This form is a sample letter in Word format covering the subject matter of the title of the form.

Demand For Payoff Letter Sample In Bexar

Description

Form popularity

FAQ

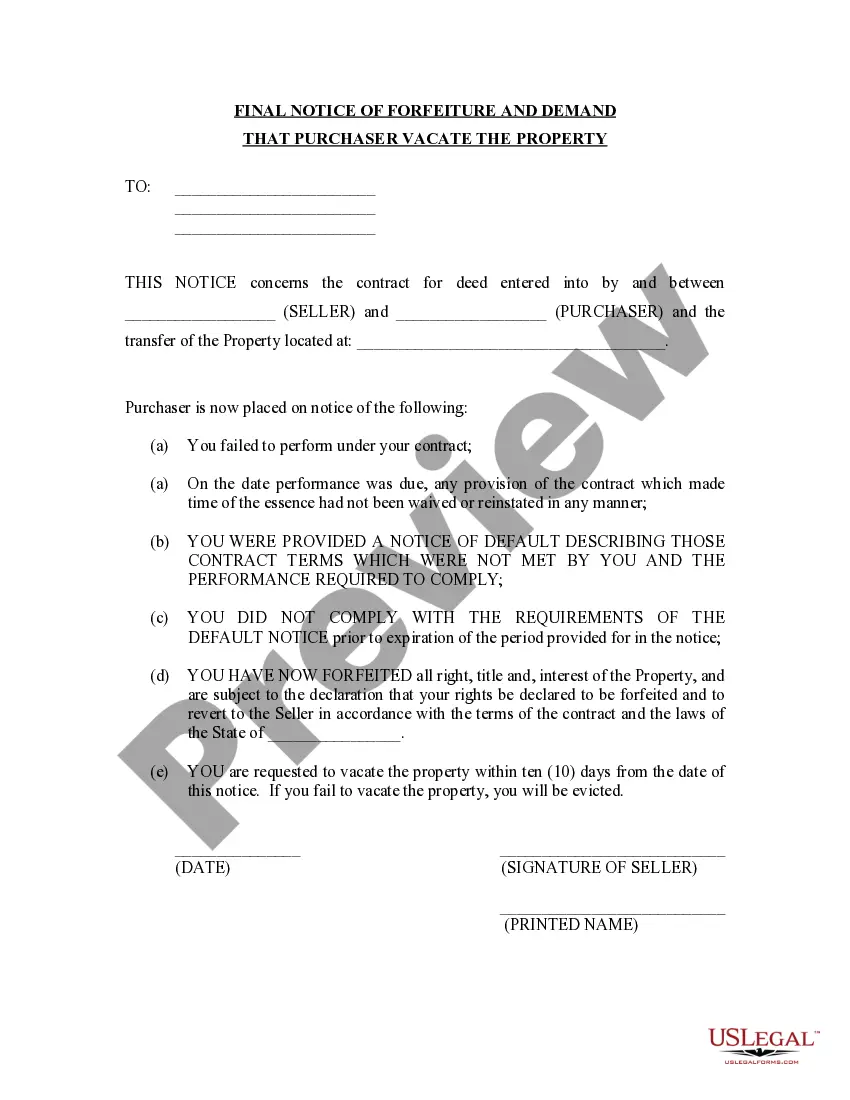

The Nuts and Bolts of a Demand Letter Gather complete information before you start writing. Describe your injuries and medical treatment. List your medical expenses, lost wages, and non-economic damages. Make a settlement demand. Include a deadline for legal action if you want to, but don't bluff.

Demand Letter Components Facts of the case. An outline of what happened. Statement of the issue. A brief description of the problem. Demand. The dollar amount or action necessary to resolve the case. Response deadline. The date by which the recipient must respond. Noncompliance consequences.

Demand Letter Components Facts of the case. An outline of what happened. Statement of the issue. A brief description of the problem. Demand. The dollar amount or action necessary to resolve the case. Response deadline. The date by which the recipient must respond. Noncompliance consequences.

If you are trying to resolve a dispute, you may want to send a demand letter. You can write one yourself, but hiring an attorney will help you navigate legalities and show the recipient the seriousness of the matter.

The first demand letter should be sent no later than 30 days after the obligation becomes delinquent. The second demand letter should be sent no sooner than 30 days, but not more than 60 days, after the first demand letter.

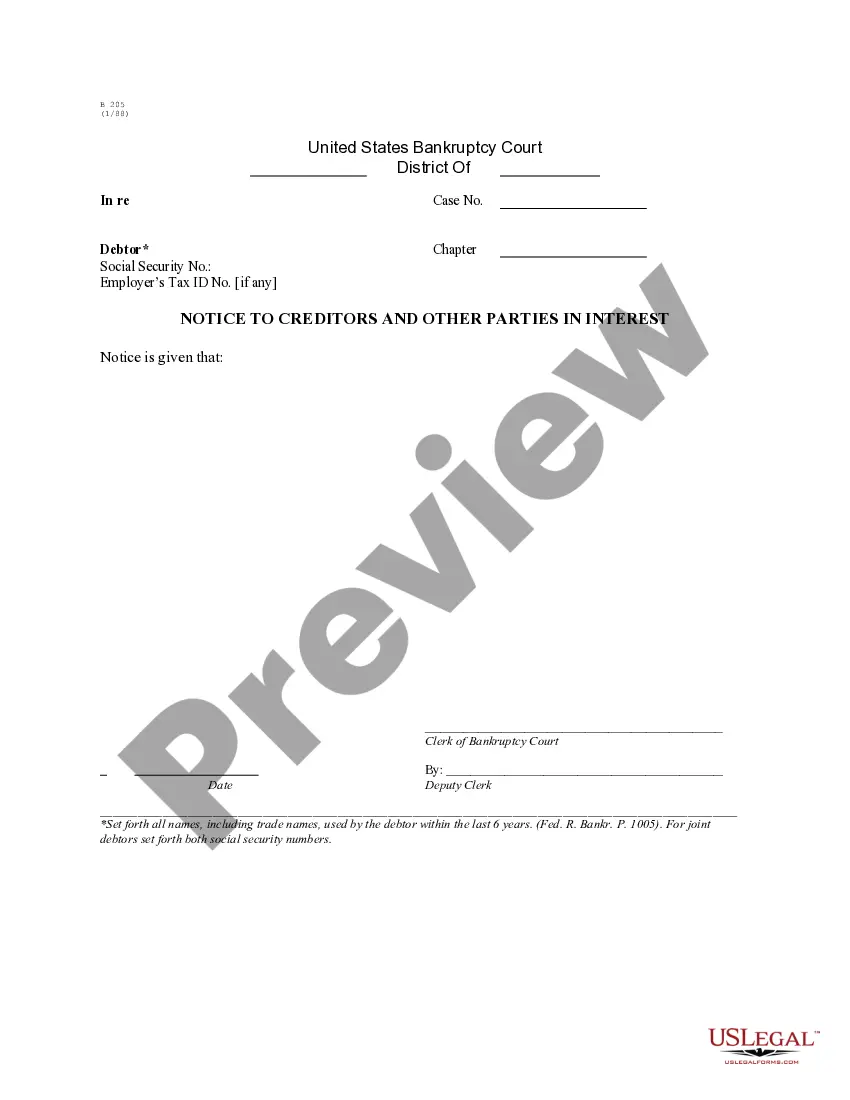

The statement is provided by the mortgage servicer and can be requested at any time. Accurate payoff information is crucial for managing financial decisions related to property ownership.

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.

Under federal law, the servicer must generally send you a payoff statement within seven business days of your request, subject to a few exceptions.