E Commerce Agreement For Farmers In San Jose

Description

Form popularity

FAQ

What are Agricultural Exempt Buildings? Agricultural Exempt Buildings are structures that comply with Appendix “C” of the current California Building Code. Agricultural Exempt Buildings shall qualify for an “exempt building permit” if they are located on a parcel of land that is at least 20 acres or is zoned AG- 20.

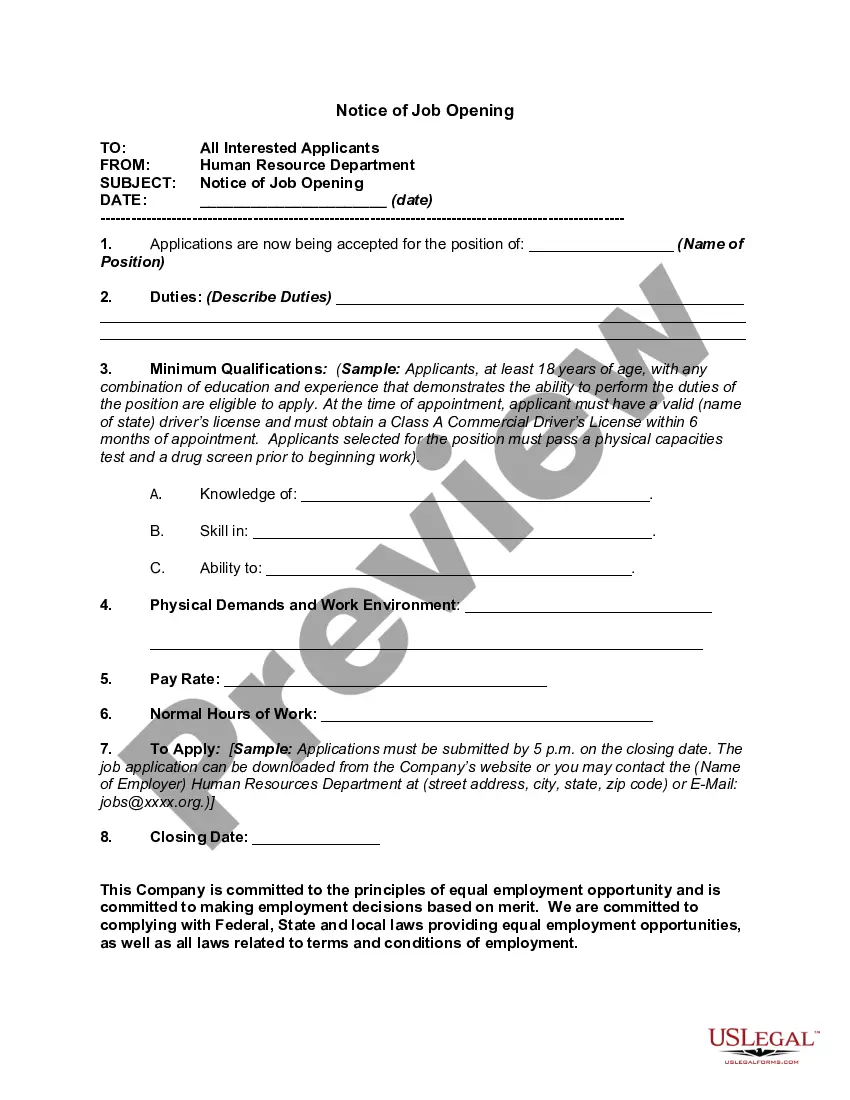

Bottom line: Business license is needed if you are doing retail sales in a municipality (e.g. farmers market, storefront). It is not needed if you are selling wholesale (e.g. to restaurants, markets).

For example, if farming is a hobby for you, then you are only able to deduct expenses related to that hobby, and you can't claim a tax loss. If your farming activities are classified as a business, you can take advantage of many more deductions and tax breaks.

