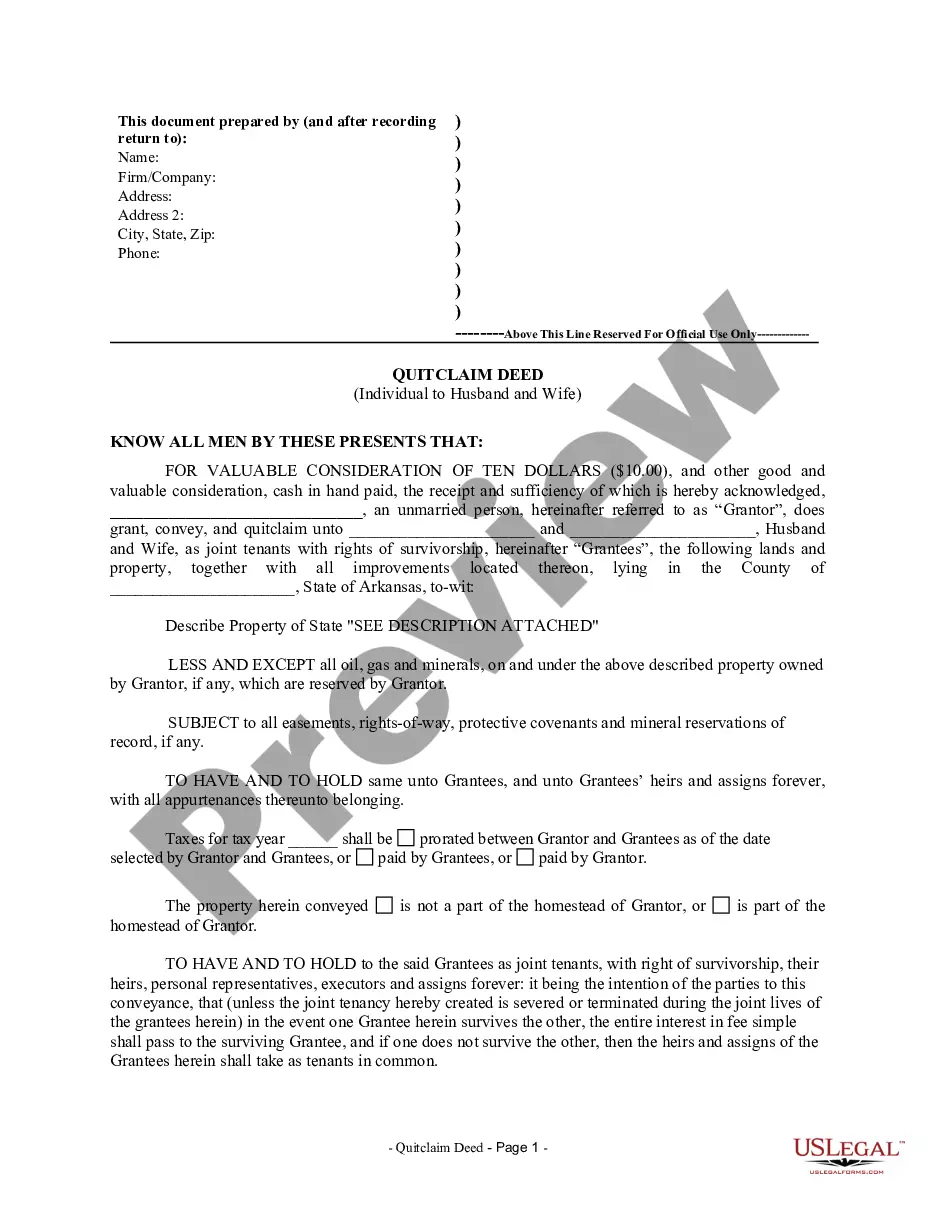

This form is an assumption agreement for a Small Business Administration (SBA) loan. Party assuming the loan agrees to continue payments thereon. SBA agrees to the assumption of the loan and release of original debtor. Adapt to fit your circumstances.

Sba Loans Assumed With Property You Received In Pennsylvania

Description

Form popularity

FAQ

Conventional loans backed by Fannie Mae and Freddie Mac are generally not assumable, though exceptions may be allowed for adjustable-rate mortgages.

Individuals who own 20% or more of a small business applicant must provide an unlimited personal guaranty.

