This form is a sample letter in Word format covering the subject matter of the title of the form.

Sample Letter Payoff Mortgage Statement With Example In Clark

Description

Form popularity

FAQ

The number you see on your mortgage statement is the principal balance, not the payoff amount. The payoff amount showing on the settlement statement takes into account the principal balance plus interest accrued for the number of days between the statement and a few days after the closing.

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

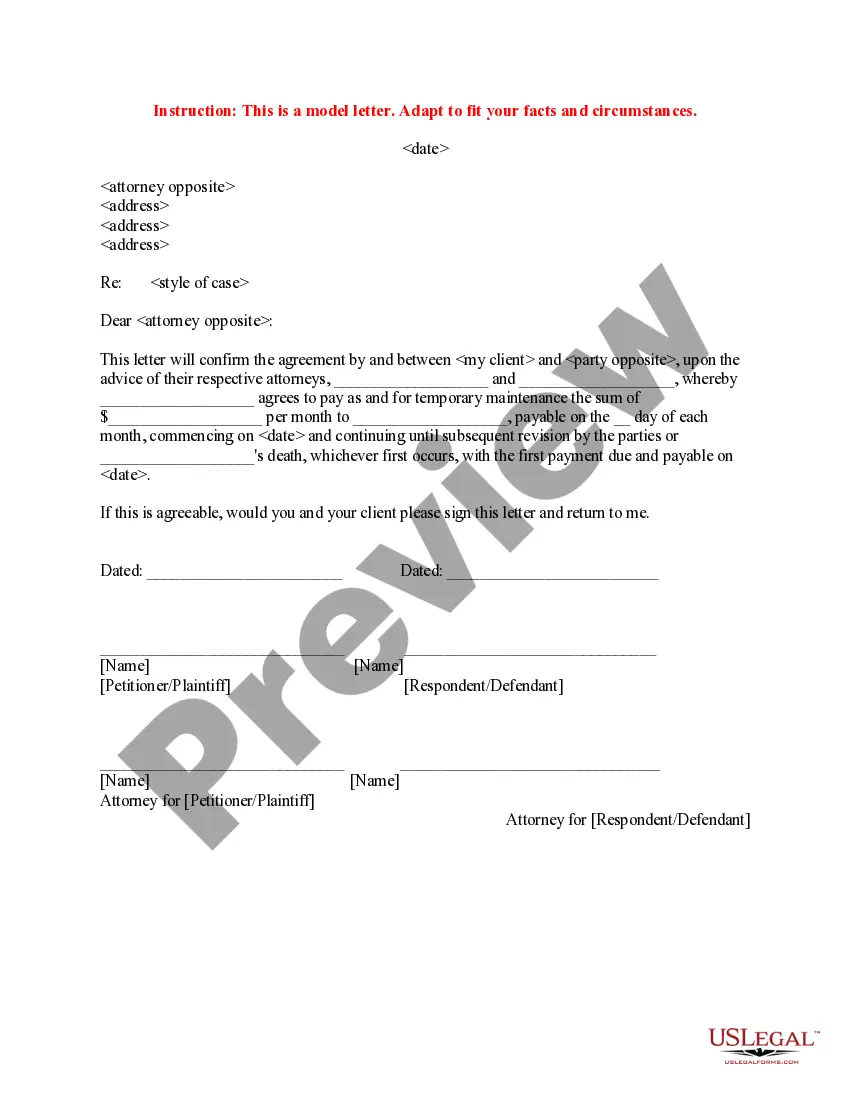

Answer the lender's request point by point, as specifically, and with as much detail, as possible. Be precise with dates and dollar amounts. Acknowledge the lender's concern, and and if necessary, explain how you've resolved (or are in the process of resolving) the issue to prevent a future occurrence.

How do I request a payoff letter? To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

How do I dispute an error or request information about my... To include your name, home address, and mortgage account number. Use the name that is on your mortgage. To identify the error or information. Not to write your letter on your payment coupon or other payment form. To mail the letter to the right address.

How to write an explanation letter in 3 steps Choose letter format. Clients, team members or students may use print or email for their letters. Explain the situation. To begin writing this type of letter, you might explain the situation or circumstance and any contributing factors. Take responsibility and accountability.

Sir / Madam, I/We are the owner(s) of the property as mentioned above and wish to seek permission to mortgage the same in favour of ______________________________________ (Name of Bank). All the requisite documents are enclosed.