This form is an assumption agreement for a Small Business Administration (SBA) loan. Party assuming the loan agrees to continue payments thereon. SBA agrees to the assumption of the loan and release of original debtor. Adapt to fit your circumstances.

Eidl Loan Assumption With Seller Financing In Florida

Description

Form popularity

FAQ

In this scenario, the seller typically retains the deed to the property until the buyer pays for it in full.

The owner is also responsible for paying property taxes when a property is owner financed. If the buyer appears as the owner on the deed, they may be responsible for the property tax. However, if the seller is financing the property, they are still responsible for paying the taxes.

In Florida, seller-financed transactions must comply with state and federal regulations, including the Dodd-Frank Act. It's important for both parties to understand the legal requirements and to work with professionals to structure the deal.

In Florida, buyers can typically assume federally guaranteed or insured mortgages, such as: FHA Loans: Insured by the Federal Housing Administration.

Who Holds the Deed When You Have a Mortgage Lender? The short answer is: You, the homeowner, typically hold the deed to your house, even when you have a mortgage.

Wrap loans are legal in Florida. See related statute below. If you want to discuss further, let me know. 655.56 Collection of fines, interest, or premiums on loans made by financial institutions.

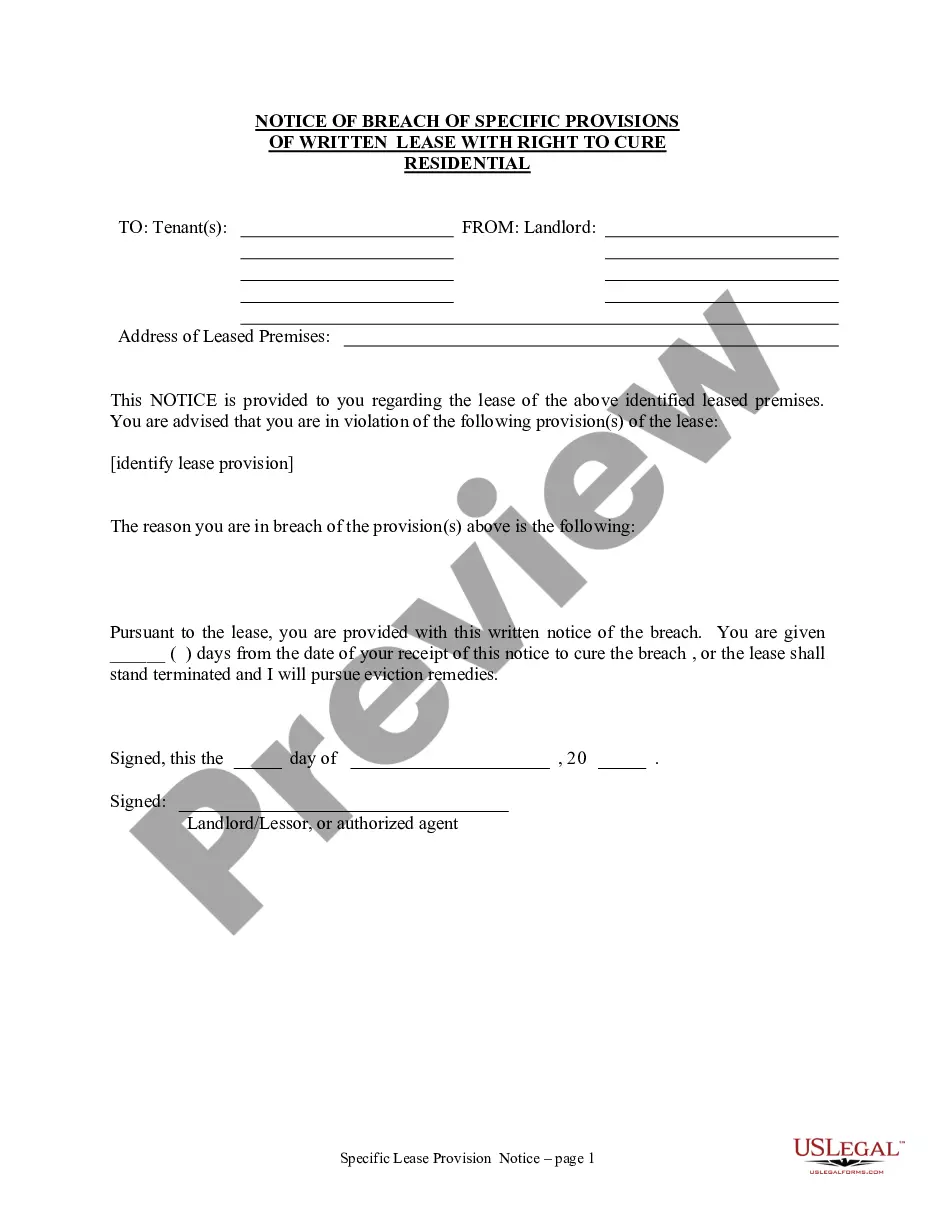

An assumption agreement, sometimes called an assignment and assumption agreement, is a legal document that allows one party to transfer rights and/or obligations to another party. It allows one party to "assume" the rights and responsibilities of the other party.

Possible foreclosure. If the buyer stops making payments and won't leave the property, you might need to start the foreclosure process, which could take months or even years.