E Commerce Agreement For Dummies In Phoenix

Description

Form popularity

FAQ

Internet commerce | Federal Trade Commission.

In the United States, federal eCommerce law includes the 1996 Telecommunications Act, the 1998 Digital Mil- lennium Copyright Act, the 2000 Electronic Signatures In Global and National Commerce, and the 2003 Con- trolling the Assault of Non-Solicited ography and Marketing Act.

The UETA and E-SIGN Act have now legitimized the ability of parties to form contracts electronically both at the federal and state levels.

The Electronic Signatures in Global and National Commerce Act (E-Sign Act), 1 signed into law on June 30, 2000, provides a general rule of validity for electronic records and signatures for transactions in or affecting interstate or foreign commerce.

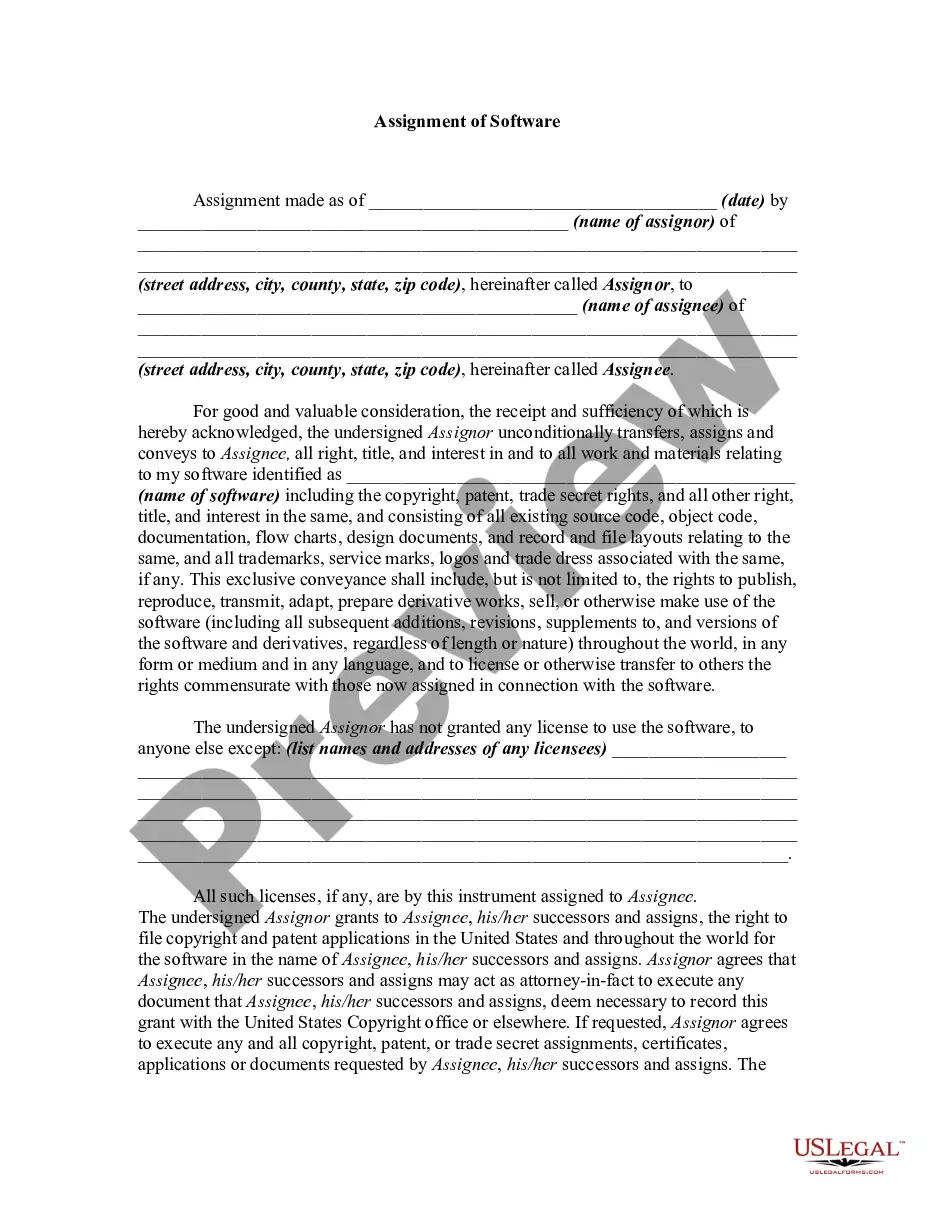

ECommerce agreements disclose the contractual relationship and obligations between a website owner and its commercial users.

