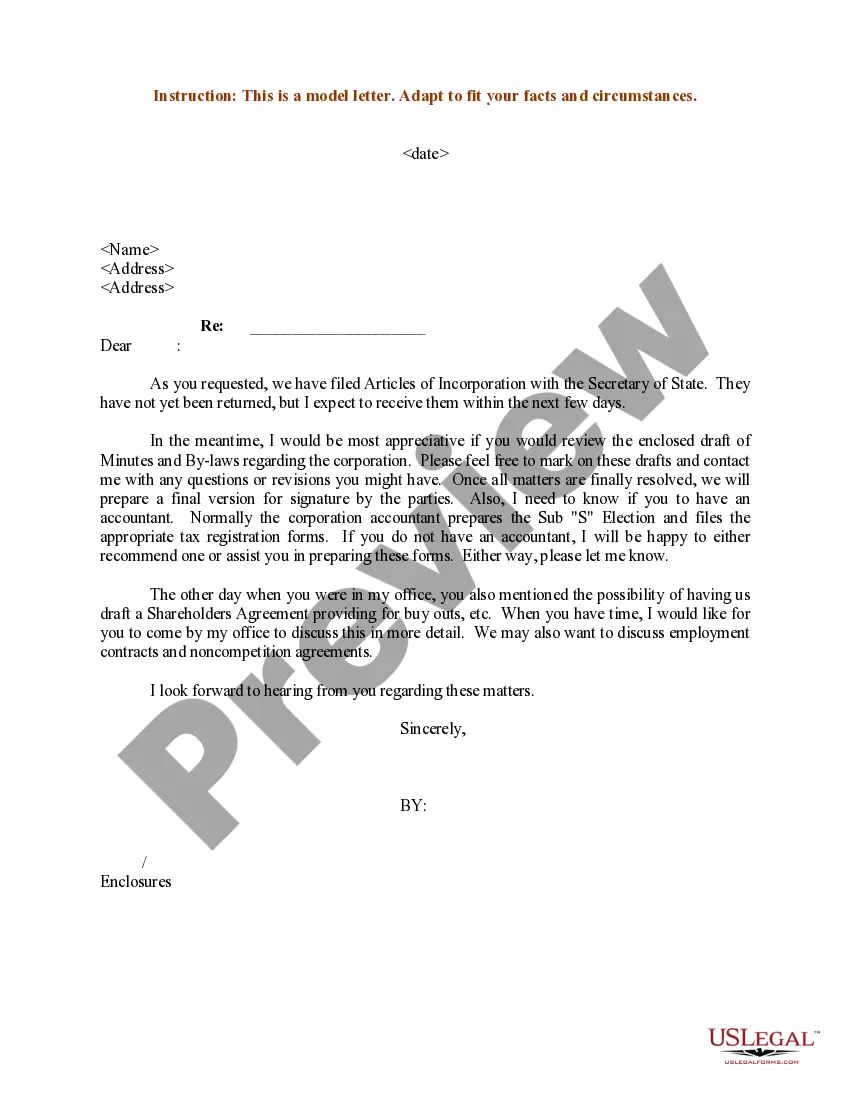

Form with which the Directors of a corporation waive the necessity of an annual meeting of directors.

Annual Meeting Do For Llc In Salt Lake

Description

Form popularity

FAQ

The renewal is due one year from the date of registration and due annually thereafter unless you are filing a DBA, in which, the renewal is 3 years from the date and registration and due every 3 years after that. However if you wish to be sure, you can do a Business Registration Search .

The Utah Annual Report can be filed online or by mail. No matter how you choose to submit your report, you'll need to visit the Utah Division of Corporations and Commercial Code website. On the state website, hover your mouse over the “Business Entities” tab.

Having an annual meeting and keeping a record of what was discussed helps validate that business owners are treating the limited liability company as a separate legal entity. That measure reinforces the corporate veil that protects LLC members' personal assets from the company's legal and financial liabilities.

The renewal is due one year from the date of registration and due annually thereafter unless you are filing a DBA, in which, the renewal is 3 years from the date and registration and due every 3 years after that. However if you wish to be sure, you can do a Business Registration Search .

After an initial filing, some states—such as California, Iowa, and Indiana— require LLCs to file a report every other year. In some states, you'll file a report every two years from the year you formed your LLC.

“There's no hard and fast rule,” says Keren de Zwart, a business attorney who runs Not Your Father's Lawyer out of Irvine, California, “but if your business is netting at least $60K in profits, that's usually a good time to formalize into an LLC or corporation because the tax benefits can really start to be utilized ...

The IRS defines a reasonable salary as the amount someone doing similar work would receive in the same industry and location. If your compensation exceeds the standard, the IRS may challenge it and reclassify some of your dividends as employee wages, which would increase your self-employment taxes.

A domestic LLC with a single owner is disregarded for federal tax purposes unless it elects to be regarded separately from its member, in which case it is treated as an association that is taxable as a corporation.