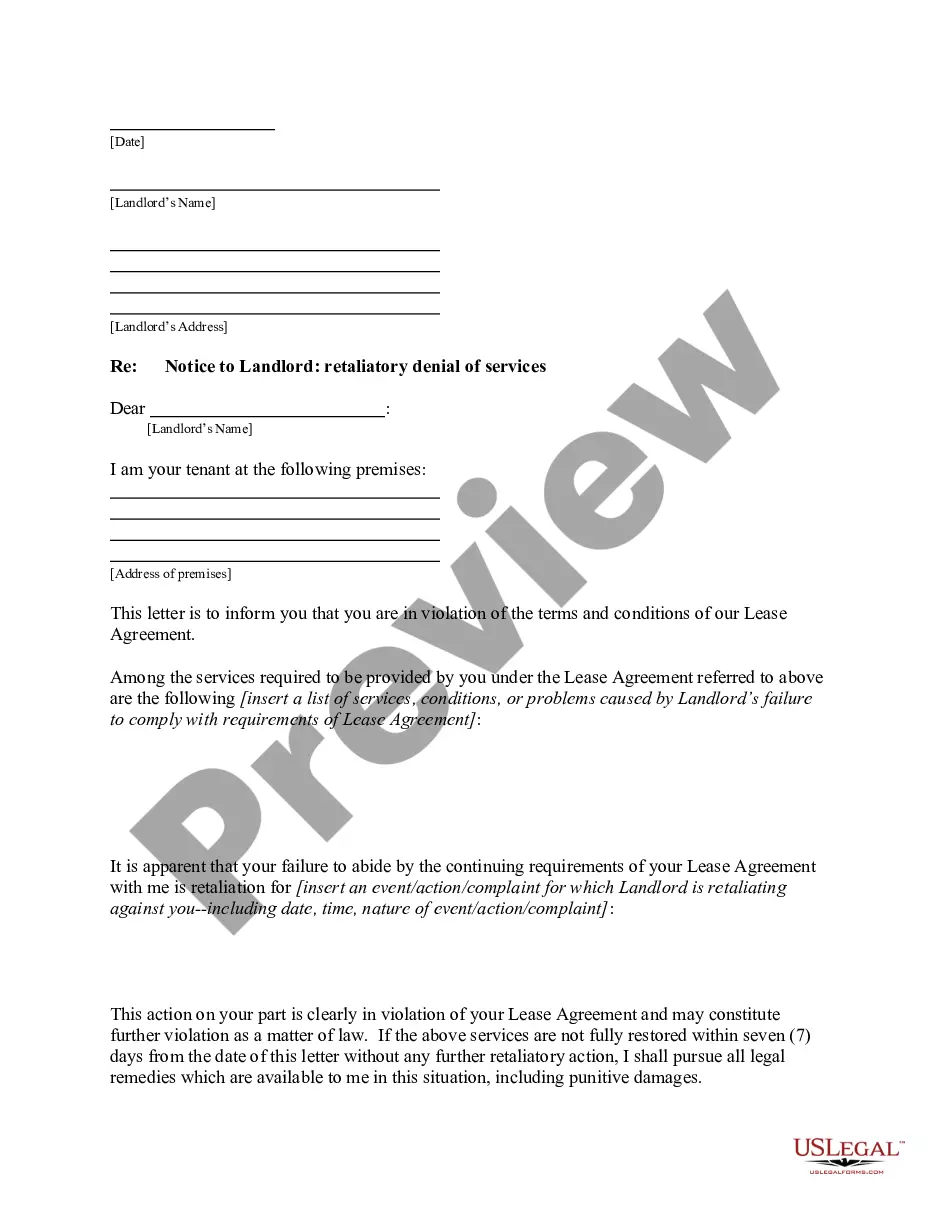

This form is a sample letter in Word format covering the subject matter of the title of the form.

Donation Letter For Tax Purposes In Collin

Description

Form popularity

FAQ

However, you should be able to provide a bank record (bank statement, credit card statement, canceled check or a payroll deduction record) to claim the tax deduction. Written records, like check registers or personal notations, from the donor aren't enough proof. The records should show the: Organization's name.

There are several details that the IRS requires you to include: The name of your donor. The full legal name of your organization. A declaration of your organization's tax-exempt status. Your organization's employer identification number. The date the gift was received. A description of the gift and the amount received.

Ing to the IRS, donation tax receipts should include the following information: The name of the organization. A statement confirming that the organization is a registered 501(c)(3) organization, along with its federal tax identification number. The date the donation was made.

How do you write a fundraising letter? Key steps Start with a personalized greeting. Explain your mission. Describe your current initiative. Outline your project's needs and what you hope to accomplish. Add meaningful photographs or infographics. Show the tangible impact associated with specific donation amounts.

Proof can be provided in the form of an official receipt or invoice from the receiving qualified charitable organization, but it can also be provided via credit card statements or other financial records detailing the donation.

Technically, if you do not have these records, the IRS can disallow your deduction. Practically, IRS auditors may allow some reconstruction of these expenses if it seems reasonable.

I'm writing to ask you to support me and my cause/project/etc.. Just a small donation of amount can help me accomplish task/reach a goal/etc.. Your donation will go toward describe exactly what the contribution will be used for. When possible, add a personal connection to tie the donor to the cause.

Ing to the IRS, any kind of donation above $250 should require a donation receipt. The same applies to stock gifts/donations.

Example 2: Individual Acknowledgment Letter Hi donor name, We're super grateful for your contribution of $250 to nonprofit's name on date received. As a thank you, we sent you a T-shirt with an estimated fair market value of $25 in exchange for your contribution.