This form is an assumption agreement for a Small Business Administration (SBA) loan. Party assuming the loan agrees to continue payments thereon. SBA agrees to the assumption of the loan and release of original debtor. Adapt to fit your circumstances.

Eidl Loan Assumption With Seller Financing In Cuyahoga

Category:

State:

Multi-State

County:

Cuyahoga

Control #:

US-00193

Format:

Word;

Rich Text

Instant download

Description

Free preview

Form popularity

FAQ

As of January 2025, there are no plans to forgive outstanding SBA EIDL loans.

Unlike the SBA's Paycheck Protection Program (“PPP”), EIDL cannot be forgiven. EIDLs are loans with 30-year terms and interest rates ranging from 2.75% – 3.75%.

As of January 2025, there are no plans to forgive outstanding SBA EIDL loans.

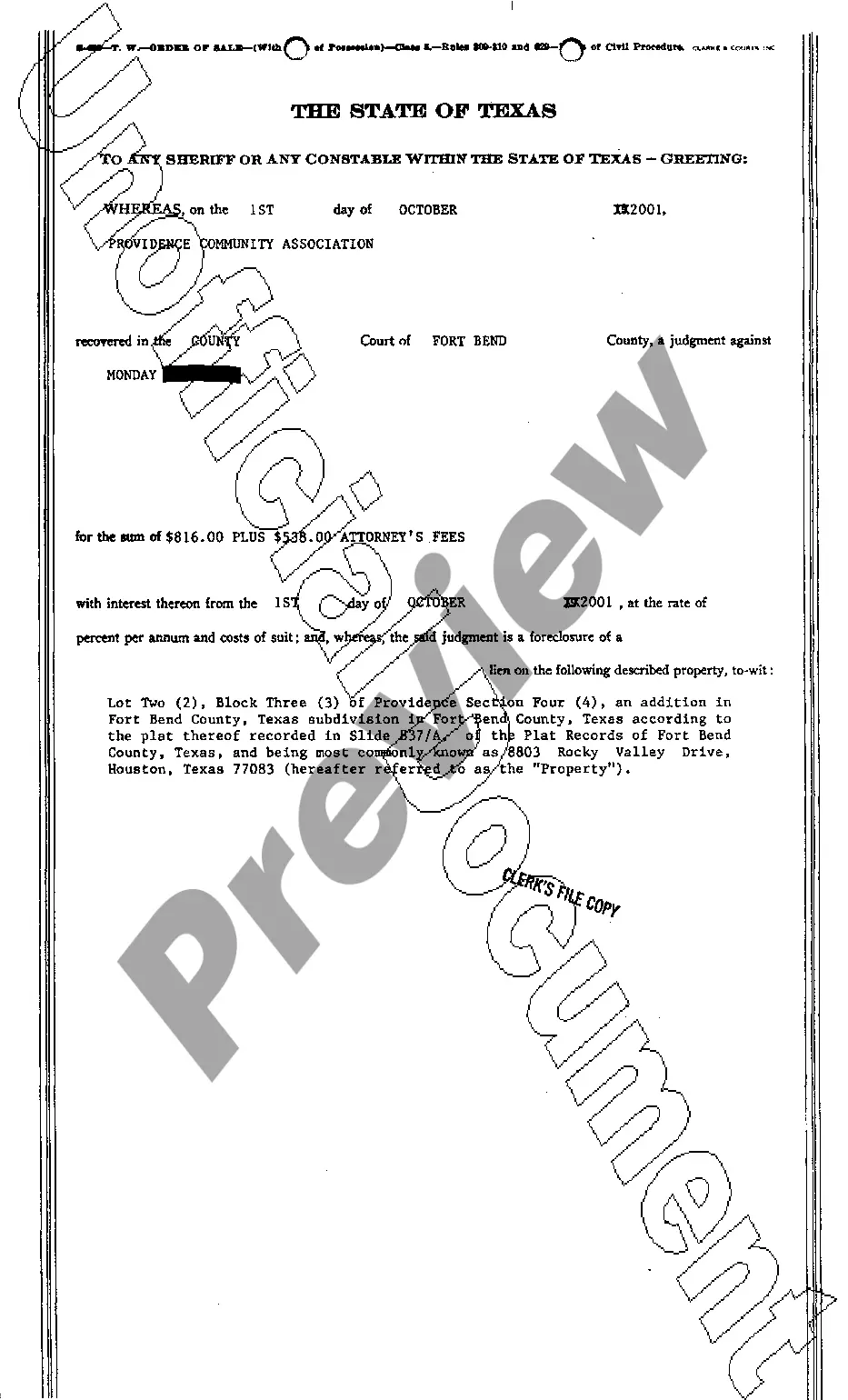

Possible foreclosure. If the buyer stops making payments and won't leave the property, you might need to start the foreclosure process, which could take months or even years.

More info

SBA EIDL loans are not assumable, meaning they cannot be transferred to another party. Has anyone had any luck with an assumption or transfer of an EIDL?I'm wanting to sell my business and have the buyer assume the loan. All lenders and CDCs should be cognizant of the loan program requirements for the assumption, assignment, and sale of SBA loans. The answer is that it depends so basically the way this works is the new buyer is going to need to be approved basically for that for that idle loan. Assumption of Loan Requirement Letter for disaster loan servicing action request packages. About this document and download. EIDL loans aren't likely eligible for a business buyer to assume and will need to be repaid when selling a business. Create an account in the MySBA Loan Portal (lending.sba. Gov) to monitor your loan status or to make payments.