This form is a sample letter in Word format covering the subject matter of the title of the form.

Sample Letter To Mortgage Company From Employer In Alameda

Description

Form popularity

FAQ

Components of a LOI Opening Paragraph: Your summary statement. Statement of Need: The "why" of the project. ( ... Project Activity: The "what" and "how" of the project. ( ... Outcomes (1–2 paragraphs; before or after the Project Activity) ... Credentials (1–2 paragraphs) ... Budget (1–2 paragraphs) ... Closing (1 paragraph) ... Signature.

Start your letter of intent with a salutation. When possible, it's preferable to address the person by their full name, rather than with a generic opening, like “To whom it may concern.” Introduce yourself in the first paragraph briefly and state your reasons for writing the letter. Then, state what you have to offer.

What Should A Letter Of Intent To Occupy A Home Include? To write an intent to occupy letter, you should include your name, the home's address, your decision to apply for a mortgage and your intent to occupy the home as the owner. You should also include any specific details that your lender requests.

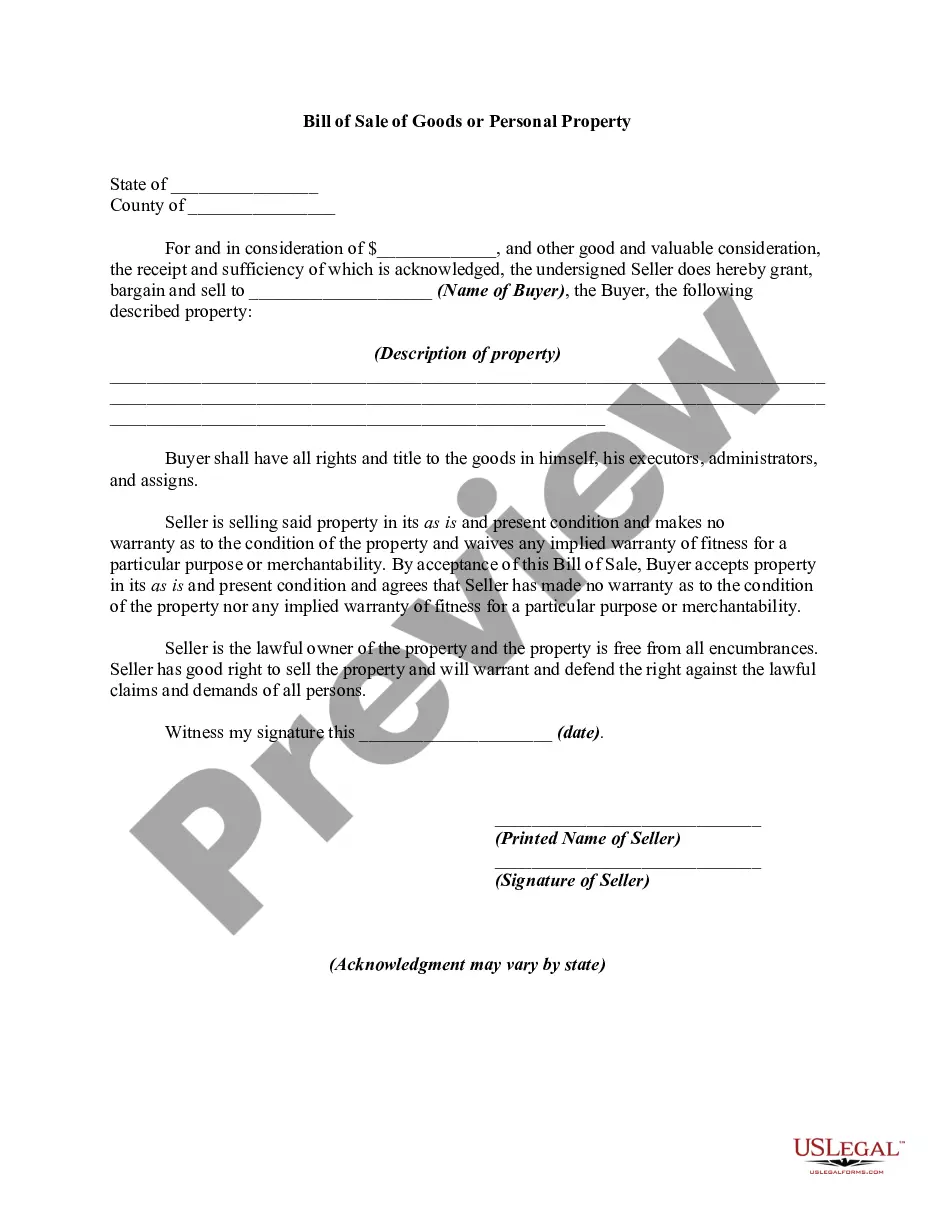

Letter of Explanation Template Provide all details the best you can, including correct dates and dollar amounts. Explain how and when all situations were resolved. If they are not resolved, explain that as well. Detail why problems won't happen again.

