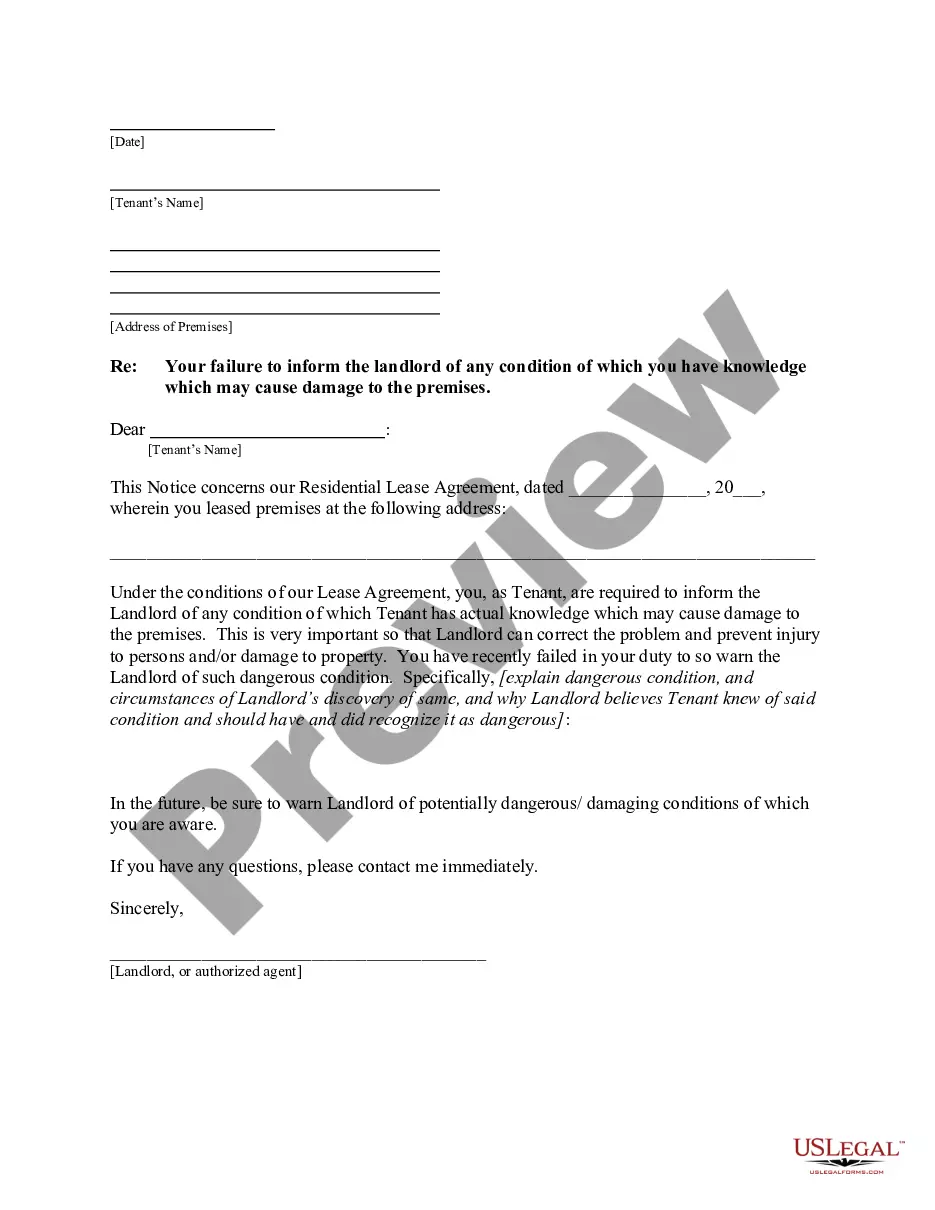

This form is a sample letter in Word format covering the subject matter of the title of the form.

Gift Letter Tax Implications In Pennsylvania

Description

Form popularity

FAQ

Gift Cards - gift cards are not subject to sales tax, but tax is due on the ready to eat food or beverages purchased with a gift card. Gratuities (tips) - not taxable when separately stated on the customer's receipt, guest check, or sales invoice. Wearing apparel - t-shirts, hats, jackets, etc.

In the case of a nonresident decedent, all real property and tangible personal property located in Pennsylvania at the time of the decedent's death is taxable. Intangible personal property of a nonresident decedent is not taxable.

Payments, not representing regular wages, including payments made by third party insurers for sickness or disability, are not taxable income for Pennsylvania purposes.

The Pennsylvania estate tax is owed by out-of-state heirs for real property and tangible personal property located in the Keystone State. There is no gift tax in Pennsylvania. The federal gift tax has an exemption of $19,000 per recipient for 2025 and $18,000 in 2024.

The best way to prove that a transfer of property qualifies as a gift is with evidence of the intent of the donor. The donor must intend to make a permanent transfer without any expectation of receiving something in return.

The tax rate for Pennsylvania Inheritance Tax is 4.5% for transfers to direct descendants (lineal heirs), 12% for transfers to siblings, and 15% for transfers to other heirs (except charitable organizations, exempt institutions, and government entities that are exempt from tax).

In 1826, Pennsylvania became the first state to adopt an inheritance tax. The inheritance tax was first imposed as a tax on inheritance received by non-lineal relatives. 1 It has since been amended to include lineal relatives, and its collection has proven to be lucrative.

While the federal tax uses a three-year look back period for gifts made by the decedent, there is a one-year look back period for the Pennsylvania inheritance tax. All gifts made within the year prior to the decedent's death are subject to the inheritance tax.

Property owned jointly between husband and wife is exempt from inheritance tax, while property inherited from a spouse, or from a child aged 21 or younger by a parent, is taxed a rate of 0%. Inheritance tax returns are due nine calendar months after a person's death.