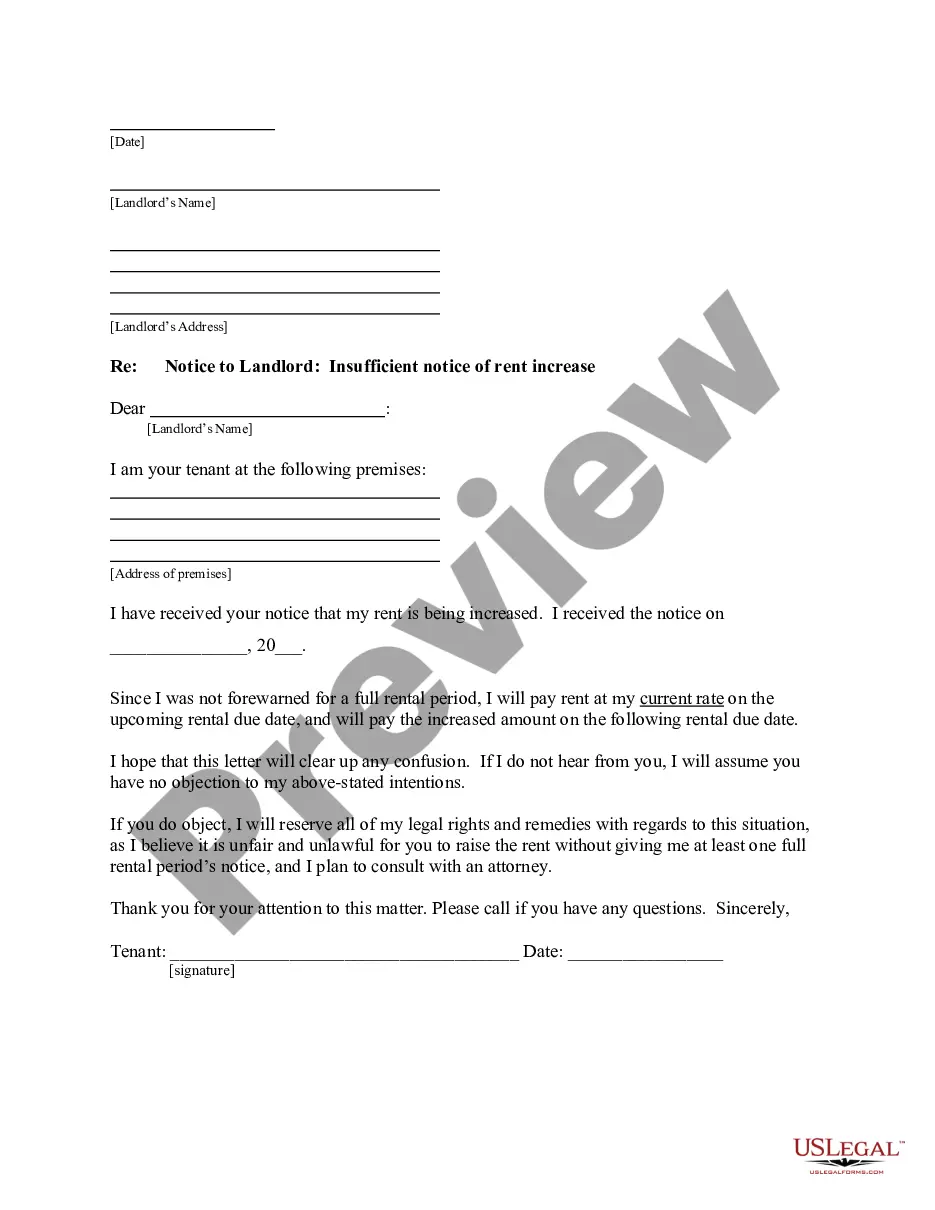

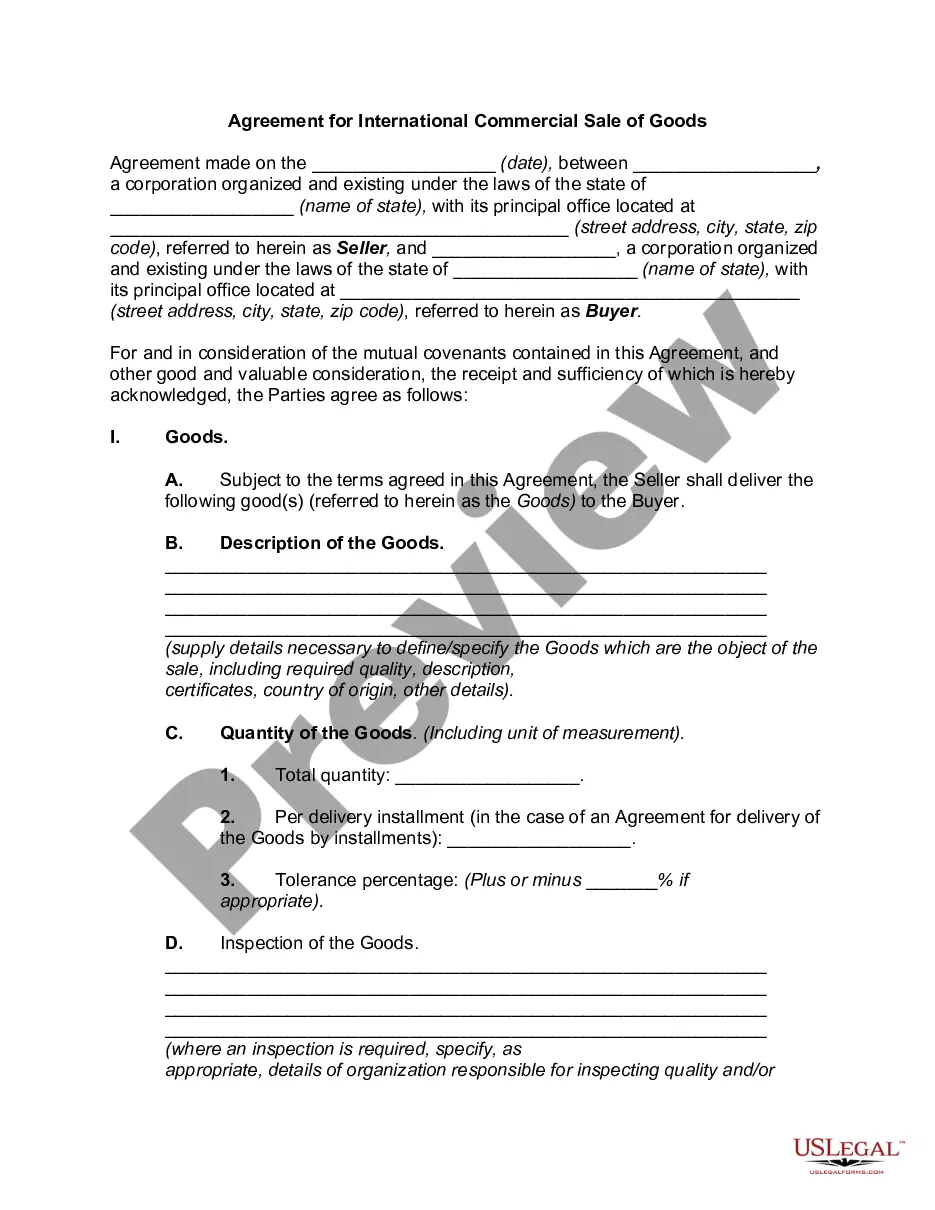

This form is a sample letter in Word format covering the subject matter of the title of the form.

Money Gift Letter For Tax Purposes In Ohio

Description

Form popularity

FAQ

(Date) Dear (Donor): I have received your "Offer of Gift," dated ___________________, by which you, on behalf of the (Name of Company), offered to convey (Description of Property) to the United States of America as a gift. I accept with pleasure your gift and conveyance of the (Property), pursuant to 10 U.S.C. 2601.

How Do I Write a Gift Letter? The donor's name, address and phone number. The donor's relationship to the client. The dollar amount of the gift. The date when the funds were (or will be) transferred. A statement from the donor that no repayment is expected. The donor's signature.

Use Form 709 to report: Transfers subject to the federal gift and certain generation-skipping transfer (GST) taxes.

Include in ITR: Report the taxable value of the income tax gift under the "Income from Other Sources" category in your ITR. Compute Tax Liability: The taxable value of the gift is added to your total income for the financial year. Use your income tax slab rate to calculate the tax liability.

Making a gift or leaving your estate to your heirs does not ordinarily affect your federal income tax. You cannot deduct the value of gifts you make (other than gifts that are deductible charitable contributions).