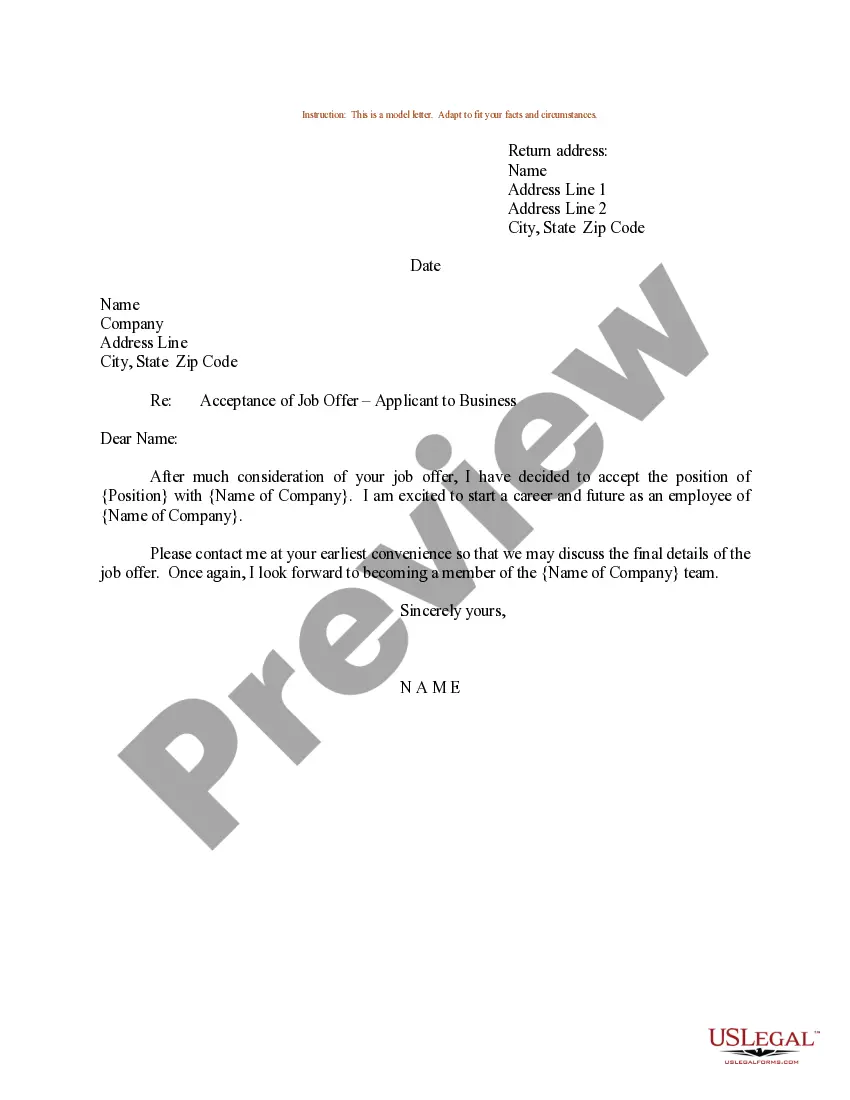

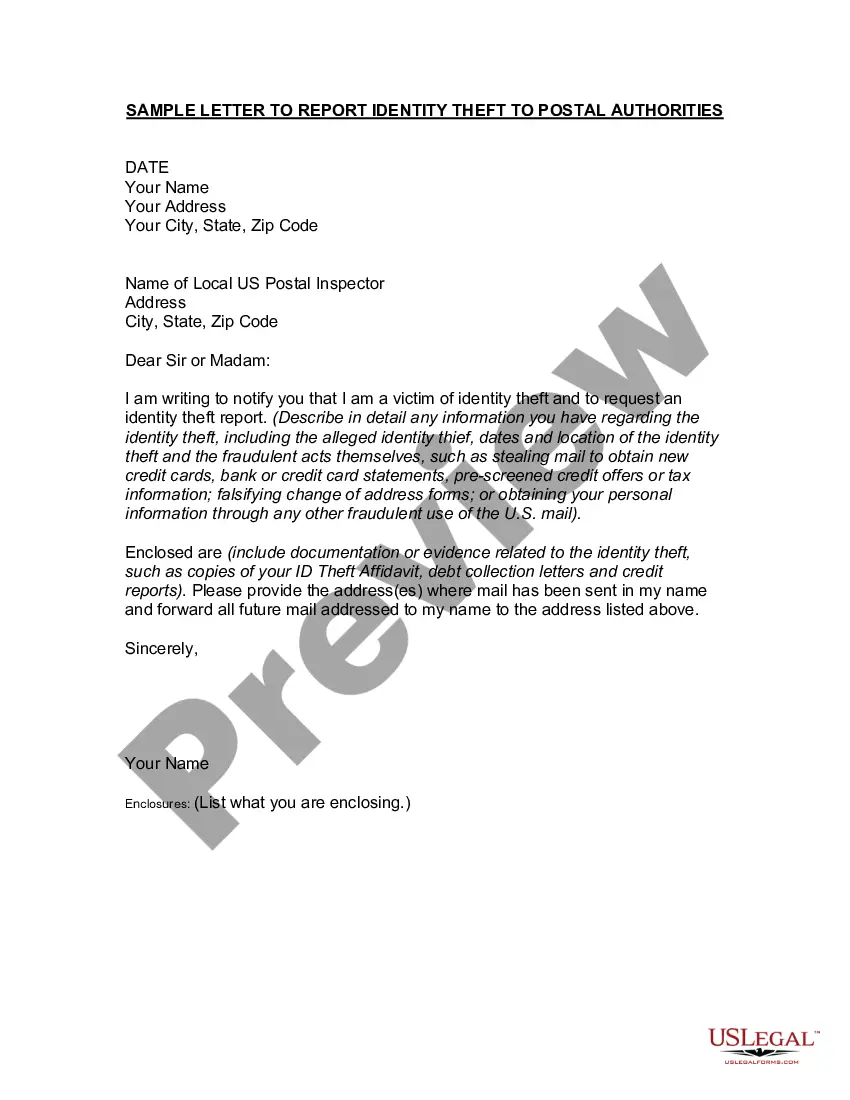

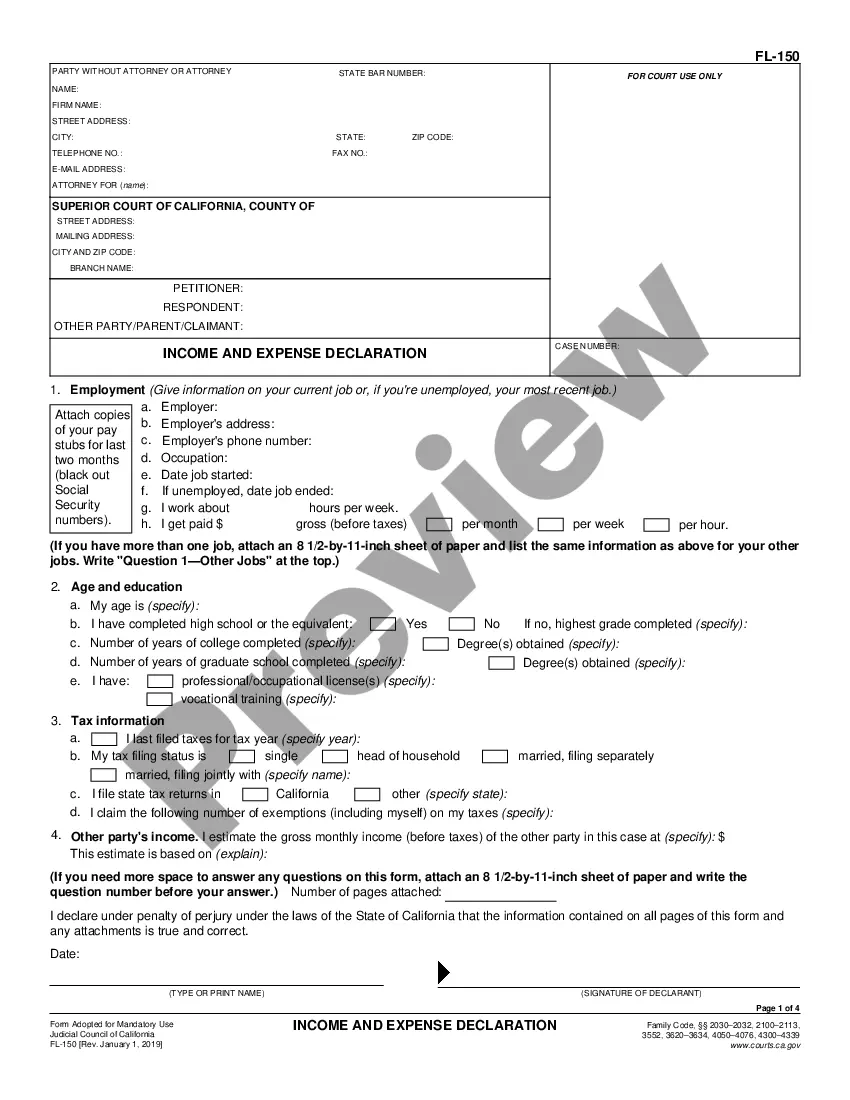

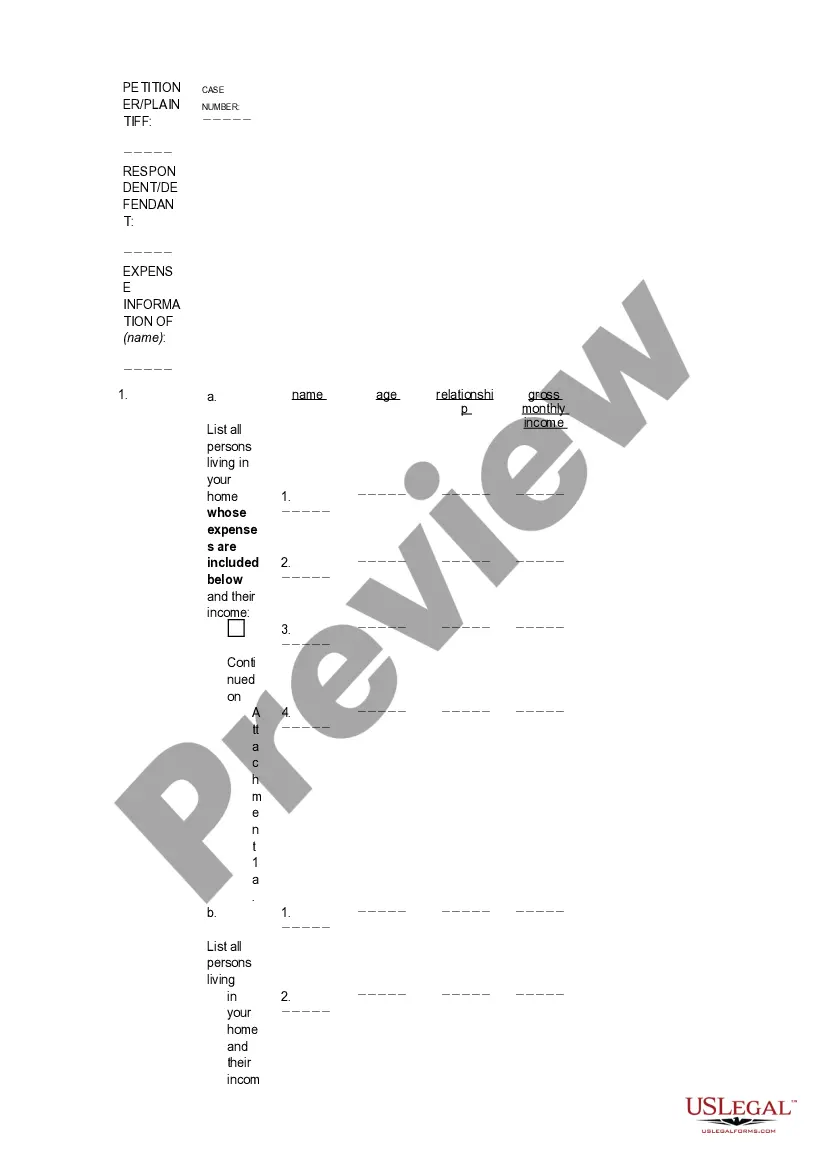

This form is a sample letter in Word format covering the subject matter of the title of the form.

Loan Payoff Letter Format Foreclosure In Dallas

Description

Form popularity

FAQ

Most loans from a bank must be 120 days delinquent before any foreclosure activity starts. However, smaller lenders can sometimes start foreclosure even if you are only one day late. The lender is only required to send you two notices before a foreclosure sale.

Generally, homeowners fall into default after missing 3-6 months of mortgage payments. Upon reaching at least 120 days behind on payments, homeowners may receive a notice of default. This is your red flag, signaling that it's time to consider options like refinancing to prevent formal foreclosure.

Texas is a power of sale jurisdiction, meaning that a lender can go through with the sale of your property without having to go to court. As a result, foreclosures in Texas can be very quick, sometimes being completed about two or three months after the process begins, though this is quicker than average.

