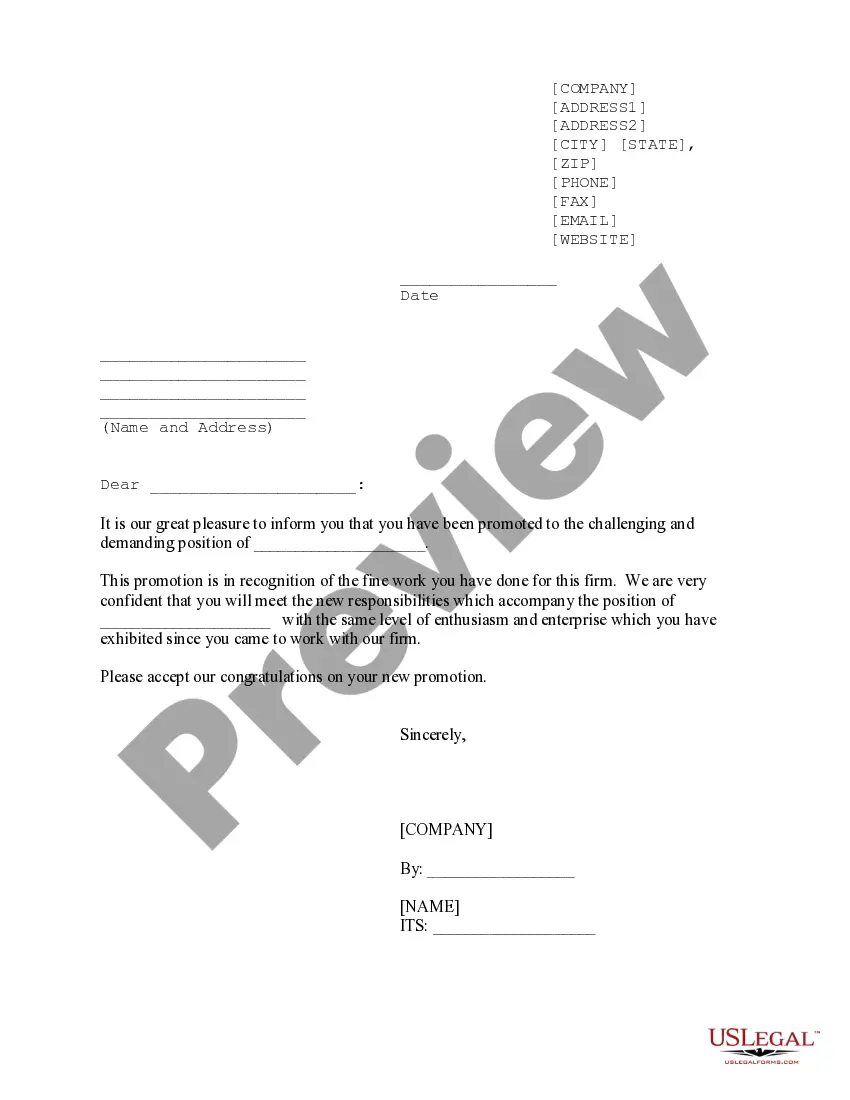

This form is a sample letter in Word format covering the subject matter of the title of the form.

Letter Payoff Mortgage Form For Auto In Contra Costa

Description

Form popularity

FAQ

First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

Under federal law, the servicer must generally send you a payoff statement within seven business days of your request, subject to a few exceptions. (12 C.F.R. § 1026.36.)

Frequently Asked Questions (FAQ) Type your letter. Concisely review the main facts. Be polite. Write with your goal in mind. Ask for exactly what you want. Set a deadline. End the letter by stating you will promptly pursue legal remedies if the other party does not meet your demand. Make and keep copies.

Sample Demand Letter for Payment I am writing to remind you of the outstanding payment for Invoice No. X, dated Invoice Date, in the amount of Amount Due. As of today, Date, this payment is Number of Days days overdue. Despite our previous reminders sent on Dates, we have not yet received this payment.

The letter usually should include: Debtor's Details: Full name and contact information of the debtor. Your Business Details: Your company's information for reference. Invoice Reference: Specific details of the outstanding invoice(s), including dates, invoice numbers, and total amount due.

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

How do I request a payoff letter? To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.