Ing to the SBA Form 1086, non-PPP loans and payments are due at the Fiscal and Transfer Agent (FTA) on the third calendar day of the month, or the next business day if the third is not a business day. The SBA allows a grace period of two business days after the due date.

When seeking a lien release, borrowers should approach the SBA with a well-prepared case that highlights the equity in their assets and the potential for a fair settlement. It is essential to gather documentation and evidence that supports your position and demonstrate your willingness to resolve the debt.

You likely will not be able to sell that home without using the sales proceeds to payoff that lien. There is not a way to transfer the lien to be on some other piece of property as collateral, unless you can negotiate such an agreement with the SBA.

When seeking a lien release, borrowers should approach the SBA with a well-prepared case that highlights the equity in their assets and the potential for a fair settlement. It is essential to gather documentation and evidence that supports your position and demonstrate your willingness to resolve the debt.

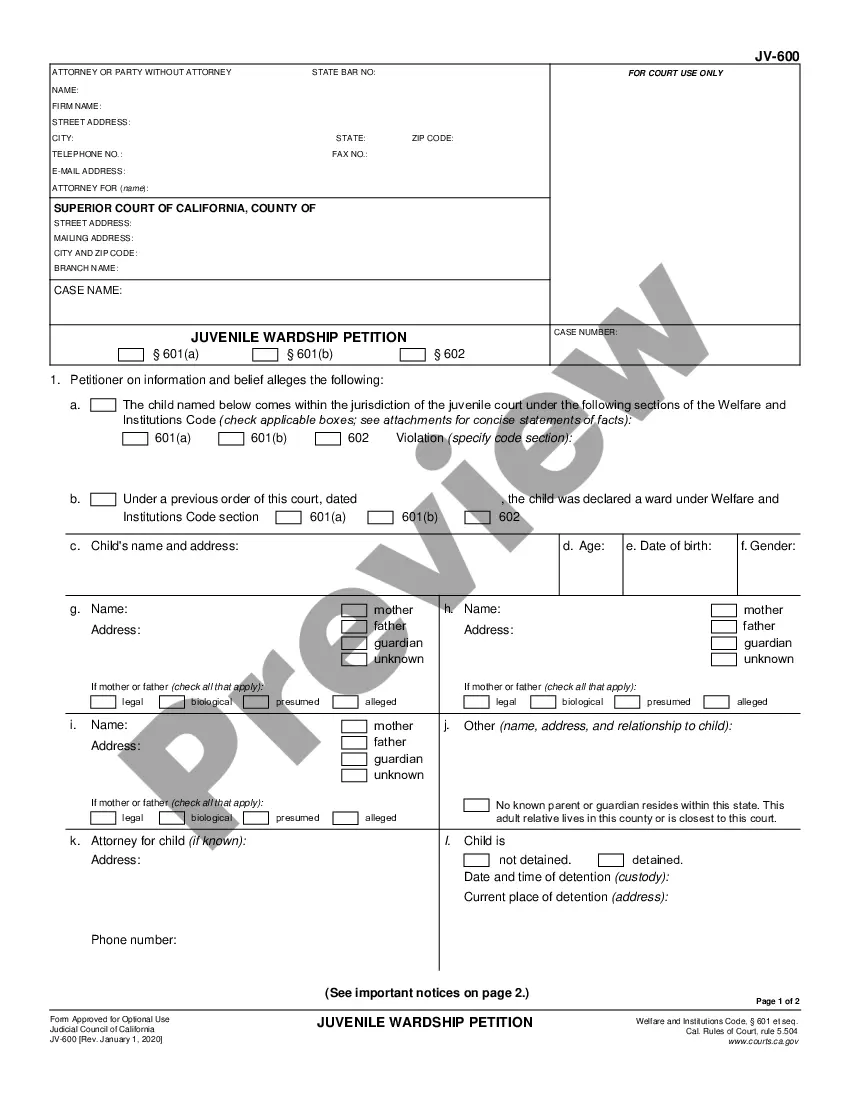

How to fill out SBA form 413 Provide basic business information. Report your assets. Report your liabilities. List your source of income and contingent liabilities to complete section 1. Detail your notes payable to banks and others in section 2. Detail the status of your stocks and bonds for section 3.

First, let's walk you through the three simple steps you'll need to complete on SBA Form 912. Step 1: Provide Identifying Information in Sections 1-6. Step 2: Provide Criminal History (If Applicable) in Sections 7-9. Step 3: Sign and Date the Form.