This form is a sample letter in Word format covering the subject matter of the title of the form.

Loan Payoff Form With Decimals In Cuyahoga

Description

Form popularity

FAQ

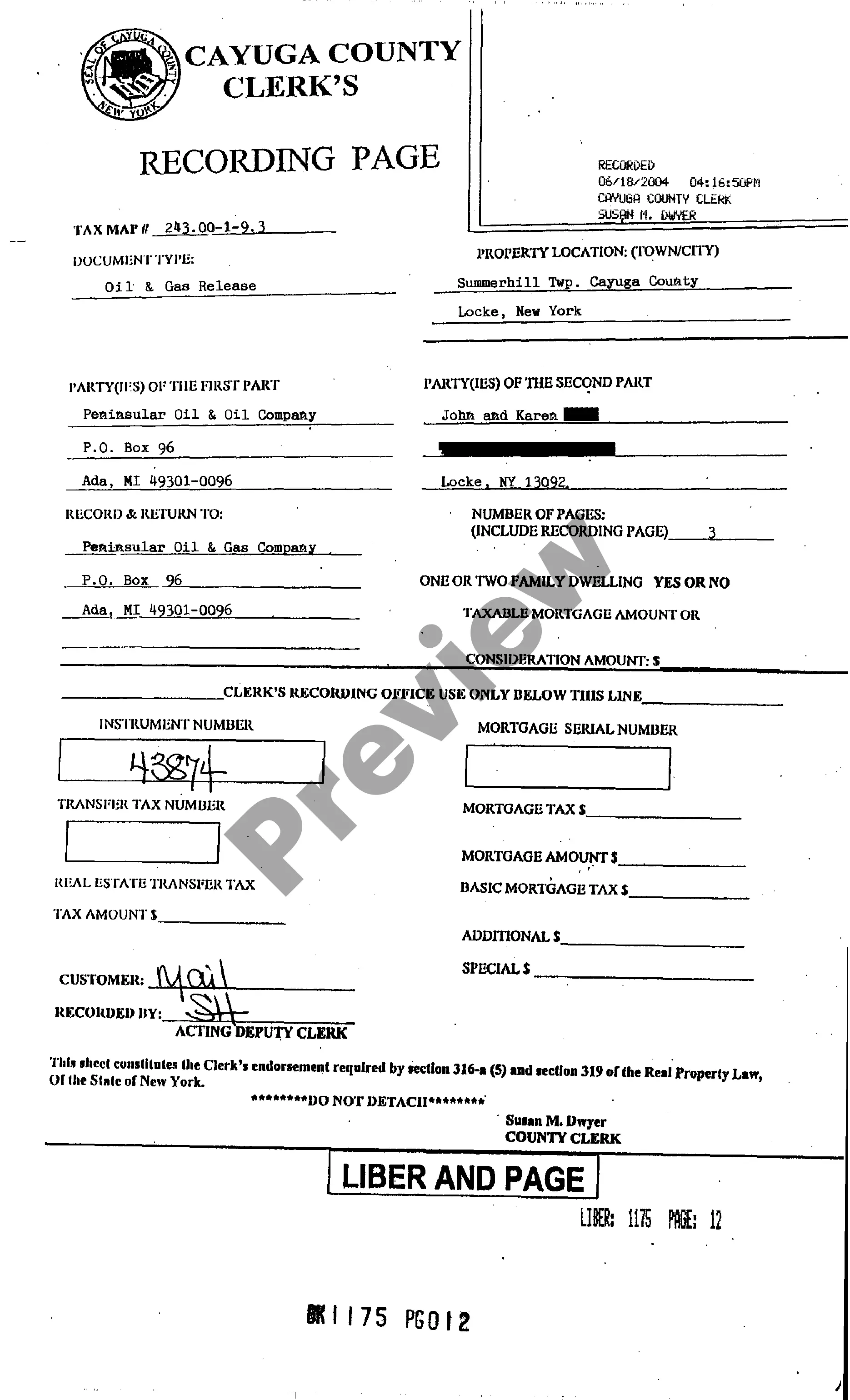

A quitclaim deed transfers the title of a property from one person to another, with little to no buyer protection. The grantor, the person giving away the property, gives their current deed to the grantee, the person receiving the property.

Revised on 01/01/25. 2024 Ohio IT 1040 Individual Income Tax Return - Includes Ohio IT 1040, Schedule of Adjustments, Schedule of Business Income, Schedule of Credits, Schedule of Dependents, IT WH, and OUPC. FILE ONLINE PDF/Fill-In.