Homeowners can obtain it from the Clerk of Court or their attorney. Former homeowners must prove they were the owner of record at the time of foreclosure, while lienholders must present valid claims. Claims must be filed with the Clerk of Court, typically within a year or two after the foreclosure sale.

Section 34.04 - Claims for Excess Proceeds (a) A person, including a taxing unit and the Title IV-D agency, may file a petition in the court that ordered the seizure or sale setting forth a claim to the excess proceeds. The petition must be filed before the second anniversary of the date of the sale of the property.

While the content of the letter will change depending on your situation, there are a few important aspects to include: Provide all details the best you can, including correct dates and dollar amounts. Explain how and when all situations were resolved. Detail why problems won't happen again.

This is basically a document telling you that the lender will foreclose on your property if you do not take action to stop it. Ignoring it will only lead to further legal trouble, and it could prevent you from being able to negotiate with the lender to find a solution that allows you to keep your home.

Send a public records request to the Office of the Assessor-Recorder in the county or city in which you reside. This office maintains public property records, and will have access to all publicly available foreclosure documents.

In a non-judicial foreclosure, after the 20-day "right to reinstate" period has expired and at least 21 days before the sale, the servicer must provider the borrower with a Notice of Sale, letting them know the date and earliest time of the sale.

Throughout the foreclosure process, various legal notices must be filed in your County Recorder's Office. This information is public record and available to anyone. Just visit your county's office and you can search for a Notice of Default (NOD), lis pendens or Notice of Sale. Two benefits to searching public records?