Eidl Loan Assumption With Credit Card In Dallas

Category:

State:

Multi-State

County:

Dallas

Control #:

US-00193

Format:

Word;

Rich Text

Instant download

Description

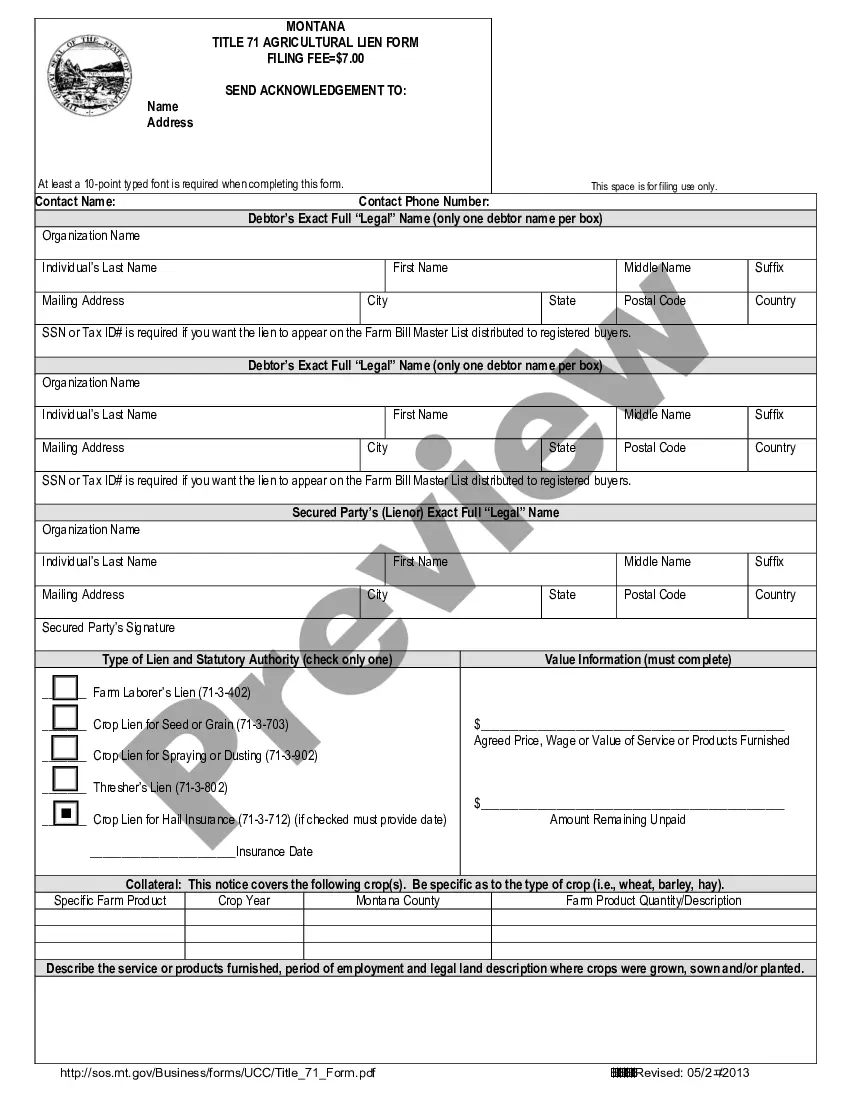

The Assumption Agreement is a crucial legal document utilized in the context of Eidl loan assumption with credit card in Dallas. It stipulates that one party, referred to as the 'Borrower,' is transferring their debt obligations associated with a Small Business Administration loan to another party, known as the 'Assumptor.' This document serves to formally request the SBA's consent for this transfer. Key features include the specification of the original loan amount, references to various security instruments, and conditions for maintaining the Borrower's obligations despite the assumption. The form requires essential details such as borrower identities, loan particulars, and notarization to validate the agreement. Legal professionals, including attorneys and paralegals, find this form beneficial for ensuring compliance with SBA requirements and protecting clients' interests. It is particularly useful in real estate transactions where financial obligations are transferred, helping to mitigate risks associated with indebtedness. Additionally, it provides a structured approach for the communication of agreements between parties, which is vital for legal clarity and operational functionality.

Free preview

Form popularity

FAQ

As of January 2025, there are no plans to forgive outstanding SBA EIDL loans.

As of January 2025, there are no plans to forgive outstanding SBA EIDL loans.

As of January 2025, there are no plans to forgive outstanding SBA EIDL loans.

As of January 2025, there are no plans to forgive outstanding SBA EIDL loans.

EIDLs offer advances up to $10,000 that do not need to be repaid, while PPP loans provide small business loans equal to 2.5 times their average monthly payroll, up to $10 million.

If you miss a payment or use too much available credit: Your business credit card could hurt both your personal and business credit scores. Even if you close your card, its history could stay on your personal credit reports for up to 10 years.