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

To create an Ohio School District Income Tax Return (Form SD 100), from the Ohio Tax Return Menu return select 7. School District Income Tax. Click New, select the county the individual was a resident of at the end of the year, and click OK. Next, select the school district they resided in and click OK.

Ohio's state and local governments rely on revenue generated by income taxes and other taxes to support critical programs and supports, build infrastructure, support families, and more.

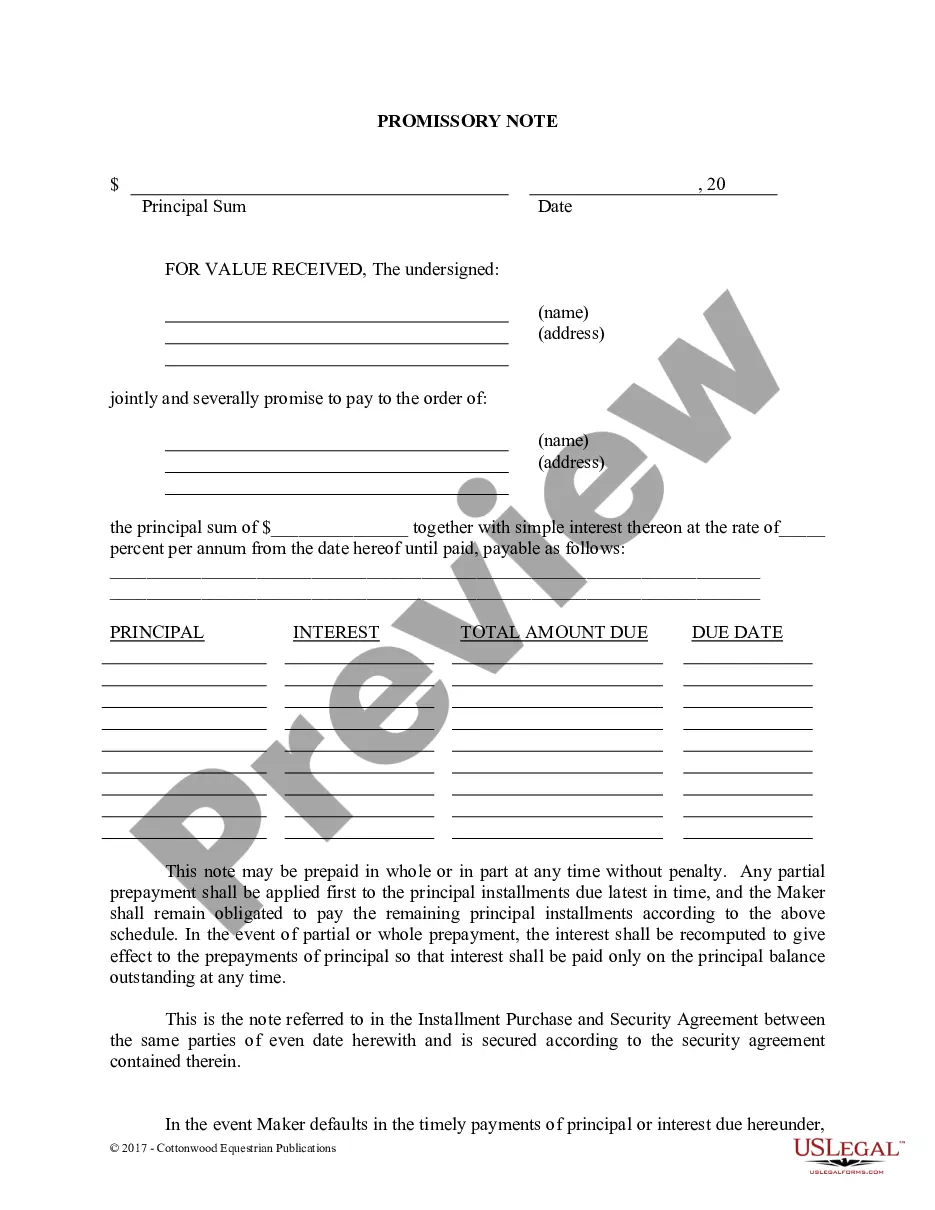

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.

The statement is provided by the mortgage servicer and can be requested at any time. Accurate payoff information is crucial for managing financial decisions related to property ownership.

Instead, you have to get a 10-day payoff estimate from your current lender, which includes the amount you owe, as well as any interest that might accrue on the principal balance in the next 10 days.