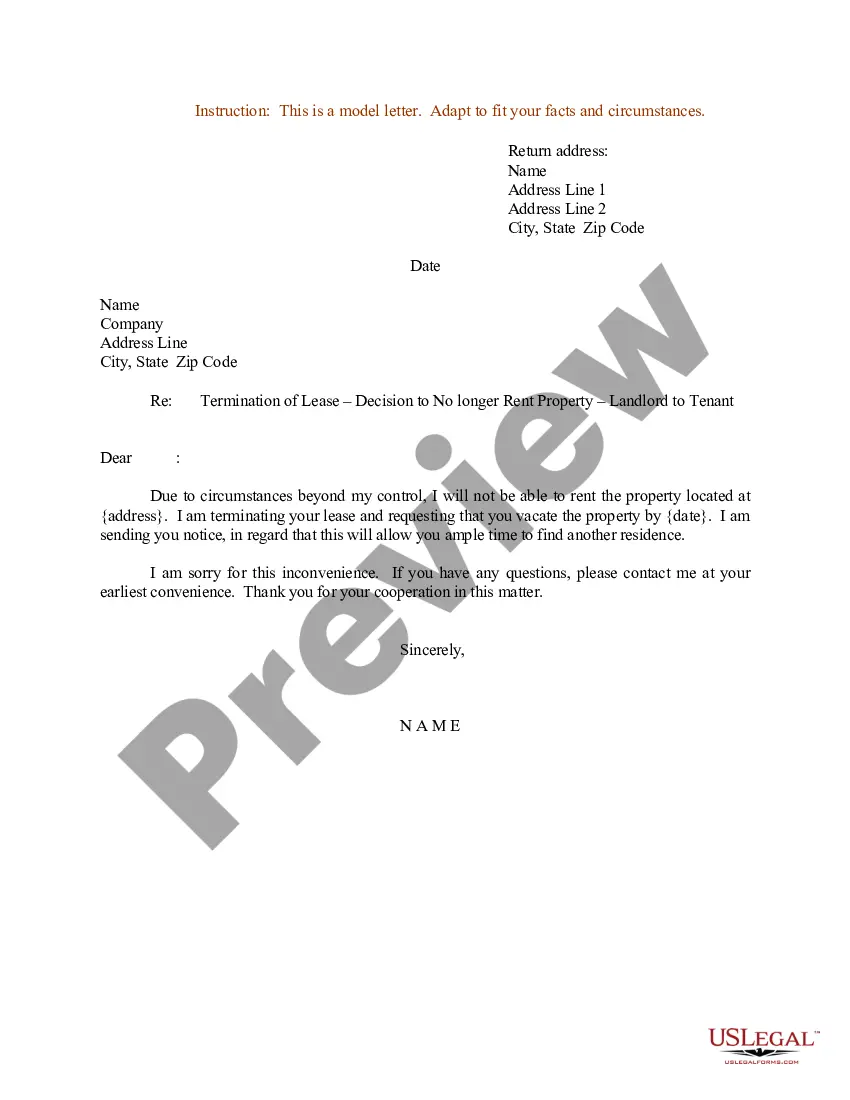

This form is a sample letter in Word format covering the subject matter of the title of the form.

Receipt Donation Sample With Replacement In Fairfax

Description

Form popularity

FAQ

Here are a few things to keep in mind before donating: What types of donations can a public school receive? Eligible for many types including supplies for classrooms, electronic and sports equipment, furniture, or musical instruments.

Offer your donation, preferably in writing, to the school board governing the public school district of your choice. School boards have the discretion to accept or reject your gift on behalf of the school district.

How can I donate to local schools? Contact the school directly or use an online platform such as TUIO. You could also attend fundraising events organized by schools or make contributions through PTOs.

Unfortunately, we do not have the capability of processing book donations, however many Friends of the Library groups, do. Click here to view a list of Friends of the Library groups.

Individuals Your nonprofit website. Text-to-donate. Direct mail. Crowdfunding pages. Peer-to-peer fundraising campaigns. Legacy or planned gifts. Payroll giving programs. In-kind donations.

I'm writing to ask you to support me and my cause/project/etc.. Just a small donation of amount can help me accomplish task/reach a goal/etc.. Your donation will go toward describe exactly what the contribution will be used for. When possible, add a personal connection to tie the donor to the cause.

How to fill out a Goodwill Donation Tax Receipt A: Date, Name and Address. This section organizes when a donation was made, who dropped off the donation and your current address. B: Donation Details. C: Tax Year. D. E: Fine Print. F: Goodwill Confirmation. How to deduct your Goodwill donations on your taxes.

Example 2: Individual Acknowledgment Letter Hi donor name, We're super grateful for your contribution of $250 to nonprofit's name on date received. As a thank you, we sent you a T-shirt with an estimated fair market value of $25 in exchange for your contribution.

What To Include in Donor Acknowledgement Letters Donor's name. Address the donor by name. Organization's name. Clearly state your nonprofit's name to make the letter official and avoid confusion. Donation amount and date. Be specific about the gift. Type of donation. Tax information. Mission impact. Closing with gratitude.

Each letter should include the following information: The donor's name. The full legal name of your organization. A declaration of your organization's tax-exempt status. Your organization's employer identification number. The date the gift was received. A description of the gift and the amount received.