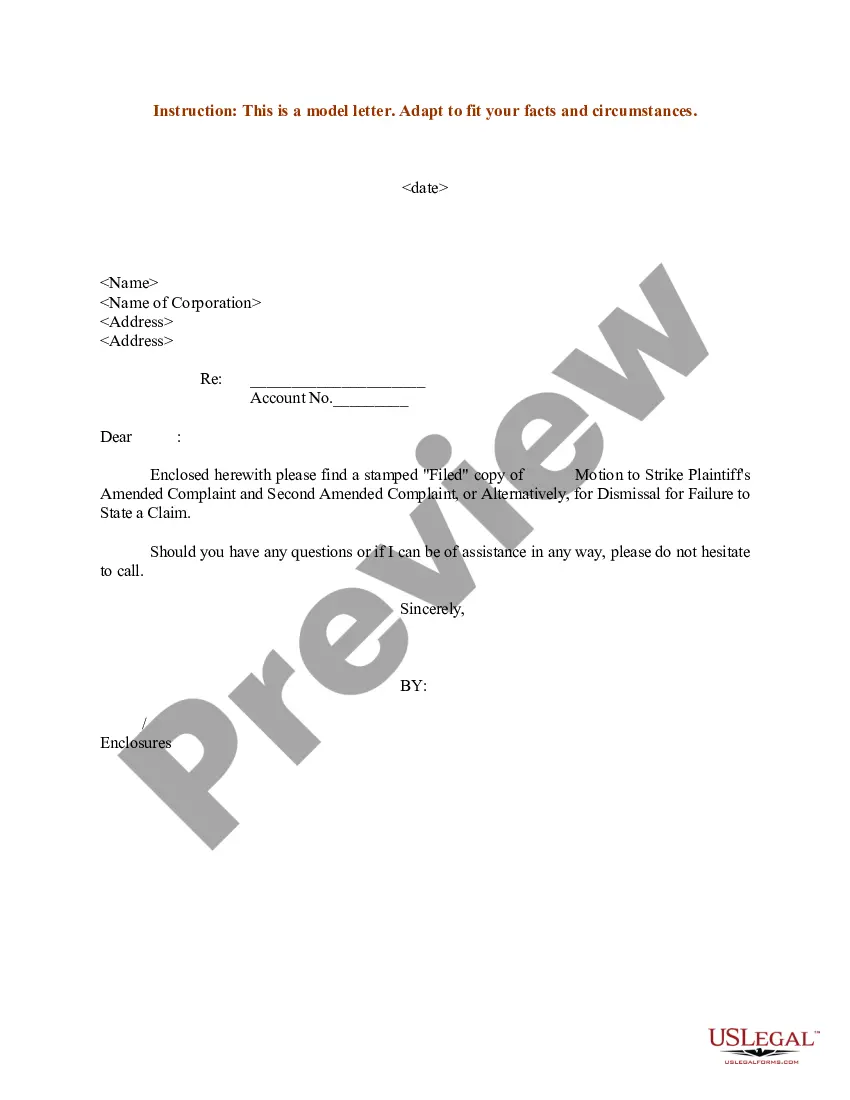

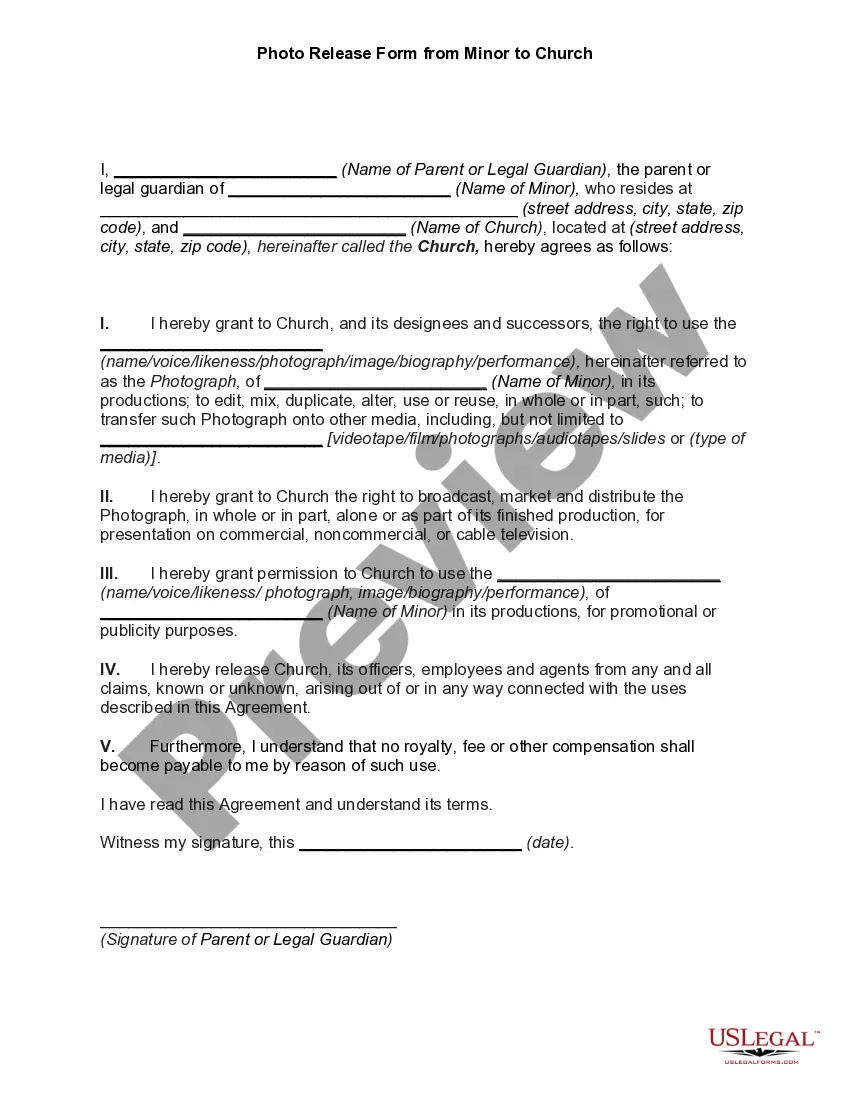

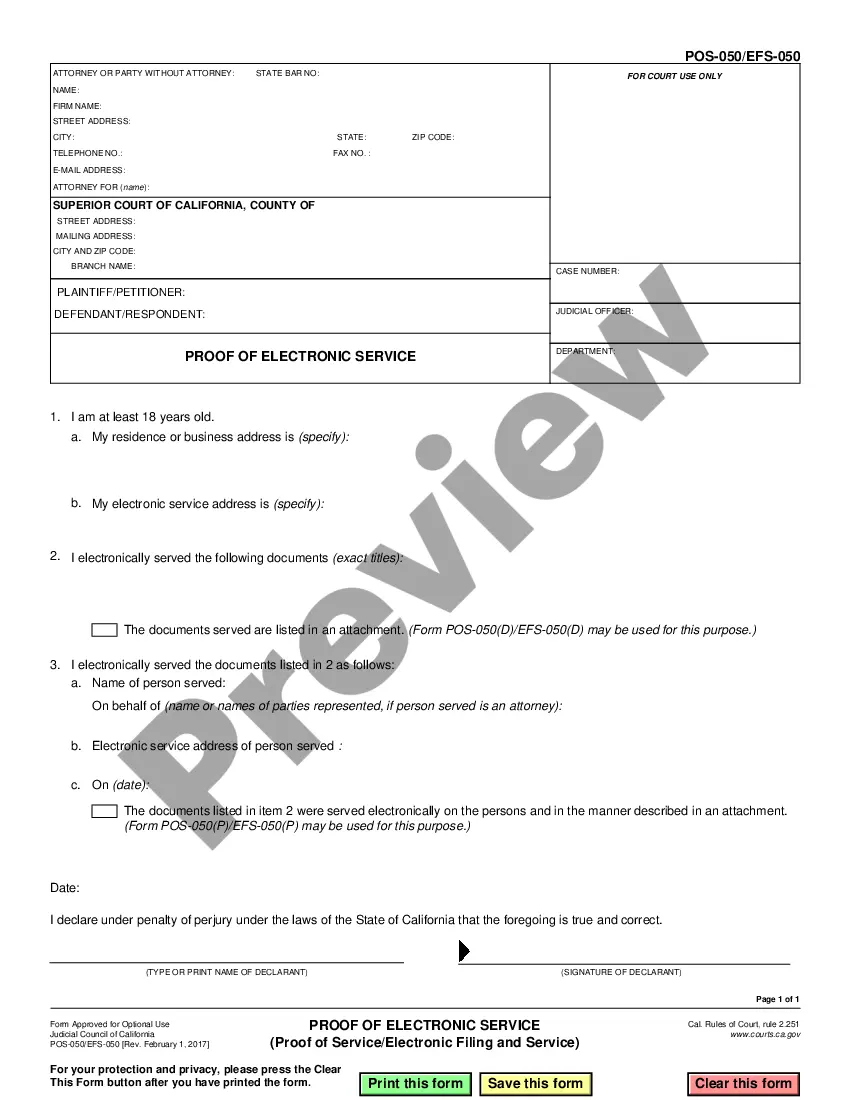

This form is a sample letter in Word format covering the subject matter of the title of the form.

Tax Letter For Donations Without 501c3 In Ohio

Description

Form popularity

FAQ

Thanks for the A2A, Sean. You have to have your nonprofit in place before you write a grant for funding. You will have to incorporate as a nonprofit and get a 501c3 designation from the IRS. Then you can write grants for that nonprofit. You will need to look through available grants to see what is being offered.

Timeline. The IRS offers a chart of postmark dates to determine if your application has been assigned to a specialist. Approval can take 3 months to a year.

Yes, you can receive a donation without be a nonprofit. In the United States and many other nations, there are tax benefits to the donor when donating toward a certified nonprofit. Regardless of your nonprofit status, someone can give you a donati...

ANY business can do a fundraiser, you don't have to be a nonprofit in order to help out others. My business does fundraisers for my local community all the time.

Actually, no! These terms are often used interchangeably, but they all mean different things. Nonprofit means the entity, usually a corporation, is organized for a nonprofit purpose. 501(c)(3) means a nonprofit organization that has been recognized by the IRS as being tax-exempt by virtue of its charitable programs.

Instant Nonprofit's 501(c)3 approval time, from “idea to IRS approval” ranges from less than 30 days (for lower-budget organizations whose applications go through without additional IRS interaction) to around 3-4 months (for higher budget organizations with more complex files).

Questions also may arise: Can I accept donations without being a nonprofit? In simple words, the answer is yes, you can.

If you ever need to replace your 501(c)(3) letter, IRS Form 4506-A instructions provides a way to get a copy of your original determination letter. (This form is primarily used by members of the public to inspect copies of exempt organizations' applications for exempt status.)

If you ever need to replace your 501(c)(3) letter, IRS Form 4506-A instructions provides a way to get a copy of your original determination letter. (This form is primarily used by members of the public to inspect copies of exempt organizations' applications for exempt status.)

If you file Form 1023, the average IRS processing time is 6 months. Processing times of 9 or 12 months are not unheard of. The IRS closely scrutinizes these applications, as the applicants are typically large or complex organizations.