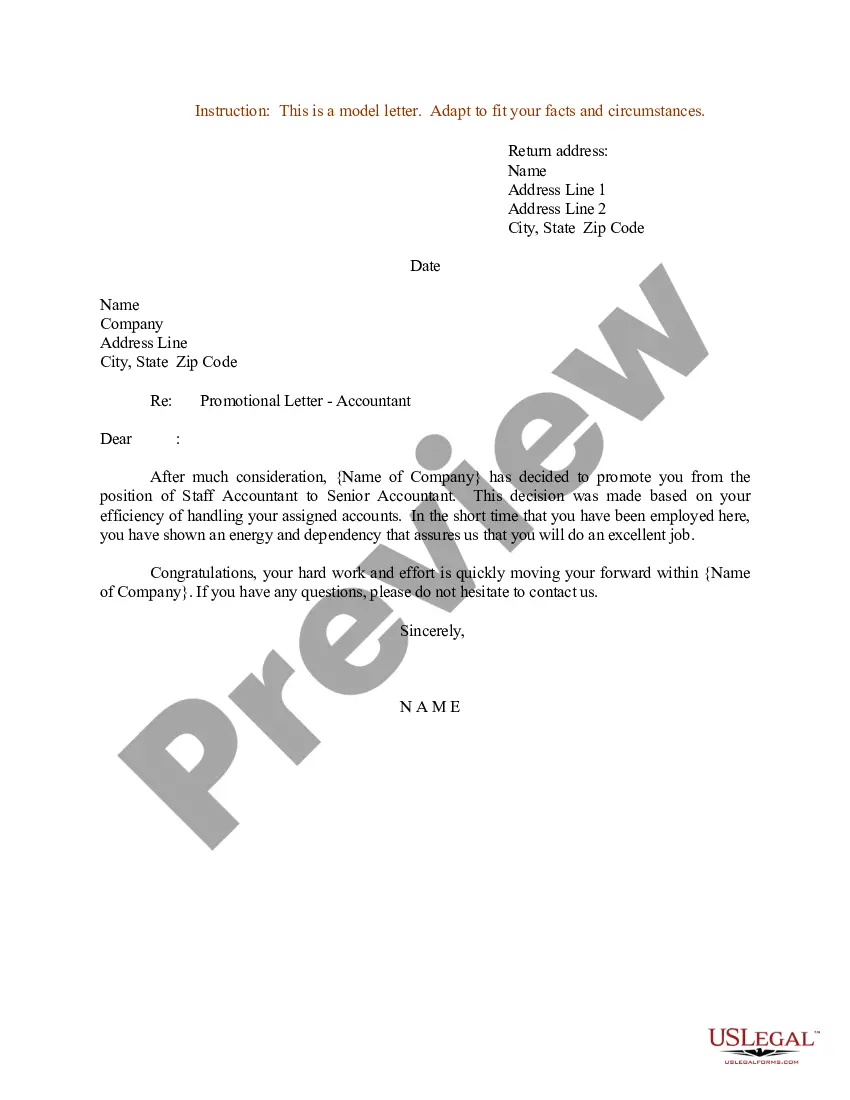

This form is a sample letter in Word format covering the subject matter of the title of the form.

Sample Loan Payoff Letter Forgiveness In California

Description

Form popularity

FAQ

I respectfully request that you forgive my alleged debt, as my condition precludes any employment, and my current and future income does not support any debt repayment. Please respond to my request in writing to the address below at your earliest convenience. Thank-you in advance for your understanding of my situation.

Credit card debt forgiveness involves negotiating with your creditor to have a portion or the entirety of your debt canceled, typically due to financial hardship. This process often requires submitting a formal request detailing your circumstances and may necessitate supporting documentation.

Unfortunately, my circumstances are unlikely to improve in the foreseeable future and I have no assets to sell to help clear my debt. I am therefore asking you to consider writing off my debt as I can see no way of ever repaying it. If you are unable to agree to this, please explain your reasons.

A Deed of Debt Forgiveness is typically used when an individual owes debt and is struggling to make repayments. This template deed allows the debtor to stop payments on outstanding debt, effectively "forgiving" the lender.

Unfortunately, my circumstances are unlikely to improve in the foreseeable future and I have no assets to sell to help clear my debt. I am therefore asking you to consider writing off my debt as I can see no way of ever repaying it. If you are unable to agree to this, please explain your reasons.

Most debt settlement letters include: The date, name, and address of the credit card company. A notation after the address that this is regarding a hardship letter. The credit card number and amount of the debt. A short statement of your financial situation, why you're in that situation, and why full payment is a hardship.

Request a Goodwill Adjustment from the original creditor to remove late payments. The process involves writing the creditor a letter explaining your situation (why you were late) and asking that they ``forgive'' the late payment and adjust your credit report ingly.

Credit inquiry removal letter template I am writing to request the removal of unauthorized credit inquiries on my (name of the credit bureau—Equifax, Experian and/or TransUnion) credit report. My latest credit report shows (number of hard inquiries you are disputing) credit inquiries that I did not authorize.

A debt forgiveness letter informs a debtor that they no longer have to repay a creditor for liabilities owed. This letter is usually sent after the creditor has decided that the debt isn't worth posting to collections or they may benefit from accounting for the receivable as a loss.