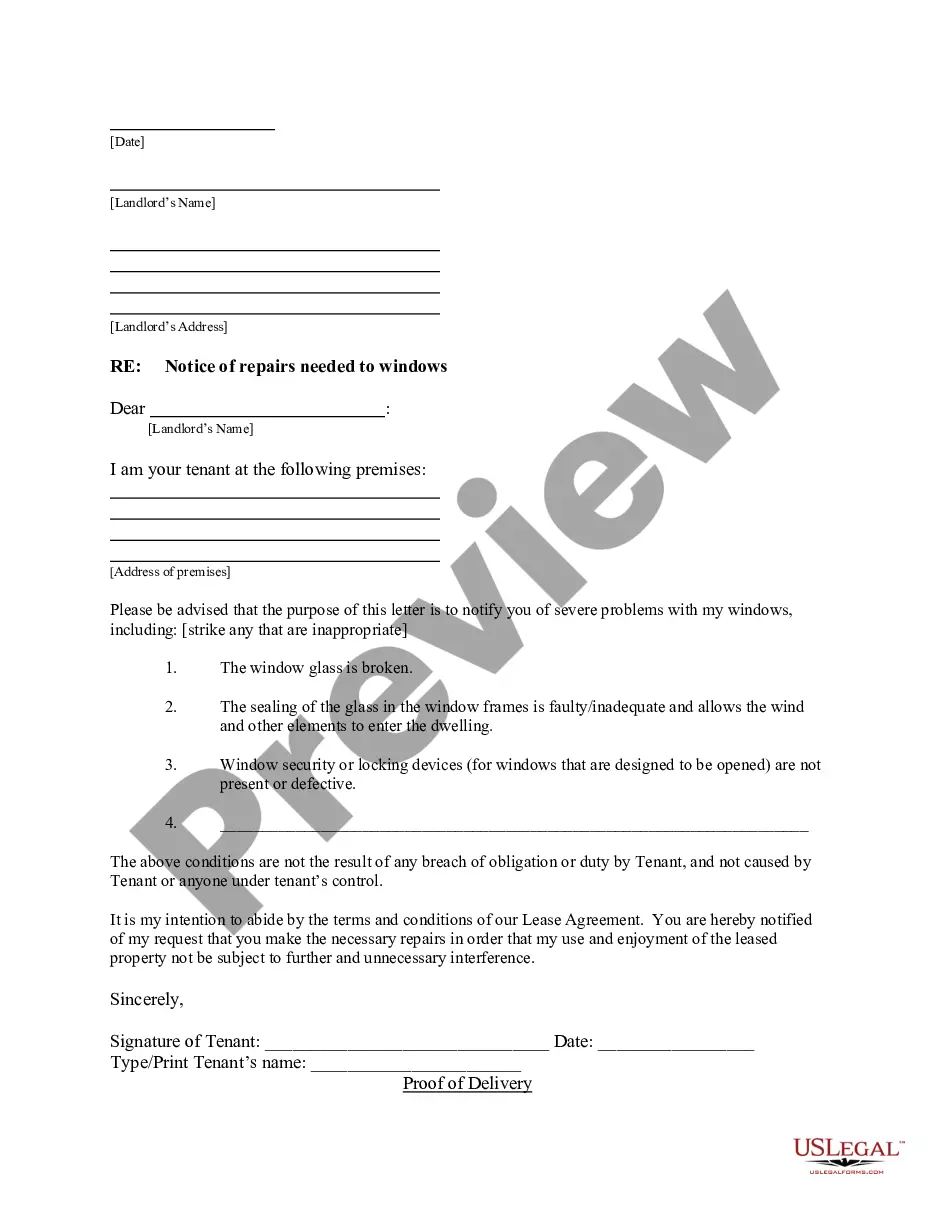

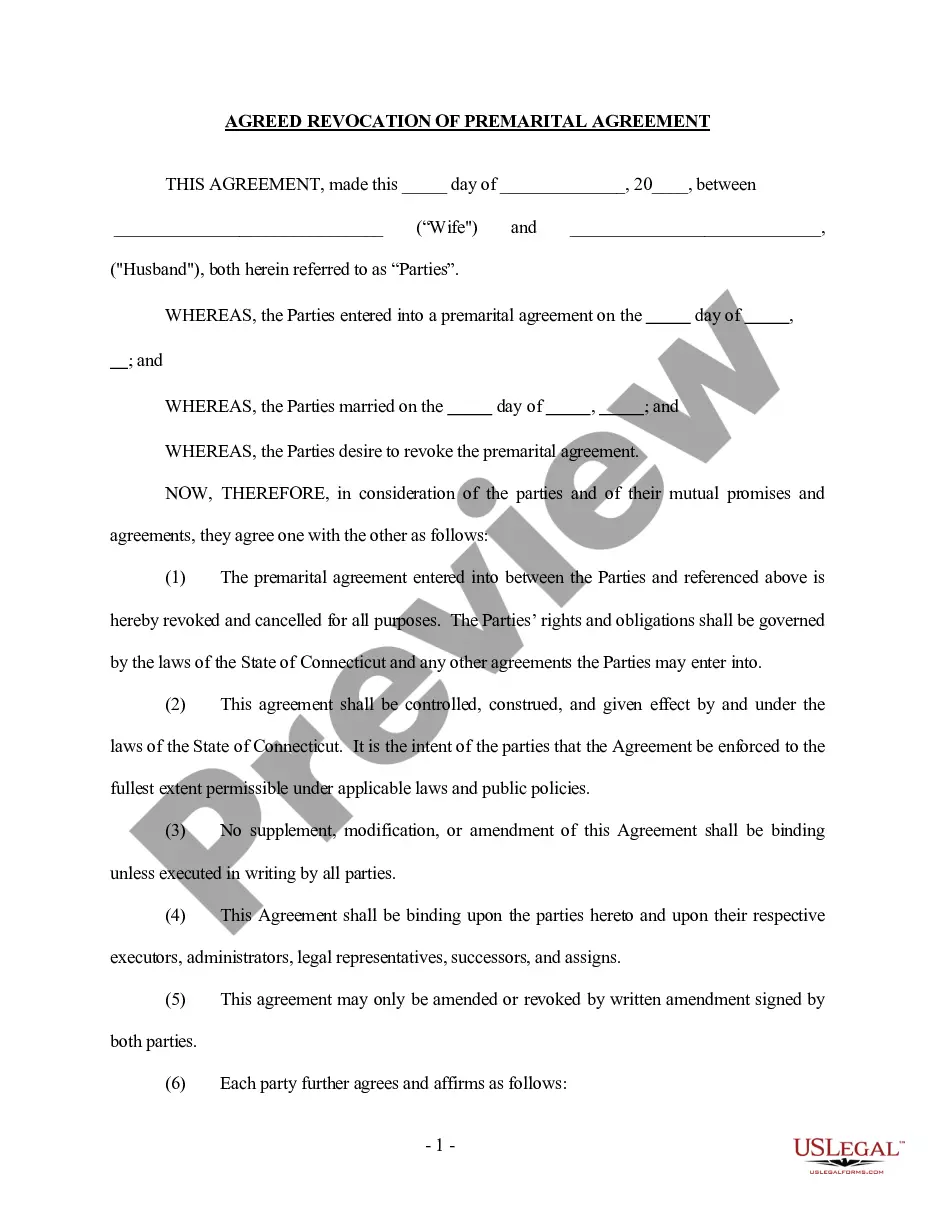

This form is a sample letter in Word format covering the subject matter of the title of the form.

Loan Payoff Letter Format For Audit In Chicago

Description

Form popularity

FAQ

How to Audit Your Credit Report in 3 Easy Steps 1st Step: Get copies of all 3 credit reports. 2nd Step: Go over each report and check each account for accuracy. 3rd Step: File disputes to any errors with the appropriate credit bureau.

Audit Process Step 1: Planning. The auditor will review prior audits in your area and professional literature. Step 2: Notification. Step 3: Opening Meeting. Step 4: Fieldwork. Step 5: Report Drafting. Step 6: Management Response. Step 7: Closing Meeting. Step 8: Final Audit Report Distribution.

How to Audit Your Credit Report in 3 Easy Steps 1st Step: Get copies of all 3 credit reports. 2nd Step: Go over each report and check each account for accuracy. 3rd Step: File disputes to any errors with the appropriate credit bureau.

To respond to an IRS audit letter, carefully read the letter, gather the requested documentation (such as tax returns and supporting records), and respond by the specified deadline, ensuring your information is accurate and complete. If needed, consider seeking professional assistance.

Credit Audit should include examination of areas such as quality of credit appraisal, adherence to terms and conditions of sanction, post sanction monitoring, end use of funds, infusion of capital, margin build up etc. A separate Policy for the Credit Audit was framed by the Inspection Department of the Bank. a.

Audit Process What happens during an audit? Internal audit conducts assurance audits through a five-phase process which includes selection, planning, conducting fieldwork, reporting results, and following up on corrective action plans. Selection. Planning. Fieldwork. Reporting. Follow-up.

INTRODUCTION. A law firm's delivery of an audit response letter confirming certain information about loss contingencies, such as pending or threatened litigation or claims (an “audit response”), is a part of the process for the external audit of a client's finan- cial statements.

Responses should be as concise and to the point as possible, and directly relate to the issues and recommendations identified in the report and planned corrective actions. Responses should be written and returned within the time period prescribed by policy.

The closing meeting of an audit should include the following items: Introductions and recording the attendees. Thanking the attendees for their time and cooperation. Reminder of the purpose and scope of the audit, as well as the scoring or rating criteria used. Review and discussion of the preliminary audit findings.