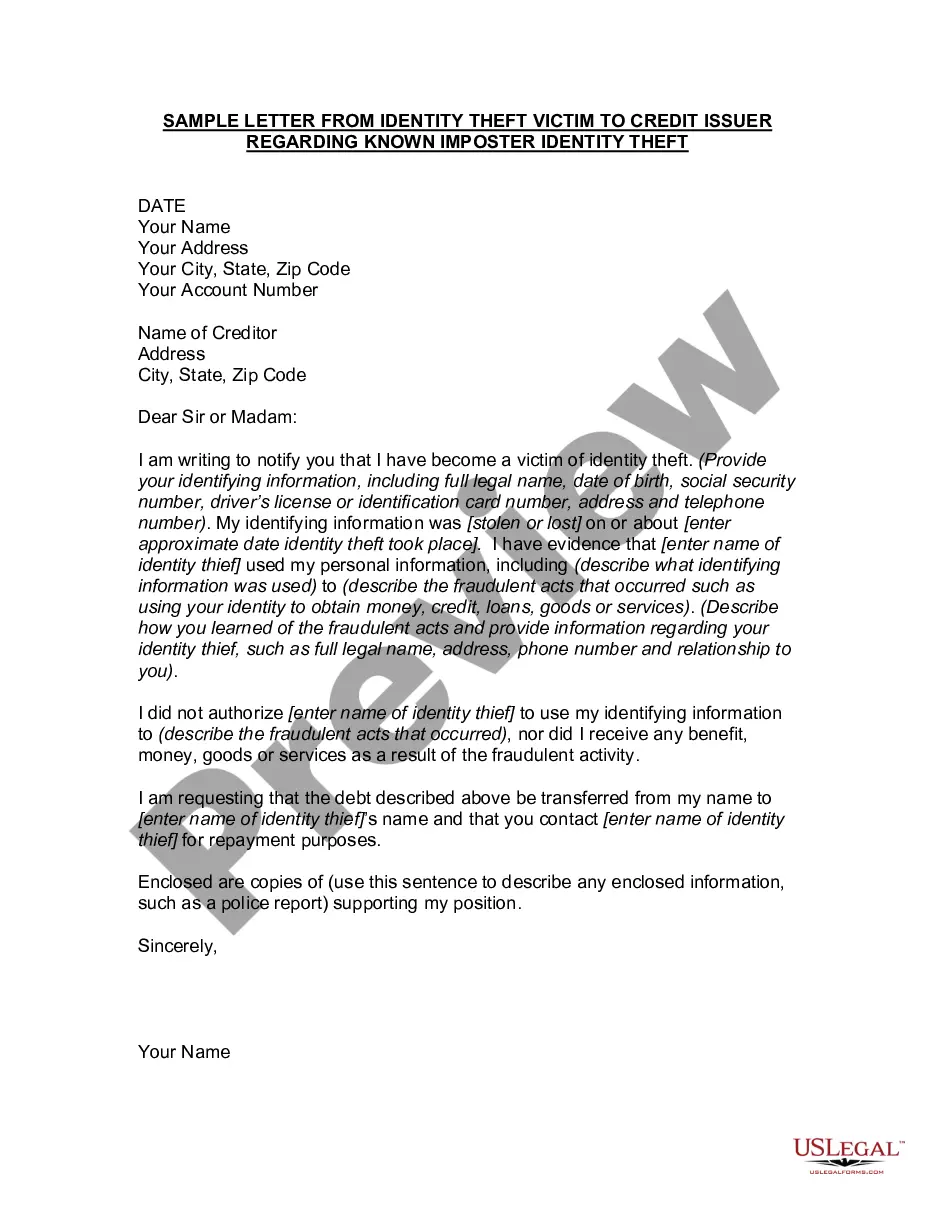

This form is a sample letter in Word format covering the subject matter of the title of the form.

Gift Letter Form Withdrawal In Sacramento

Description

Form popularity

FAQ

They are legally binding — While giving a family member a financial gift may not feel like a big deal to some people, gift letters are not only a formality. They are a legally binding document that both parties must sign.

Most mortgage providers will have a template that you can follow, but in general, your gift letter should include: The donor's name, address and phone number. The donor's relationship to the client. The dollar amount of the gift. The date when the funds were (or will be) transferred.

A promise to make a gift speaks to a future event. The gift is incomplete until there is delivery of the associated monies or items. ingly, the law considers such promises to be unenforceable.

How Do I Write a Gift Letter? The donor's name, address and phone number. The donor's relationship to the client. The dollar amount of the gift. The date when the funds were (or will be) transferred. A statement from the donor that no repayment is expected. The donor's signature.

Page 6 Internal Revenue Service Center. Kansas City, MO 64999. If using a PDS, file at this address. Internal Revenue Service. 333 W. Pershing Road. Kansas City, MO 64108.

The IRS is now accepting both handwritten and electronic signatures on the following select forms for which e-filing is not available (see IRM 10.10. 1-2 for a complete list): 706 series returns – Estate and Generation-Skipping Transfer Tax Returns. Form 709 – U.S. Gift (and Generation-Skipping Transfer) Tax Return.

Who Must File. In general. If you are a citizen or resident of the United States, you must file a gift tax return (whether or not any tax is ultimately due) in the following situations. If you gave gifts to someone in 2024 totaling more than $18,000 (other than to your spouse), you probably must file Form 709.

Answer. The IRS does not currently support electronic filing for the 706 - Estate Tax return or 709 - Gift Tax return.

You cannot e-file Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return. The Instructions for Form 709 direct you to mail it to the applicable address listed below.

In addition, some Forms 1040, 1040-A, 1040-EZ, and 1041 cannot be e-filed if they have attached forms, schedules, or documents that IRS does not accept electronically.