Escrow Seller Does For Taxes Mean In Sacramento

Description

Form popularity

FAQ

I.R.C. § 121(a) Exclusion — Gross income shall not include gain from the sale or exchange of property if, during the 5-year period ending on the date of the sale or exchange, such property has been owned and used by the taxpayer as the taxpayer's principal residence for periods aggregating 2 years or more.

If the property was last used as the seller's/transferor's (or decedent's, if sold by the decedent's estate or trust) principal residence within the meaning of IRC Section 121 without regard to the two-year time period, no withholding is required.

Good excuses include: a change in your place of employment. health problems that require you to move, or. circumstances you didn't foresee when you bought the home that force you to sell it.

The Section 121 Exclusion is an IRS rule that allows you to exclude from taxable income a gain of up to $250,000 from the sale of your principal residence. A couple filing a joint return gets to exclude up to $500,000. The exclusion gets its name from the part of the Internal Revenue Code allowing it.

Section 121 allows an individual to sell his/her residence and receive a tax exemption on $250,000 of the gain as an individual and $500,000 as a married couple. To be eligible for this tax savings, the home must be held as a primary residence for an aggregate of 2 of the preceding 5 years.

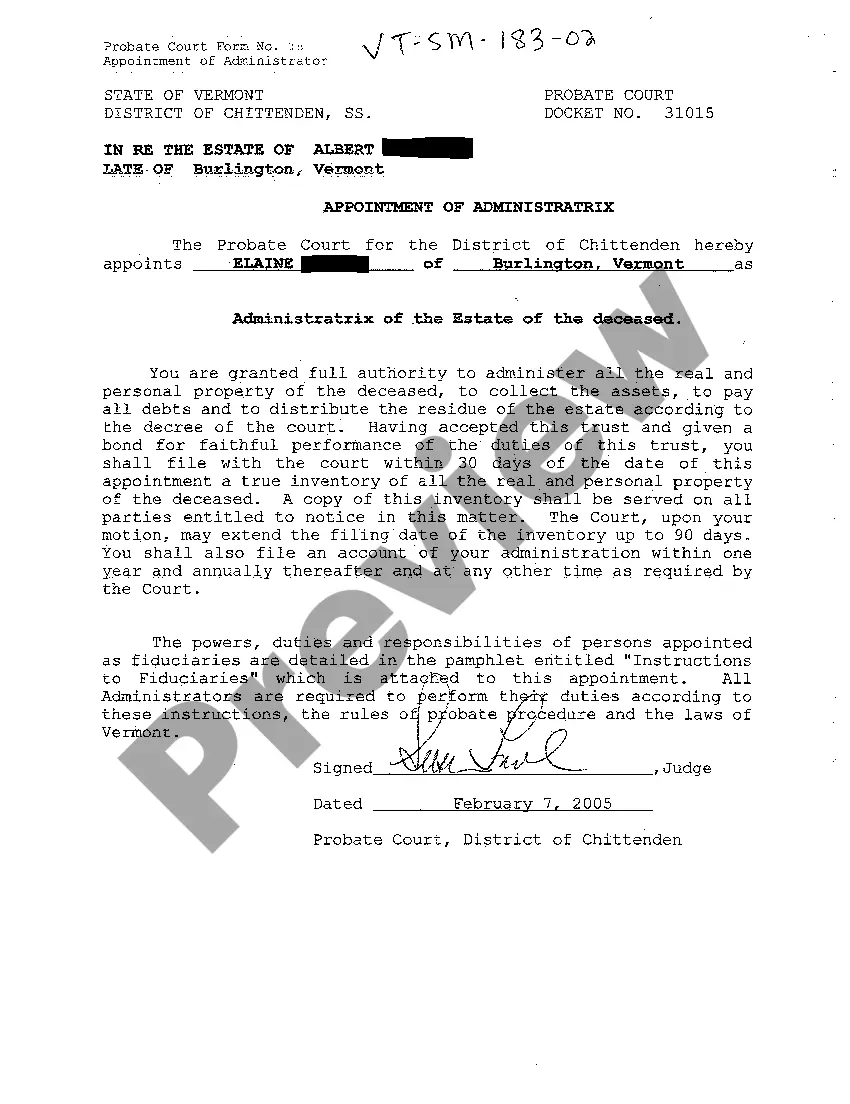

- An Executor or Legal Representative Whether an executor or legal representative, they are responsible for paying the property taxes as long as the property is part of the estate.

To set up your mortgage escrow account, the lender will calculate your annual tax and insurance payments, divide the amount by 12 and add the result to your monthly mortgage statement.

A seller/transferor that qualifies for a full, partial, or no withholding exemption must file Form 593. Any remitter (individual, business entity, trust, estate, or REEP) who withheld on the sale/transfer of California real property must file Form 593 to report the amount withheld.

The seller/transferor must complete and sign this form and return it to your REEP or remitter by the close of the real estate transaction for it to be valid. The buyer/transferee is not required to sign Form 593 when no exemptions apply.

Form 593, also known as the “Real Estate Withholding Certificate,” is a document used in California real estate transactions. It serves as a mechanism for the collections of state income tax on the gain from the sale or transfer of real property.