The letter should include an explanation regarding the negative event, the date it happened, the name of the creditor and your account number. It should also include an explanation of why you don't see this problem happening again.

This letter should explain your current financial situation and why you're unable to make payments. It should provide specific details about the hardship, such as when it began, how it was caused and how long it may continue.

In your letter, state what the problem is and what you wish the lender to do about it; make sure you are specific. Keep a copy of your letter. Confirm in writing any telephone conversations with the lender. If you send documents, make certain they are copies and not the originals.

To begin writing this type of letter, you might explain the situation or circumstance and any contributing factors. Consider including information to answer questions like: What happened? How did it happen?

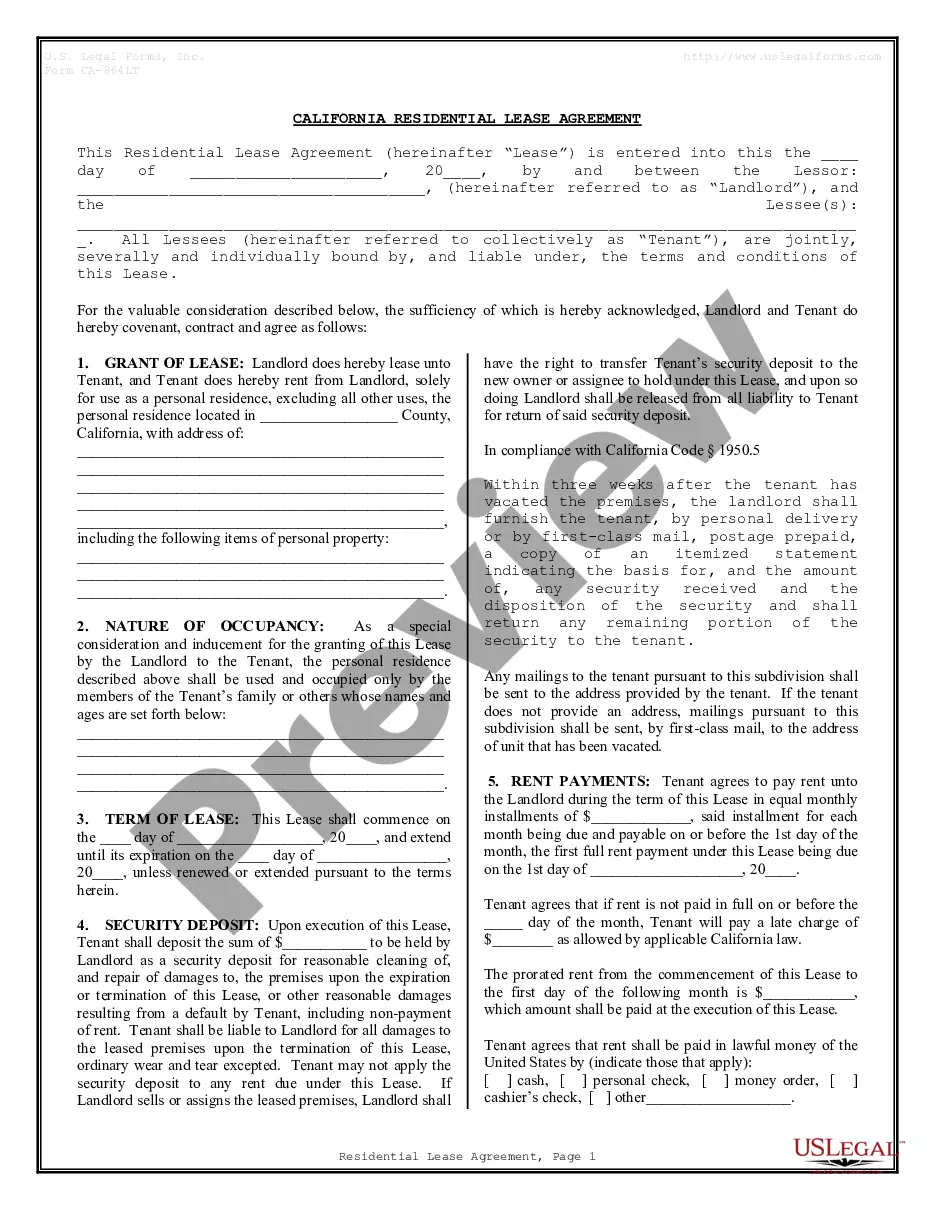

A letter of employment is a document provided by your employer that verifies your employment status, including your position, salary, and the length of your employment. Most mortgage lenders require this letter as part of the application process to determine your eligibility for a mortgage.