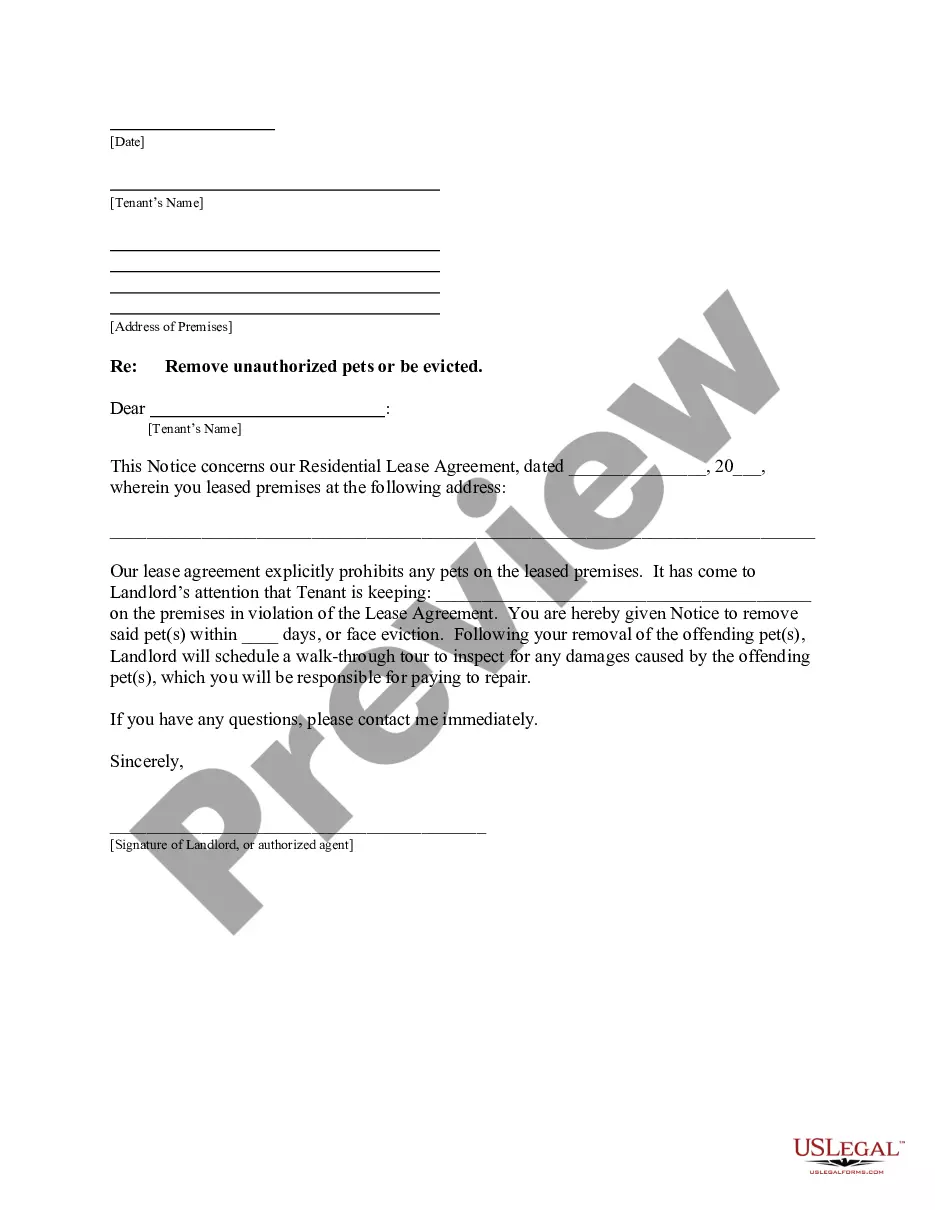

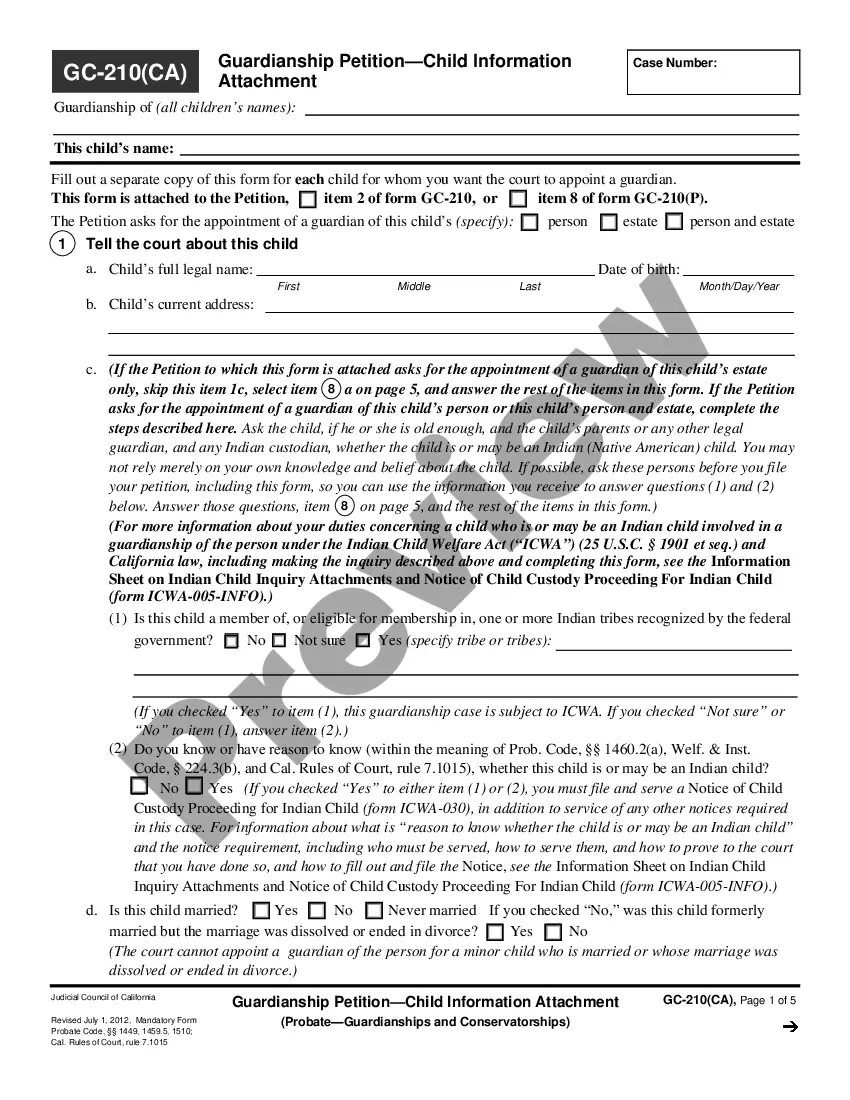

This form is a sample letter in Word format covering the subject matter of the title of the form.

Private Loan Payoff Letter Template With Interest In Alameda

Description

Form popularity

FAQ

This is a standard form of mortgage payout statement provided by a lender to a borrower. This mortgage payout statement sets out the monies owed by the borrower to the lender as of the date of the statement. This Standard Document has integrated notes with important explanations and drafting and negotiating tips.

Purpose, Process, Payoff Having a purpose, process, and payoff statement prepared beforehand can enable you to immediately articulate the benefit of holding a quick conversation and/or capture the attention of everyone participating. It's also a good idea to send this information in the agenda (see point 3).

The winning bidder may take possession of a property after the County Registrar Recorder/County Clerk records the Tax Deed to the Purchaser, which is between 60 and 70 calendar days after the date of the auction.

Ways to Invest in Tax Lien Properties in California Online tax lien auctions: Counties across the state frequently hold these auctions to sell liens on properties with unpaid taxes. Investors can register online, review the list of available properties, and place bids.

Complying with California's lien procedures allows a creditor to obtain a lien on any real property owned by the debtor in the county in which it is recorded. The lien attaches to all real property in the debtor's name. See CCP § 697.310(a). The lien remains effective for 10 years.

Ing to California State Law, documents can only be viewed in the Clerk Recorder office. You will be able to view the images of recorded documents involving your name to find out if a lien has been placed against you or if a recorded lien has been released.

No. Legal title to a tax-defaulted property subject to the Tax Collector's power to sell can only be obtained by becoming the successful bidder at the county tax sale. Paying the outstanding property taxes on such property will only benefit the current owner.

Buy directly from county offices: Some counties allow investors to buy tax liens that were not sold during the initial auction. By contacting the county tax collector's office, investors can obtain a list of available liens and make purchases directly.

We're all familiar with the basic concept of setup and payoffs: early on in your screenplay, you set up some detail/scenario that may seem irrelevant, but later on will yield a result that hopefully your audience wasn't anticipating (the payoff).

Under federal law, the servicer must generally send you a payoff statement within seven business days of your request, subject to a few exceptions. (12 C.F.R. § 1026.36.)