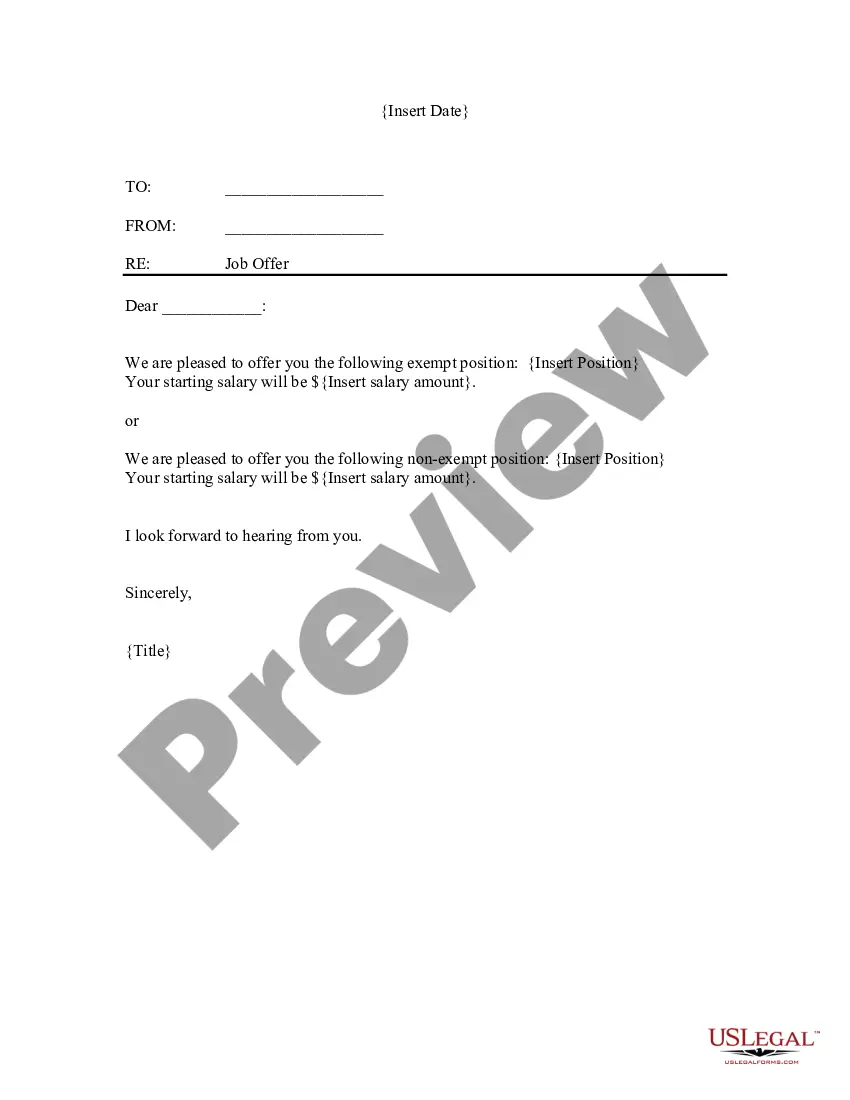

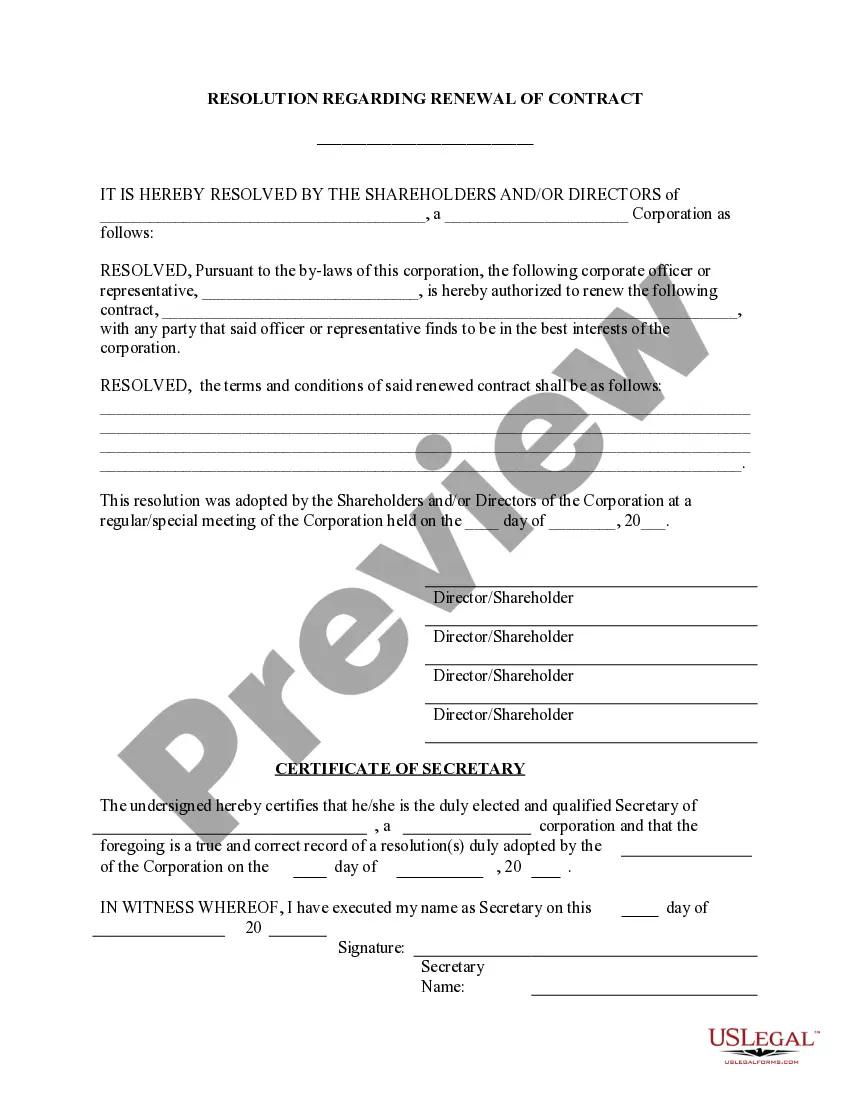

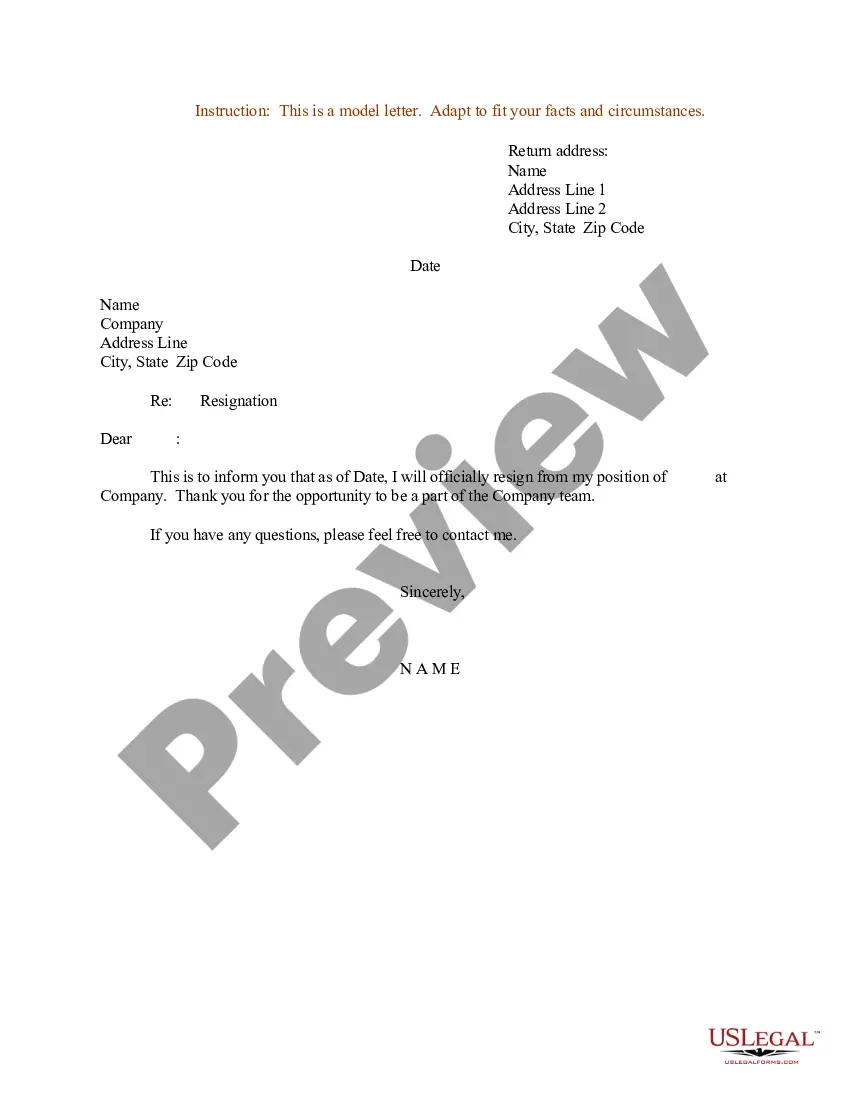

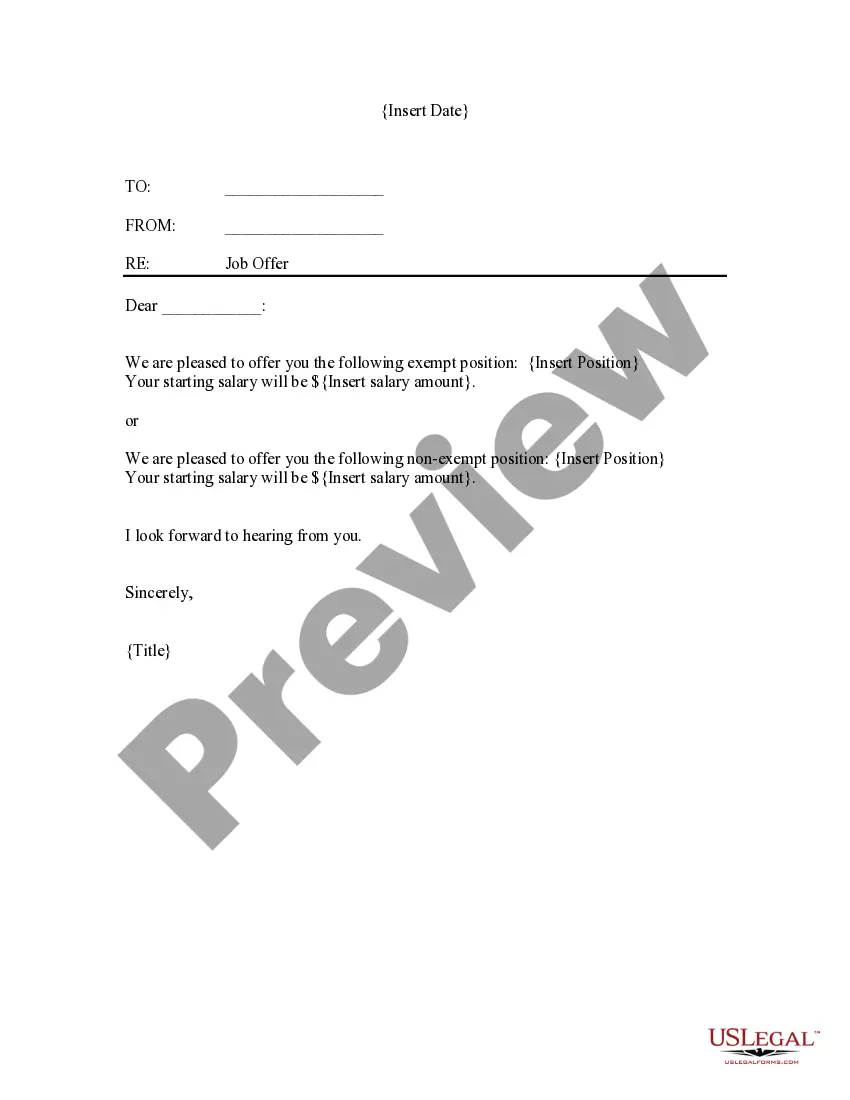

This form is a sample letter in Word format covering the subject matter of the title of the form.

Gift Letter Tax Implications In Florida

Description

Form popularity

FAQ

Write a Bill of Sale/Gift Affidavit It would be best if you got this statement notarized so you can prove that you do not owe sales tax on the gift. It's also helpful to have a bill of sale written out when you give the gift.

In general, a gift letter should include details about the donor, the recipient, the amount of the gift, and the purpose of the gift. It's also important to note that gift letters should be signed and dated by both the donor and the recipient.

(Date) Dear (Donor): I have received your "Offer of Gift," dated ___________________, by which you, on behalf of the (Name of Company), offered to convey (Description of Property) to the United States of America as a gift. I accept with pleasure your gift and conveyance of the (Property), pursuant to 10 U.S.C. 2601.

Who Must File. In general. If you are a citizen or resident of the United States, you must file a gift tax return (whether or not any tax is ultimately due) in the following situations. If you gave gifts to someone in 2024 totaling more than $18,000 (other than to your spouse), you probably must file Form 709.

Use Form 709 to report: Transfers subject to the federal gift and certain generation-skipping transfer (GST) taxes.

How Do I Write a Gift Letter? The donor's name, address and phone number. The donor's relationship to the client. The dollar amount of the gift. The date when the funds were (or will be) transferred. A statement from the donor that no repayment is expected. The donor's signature.