The laws, regulations and legal precedents that encompass what is now called cyber law seek to address: Privacy and Data Protection. Intellectual Property Protection. Cybersecurity and Cybercrime. E-Commerce and Online Contracts. Freedom of Expression and Speech. Internet Governance. Liability and Responsibility.

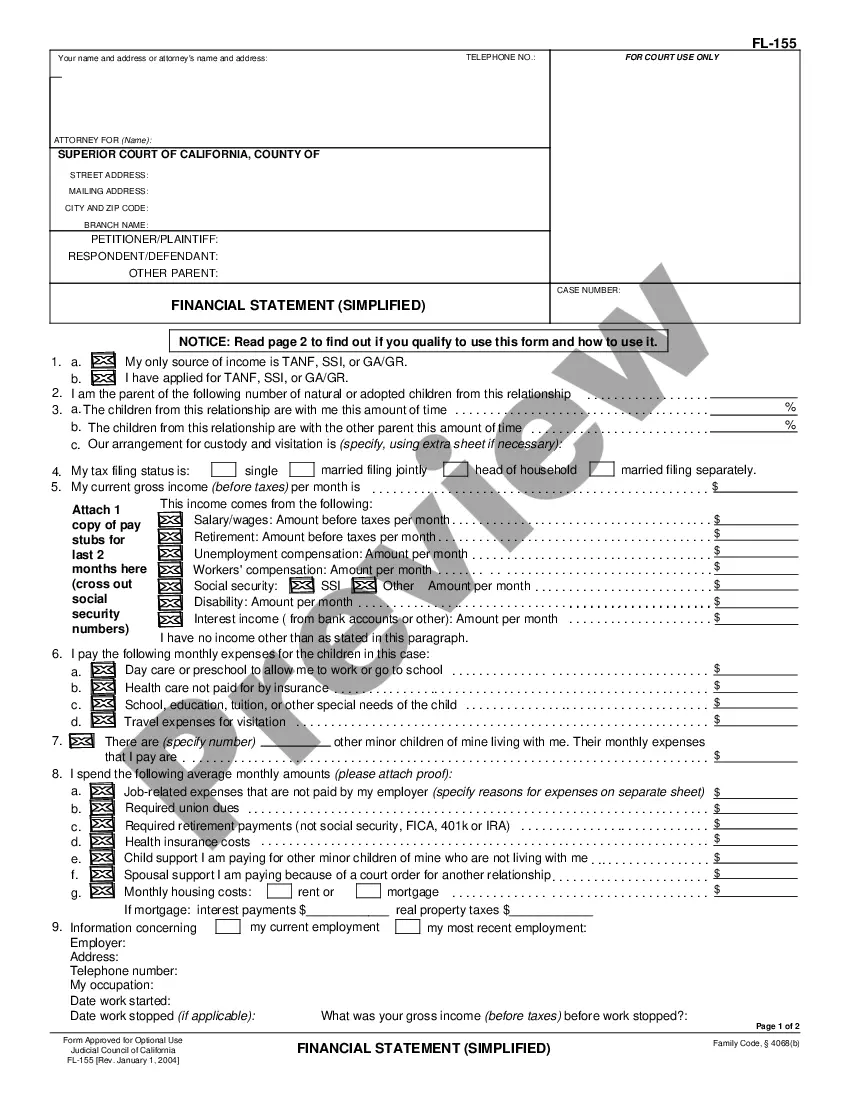

Remote Seller: Any person or business selling or shipping products into Arizona but does not have a physical presence. TPT filing is required if in the current year or previous calendar year a remote seller has more than $200,000 (2019), $150,000 (2020) or $100,000 (2021 and beyond) in sales to Arizona customers.

Retail Sales, Level 1 (State Business Activity Code 017) The gross income from the sale of tangible personal property must be reported at a two and three tenths percent (2.3%) tax rate.

If your LLC engages in a business type that's subject to the TPT, you must get the state transaction privilege tax license from the Arizona Department of Revenue. This license is sometimes called a sales tax, resale, wholesale, vendor or tax license.

Common sales tax exemptions include: Professional or personal services where the sale of tangible personal property constitutes an inconsequential element. Services rendered in addition to the sale of tangible personal property at retail.