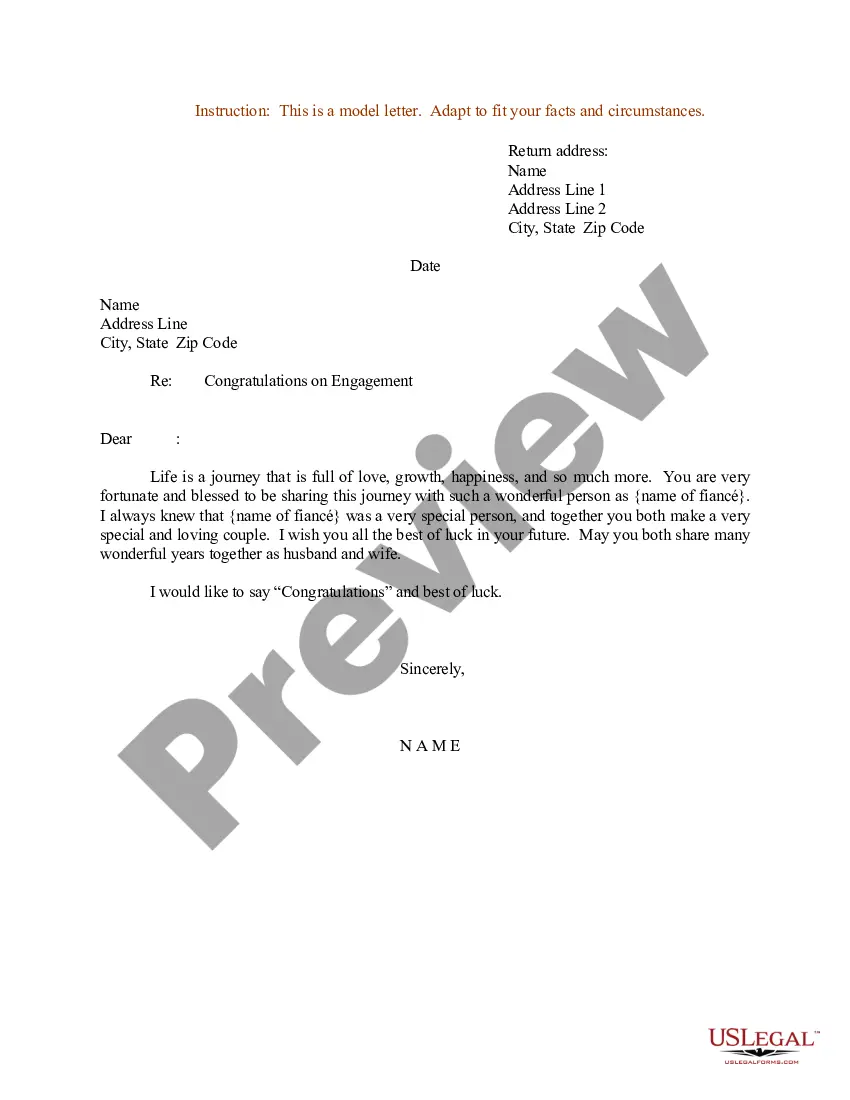

This form is a sample letter in Word format covering the subject matter of the title of the form.

Tax Letter For Donations Without 501c3 In Montgomery

Description

Form popularity

FAQ

Actually, no! These terms are often used interchangeably, but they all mean different things. Nonprofit means the entity, usually a corporation, is organized for a nonprofit purpose. 501(c)(3) means a nonprofit organization that has been recognized by the IRS as being tax-exempt by virtue of its charitable programs.

Yes, you can receive a donation without be a nonprofit. In the United States and many other nations, there are tax benefits to the donor when donating toward a certified nonprofit. Regardless of your nonprofit status, someone can give you a donati...

Requesting Copies Older organizations can request a copy of the determination letter by submitting Form 4506-A to the IRS. Alternatively, you can request an affirmation letter, which will confirm that your nonprofit is tax-exempt as of the date of the request.

Proof can be provided in the form of an official receipt or invoice from the receiving qualified charitable organization, but it can also be provided via credit card statements or other financial records detailing the donation.

Nonprofit or charitable organizations typically create donation invoices after they've processed incoming donations. These organizations then send the donation invoices back to their donors.

Yes, you can receive a donation without be a nonprofit. In the United States and many other nations, there are tax benefits to the donor when donating toward a certified nonprofit. Regardless of your nonprofit status, someone can give you a donati...

🧲 Do you need a 501(c)3 to receive donations? No, you can continue receive to donations without having yet filed your 501(c)3 application. However, without a 501(c)3 status, your donors will not be able to receive a tax deduction for their donations.

Each letter should include the following information: The donor's name. The full legal name of your organization. A declaration of your organization's tax-exempt status. Your organization's employer identification number. The date the gift was received. A description of the gift and the amount received.

Organizations that meet specified requirements may qualify for exemption under subsections other than 501(c)(3). These include social welfare organizations, civic leagues, social clubs, labor organizations and business leagues.

Organizations that meet specified requirements may qualify for exemption under subsections other than 501(c)(3). These include social welfare organizations, civic leagues, social clubs, labor organizations and business leagues.