Money Gift Letter From Parents In Santa Clara

Description

Form popularity

FAQ

Acceptable Donors A gift can be provided by: a relative, defined as the borrower's spouse, child, or other dependent, or by any other individual who is related to the borrower by blood, marriage, adoption, or legal guardianship; or.

A gift can be provided by: a relative, defined as the borrower's spouse, child, or other dependent, or by any other individual who is related to the borrower by blood, marriage, adoption, or legal guardianship; or.

(Date) Dear (Donor): I have received your "Offer of Gift," dated ___________________, by which you, on behalf of the (Name of Company), offered to convey (Description of Property) to the United States of America as a gift. I accept with pleasure your gift and conveyance of the (Property), pursuant to 10 U.S.C. 2601.

A gift letter must contain the donor's name, the gift's value, confirmation that the gift is not to be repaid, and the donor's signature. For tax year 2024, the annual exclusion on a gift per person per year is $18,000, an increase of $1,000 over 2023, ing to the Internal Revenue Service (IRS).

Santa Clara University is a nonprofit corporation organized under the laws of the State of California and exempt under Section 501(c)(3) of the Internal Revenue Code.

Santa Clara University's tax identification is 94-1156617.

A letter from your parents and a copy of the bank statement may be enough. However, if your parents give more than that in a single year, they will be required to file a gift tax return on Form 709, assuming they are American citizens.

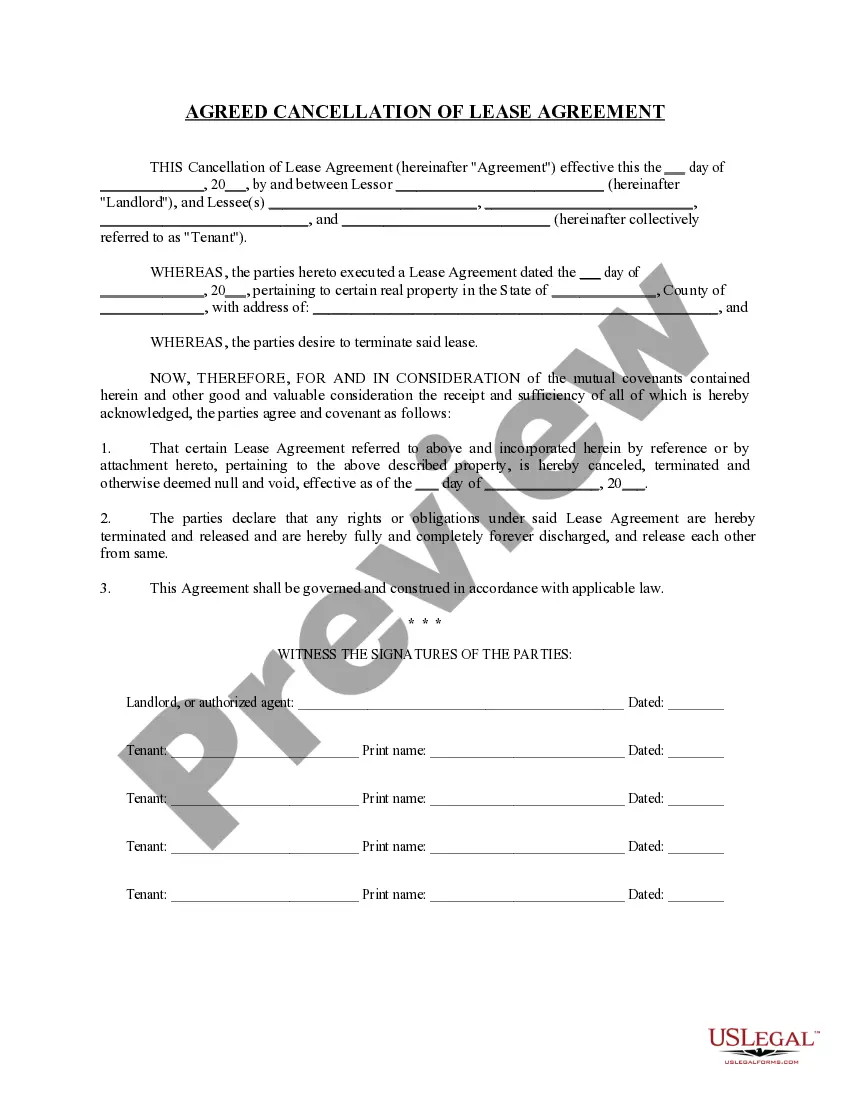

Documentation Requirements Gifts must be evidenced by a letter signed by the donor, called a gift letter. When the gift is sourced by a trust established by an acceptable donor or an estate of an acceptable donor, the gift letter must be signed by the donor and list the name of the trust or the estate account.