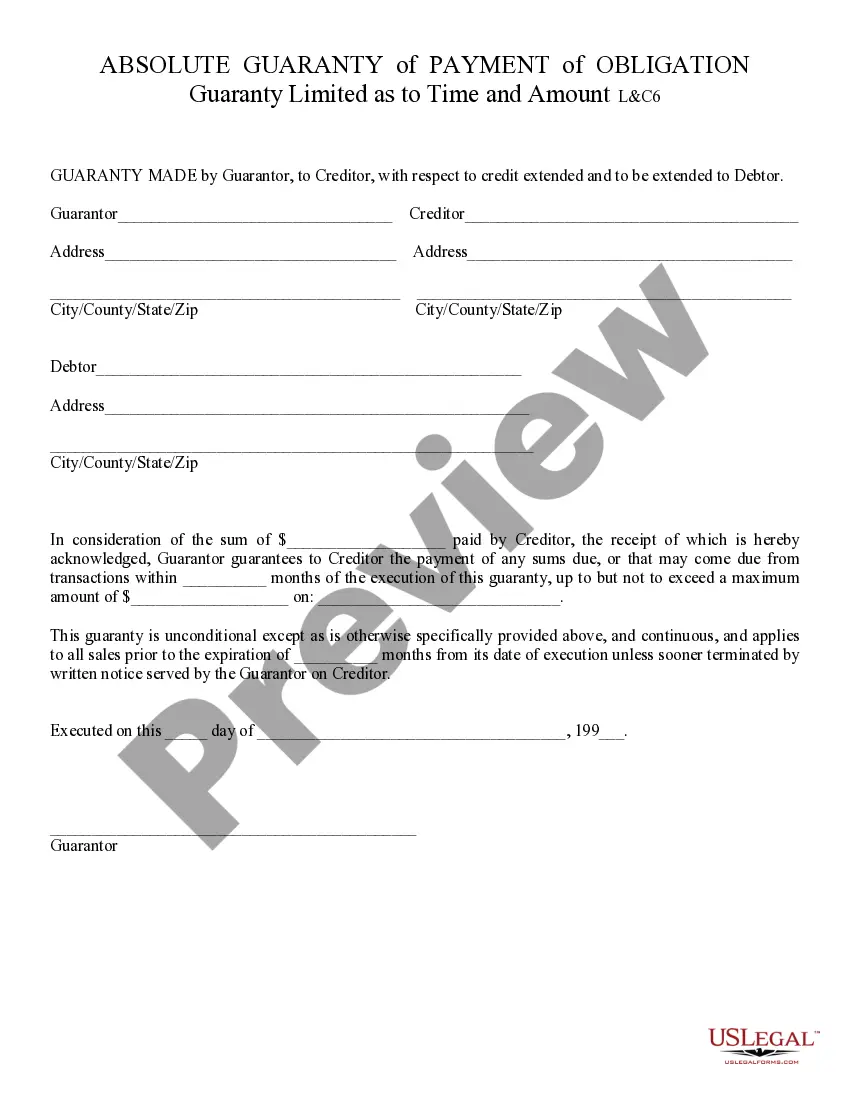

This form is a sample letter in Word format covering the subject matter of the title of the form.

Receipt Donation Document With Iphone In Texas

Description

Form popularity

FAQ

Fill out forms, sign documents, and create signatures on iPhone Go to the file you want to open. Tap the file to open the document. Tap. To fill out another field, tap it, then enter text. To add additional text or to add your signature to the form, tap. When you're done, tap. Tap Done to close the document.

In the Mail app, you can give feedback on a draft, decorate a photo, and more. You can also draw and write on a photo, video, or PDF attachment, then save it or send it back.

Write and draw in documents with Markup on iPhone In a supported app, tap. or Markup. In the Markup toolbar, tap the pen, marker, or pencil tool, then write or draw with your finger. While drawing, do any of the following. To close the Markup toolbar, tap. or Done.

Fill out forms, sign documents, and create signatures on iPhone Go to the file you want to open. Tap the file to open the document. Tap. To fill out another field, tap it, then enter text. To add additional text or to add your signature to the form, tap. When you're done, tap. Tap Done to close the document.

Select the pencil icon on the bottom right select the plus button then text now you can type yourMoreSelect the pencil icon on the bottom right select the plus button then text now you can type your text onto the document. You can also sign your document by tapping on the plus signature ad signature.

If you don't have receipts, keep as much alternative documentation as possible to support your tax deductions. Some examples include: Canceled checks or bank statements. Credit card statements.

Proof can be provided in the form of an official receipt or invoice from the receiving qualified charitable organization, but it can also be provided via credit card statements or other financial records detailing the donation.

Ing to the IRS, any kind of donation above $250 should require a donation receipt. The same applies to stock gifts/donations.

Whether for charitable reasons or tax avoidance reasons, taxpayers frequently utilize the charitable contributions deduction when itemizing their returns to reduce their tax liability. However, this deduction is subject to IRS policies and may be subject to audit.

Technically, if you do not have these records, the IRS can disallow your deduction. Practically, IRS auditors may allow some reconstruction of these expenses if it seems reasonable.