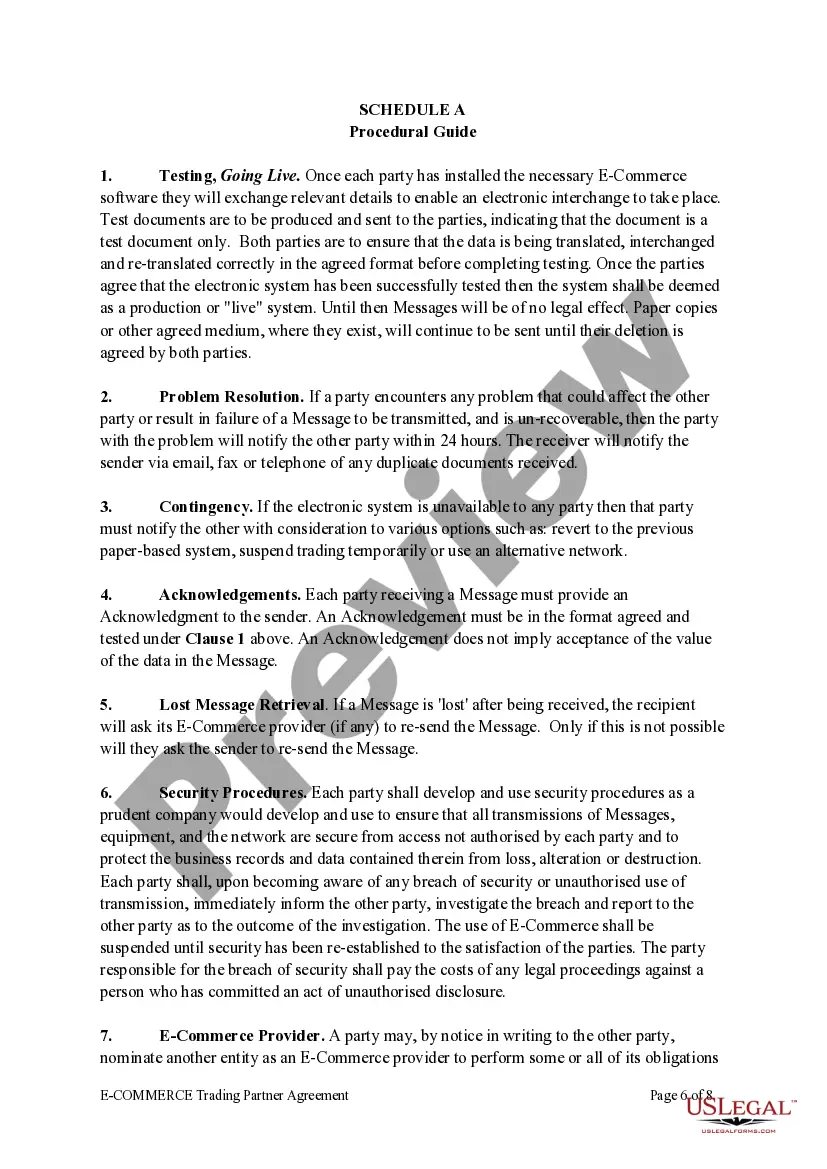

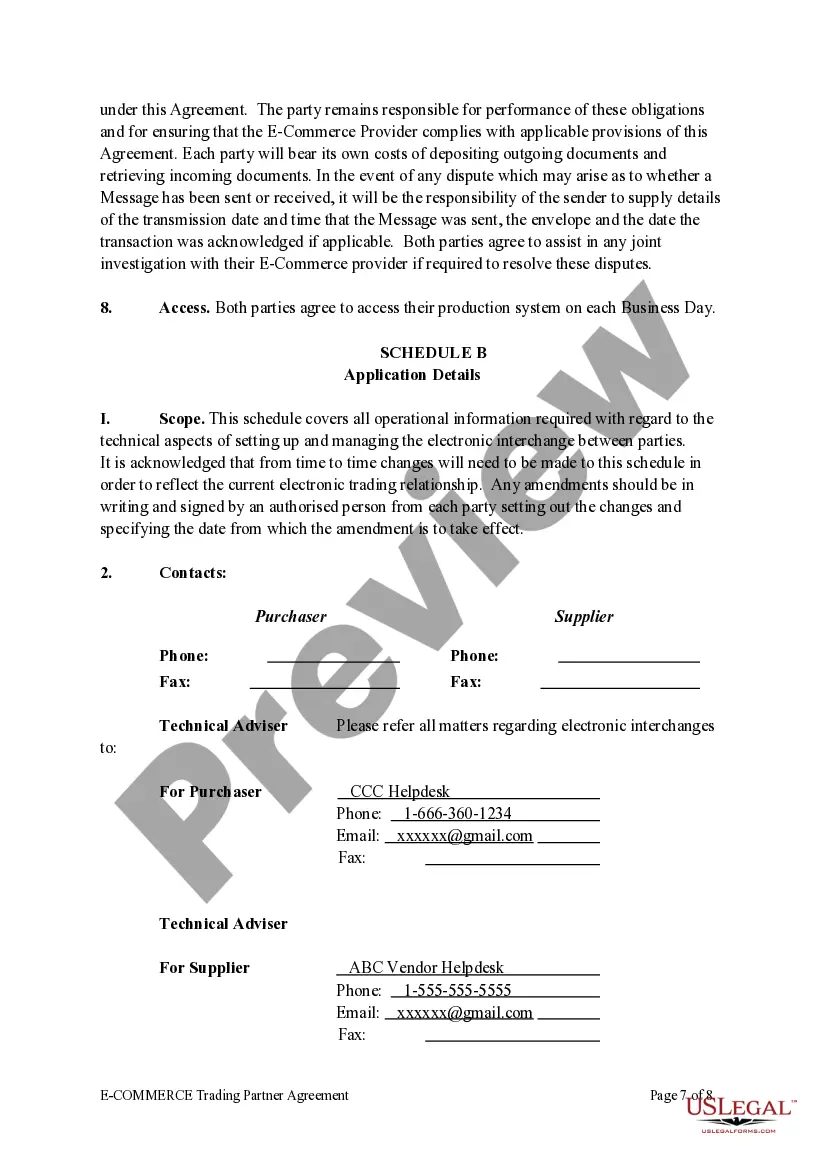

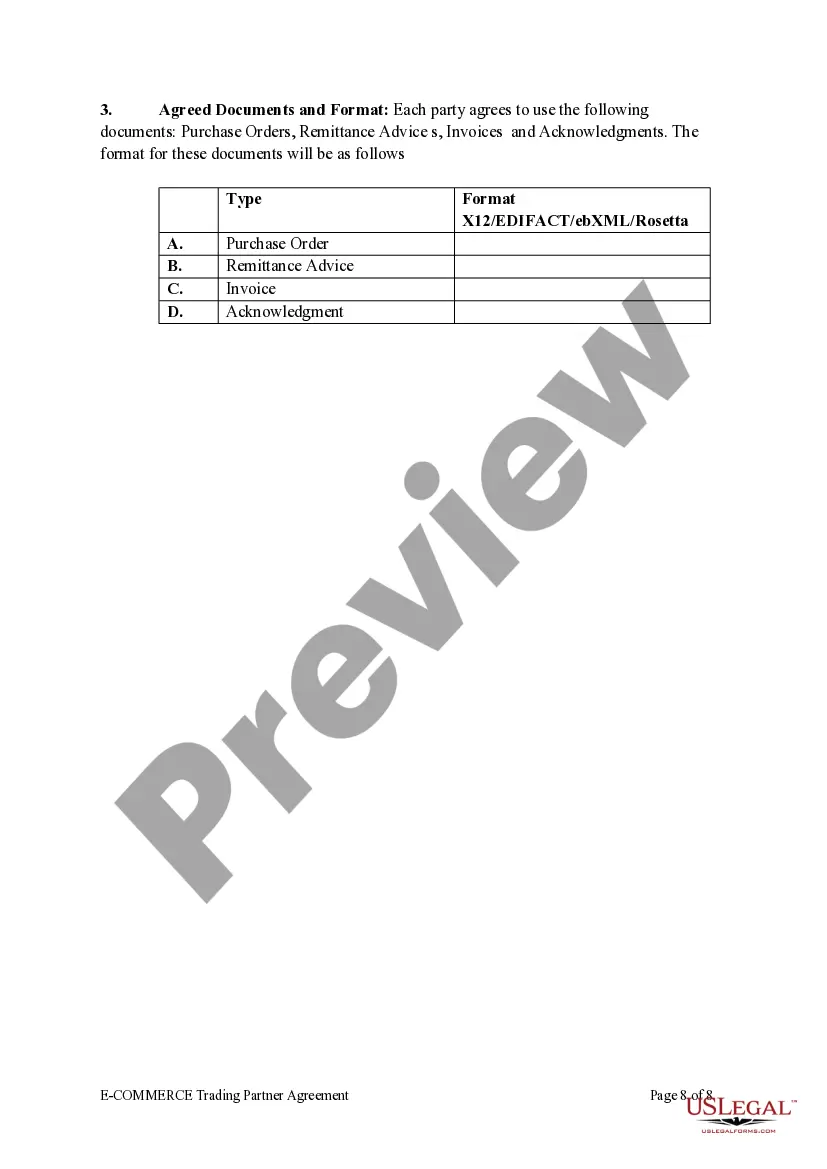

A user agreement is any contract between a website user and the site's owner or operator. These e-commerce contracts can be end-user license agreements (EULAs), terms of service/terms and conditions, or privacy policies. They outline the rights and obligations of both parties.

Grazing a single cow on your property can be enough to trigger tax breaks in some places. If you qualify, an agricultural tax exemption could knock thousands off your property tax bill. Depending on your state's rules, one way to execute this tax strategy is to offer use of your land to a local farmer.

There is no minimum acreage required in order for your property to be considered a farm.

What are Agricultural Exempt Buildings? Agricultural Exempt Buildings are structures that comply with Appendix “C” of the current California Building Code. Agricultural Exempt Buildings shall qualify for an “exempt building permit” if they are located on a parcel of land that is at least 20 acres or is zoned AG- 20.