This form is a sample letter in Word format covering the subject matter of the title of the form.

Tax Letter For Donations For Church In Queens

Description

Form popularity

FAQ

We thank God for you! Your gifts to _________Church throughout year are gratefully acknowledged. Because of your contributions, our congregation has been able to support the work of Jesus Christ locally, regionally, and around the world.

Some examples of contribution statements are: “wrote entire original draft”; “contributed to methodology design”; “provided animals for experiments”.

6 Proven Tips for Effective Church Donation Letters Open with a feel-good message. Send receipts for earlier donations and express gratitude. Include examples and stories. Combine donation letters with your online campaign. Send email donation letters too. Don't send donation letters all the time.

Mission: “To love God and love people. We reach them with love, bring them with grace, teach them the truth and send them out on mission.”

Example of an Annual Contribution Statement: Dear personalize, We thank God for you! Your gifts to _________Church throughout year are gratefully acknowledged. Because of your contributions, our congregation has been able to support the work of Jesus Christ locally, regionally, and around the world.

Start by describing all the good things the church has done for the congregation and the community. This will help convince the reader to donate. Then be sure to inform the reader of the kind of donation you are looking for and why it's needed.

How much can you deduct for the gently used goods you donate to Goodwill? The IRS allows you to deduct fair market value for gently-used items. The quality of the item when new and its age must be considered. The IRS requires an item to be in good condition or better to take a deduction.

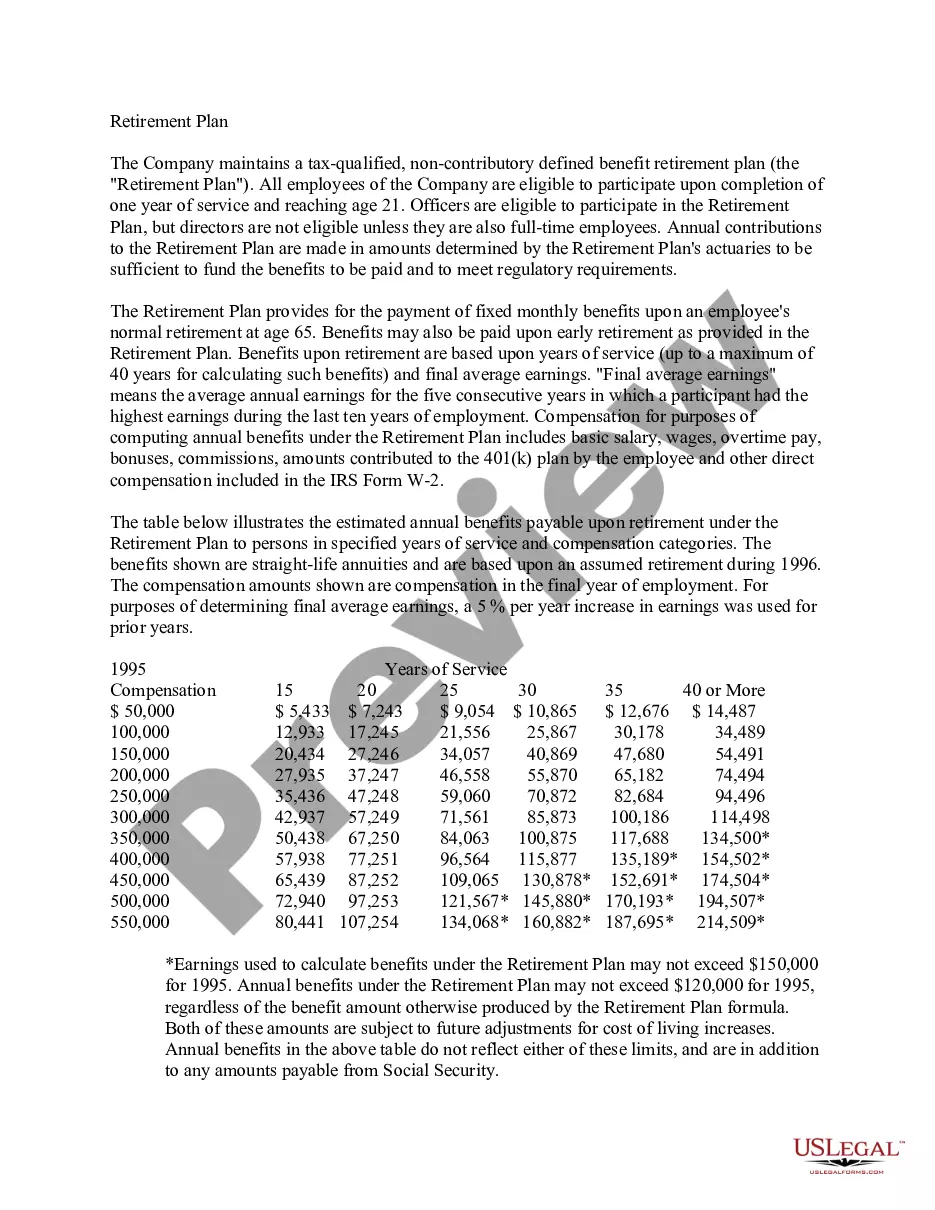

All of your church donations are tax deductible, assuming your church meets the 501(c)(3) requirements. But you might not be able to claim them all in one year. If your donations exceed 60% of your Adjusted Gross Income, you will need to claim the remaining donations in future tax years.

When you prepare your federal tax return, the IRS allows you to deduct the donations you make to churches. If your church operates solely for religious and educational purposes, your donation will qualify for the tax deduction.

Charitable donations are tax deductible and the IRS considers church tithing tax deductible as well. To deduct the amount you tithe to your church or place of worship report the amount you donate to qualified charitable organizations, such as churches, on Schedule A.