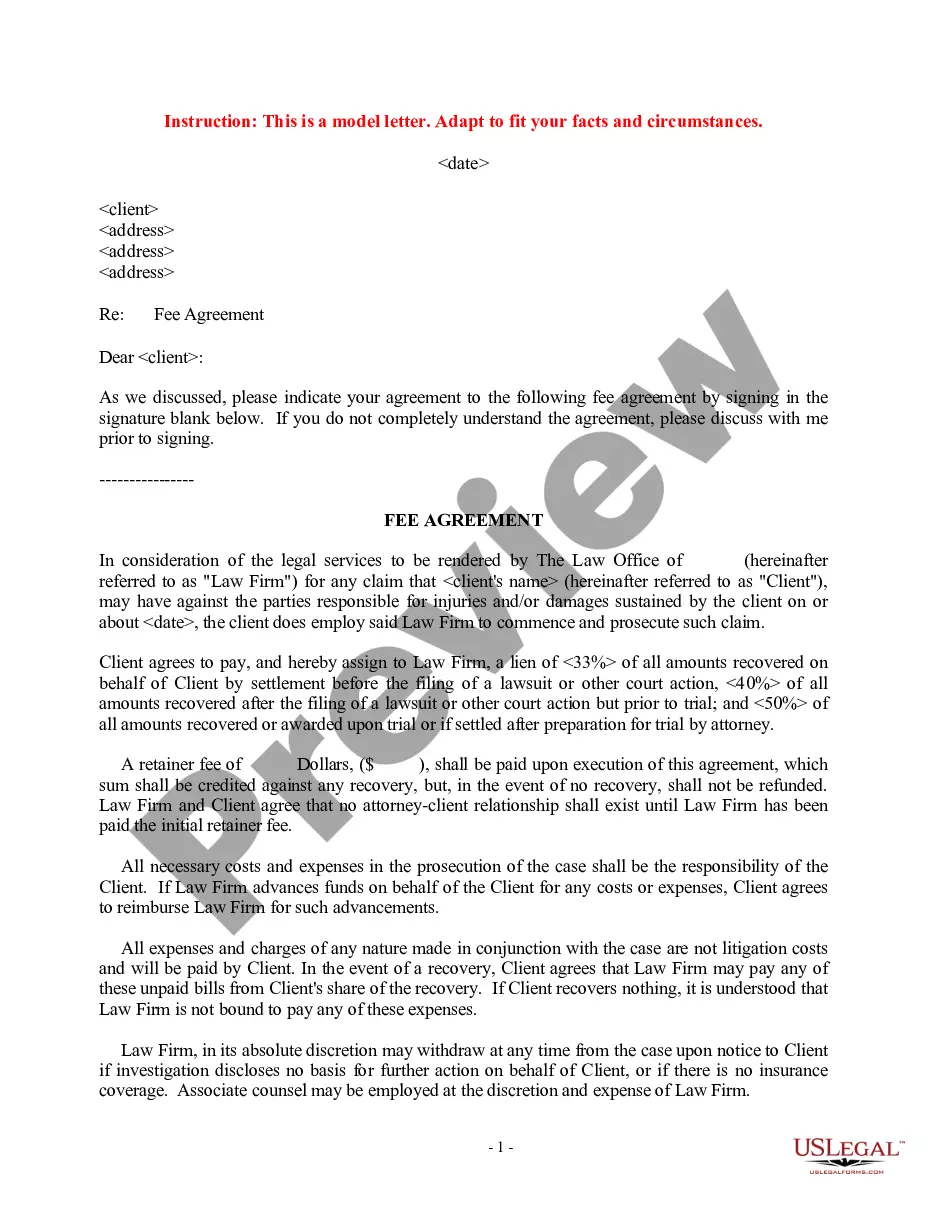

This form is a sample letter in Word format covering the subject matter of the title of the form.

Gift Letter Form With Spouse In San Bernardino

Description

Form popularity

FAQ

At minimum, a gift letter should include: The giver's name and relationship to the borrower. The dollar amount of the gifted funds. The source of the gifted funds, such as an account number and statements.

They are legally binding — While giving a family member a financial gift may not feel like a big deal to some people, gift letters are not only a formality. They are a legally binding document that both parties must sign.

The gift letter must: specify the actual or the maximum dollar amount of the gift; include the donor's statement that no repayment is expected; and. indicate the donor's name, address, telephone number, and relationship to the borrower.

San Bernardino County sales tax details The minimum combined 2025 sales tax rate for San Bernardino County, California is 7.75%. This is the total of state, county, and city sales tax rates. The California sales tax rate is currently 6.0%. The San Bernardino County sales tax rate is 0.25%.

To change the name(s) on real property, the present owner(s) may execute a new deed conveying the property from the name(s) as they presently appear, to the name(s) that will be used to hold title. Full names of all parties must be used.

The Documentary Transfer Tax (DTT) imposes a tax on each deed, instrument, or writing by which any lands, tenements, or any other realty sold, shall be granted, transferred, or otherwise conveyed to another person. The State Revenue and Taxation Code 11902 - 11934 governs this tax.

In most California counties, the seller typically pays for the transfer tax. But this can be negotiated between both parties and specified within the contract. RETTs are imposed by state and local governments in many parts of the United States, including California.

It is essentially letter that someone writes to the U.S. government that indicates the writer is a witness to your marriage and knows certain facts. The affidavit serves as a personal testimonial that your marriage is genuine, not arranged solely for the purpose of obtaining a green card.

The content may vary depending on the circumstances, but it generally contains the names of both spouses, a formal legal description of the shared real estate, and the recording information for the deed transferring ownership to the couple, confirming their intention to hold title as community property.