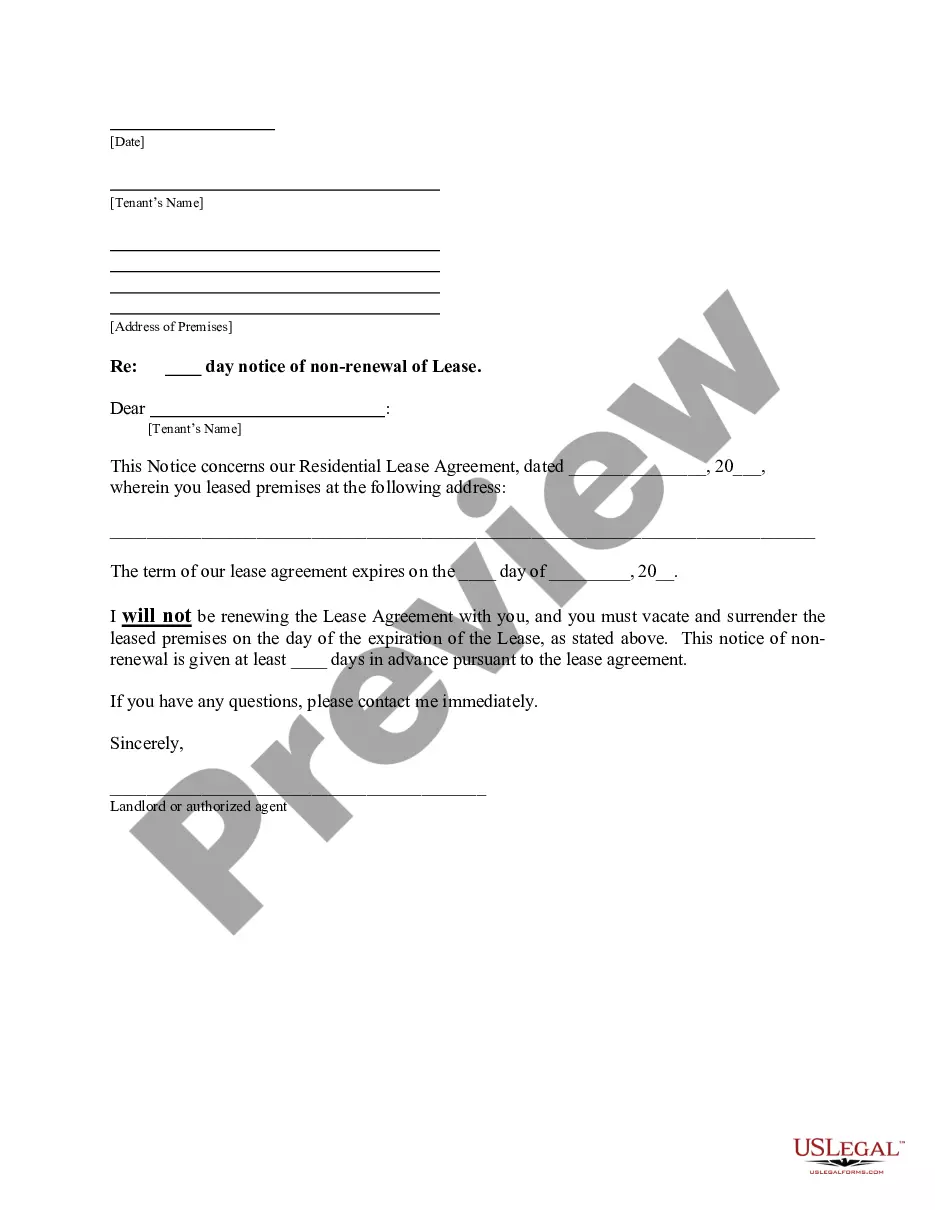

This form is a sample letter in Word format covering the subject matter of the title of the form.

Tax Letter For Donations For Medical Expenses In Pennsylvania

Description

Form popularity

FAQ

For Individuals: Redirect your PA state tax to an approved private school or charity and enjoy a 90% state income tax credit. The remaining 10% qualifies as a federal charitable deduction, maximizing impact with ease.

Sole proprietors having net income (loss) from the operation of a business or profession other than a farm must file PA-40 Schedule C. If a taxpayer had more than one business or if a taxpayer and spouse each had separate businesses, submit a separate PA-40 Schedule C for each business.

Pennsylvania personal income law does not allow deductions for charitable contributions.

We Cannot Accept: Merchandise that has been banned or does not meet safety standards. Hazardous materials, such as batteries, gasoline, tires, oil, paint, pesticides, chemicals, household cleaning supplies, medicine, and syringes. Guns, knives, or ammunition.

Items to donate can include: Toiletries: shampoo, conditioner, soap, toothpaste, tooth brushes, or deodorant. Feminine Hygienic Products: tampons or pads. Basic clothing: t-shirts, sweat pants, socks, pyjamas, or sweaters. Outerwear: jackets, mittens, hats, or gloves.

Some types of income are exempt from Pennsylvania state income tax, including child support, alimony, unemployment payments, and some capital gains on the sale of a primary residence. Some deductions are allowed for contributions to educational savings accounts and medical or health savings accounts.

Pennsylvania currently caps a business's NOL carryforward deduction at 40 percent of taxable income. We are one of only two states that cap NOL deductions below the federal limit of 80 percent of taxable income. There are 19 states that align with the federal rules, while 25 states have no deduction cap at all.

Pennsylvania is one of only a handful of states which have a Personal Income Tax but no PTET election. The 2017 Tax Cuts and Jobs Act caps individual taxpayer deductions for state and local taxes (SALT) at $10,000 for tax years 2018 through 2025.

Pennsylvania Income Tax Treatment on HSA Contributions Residents of Pennsylvania can deduct HSA contributions on their Pennsylvania personal income taxes.