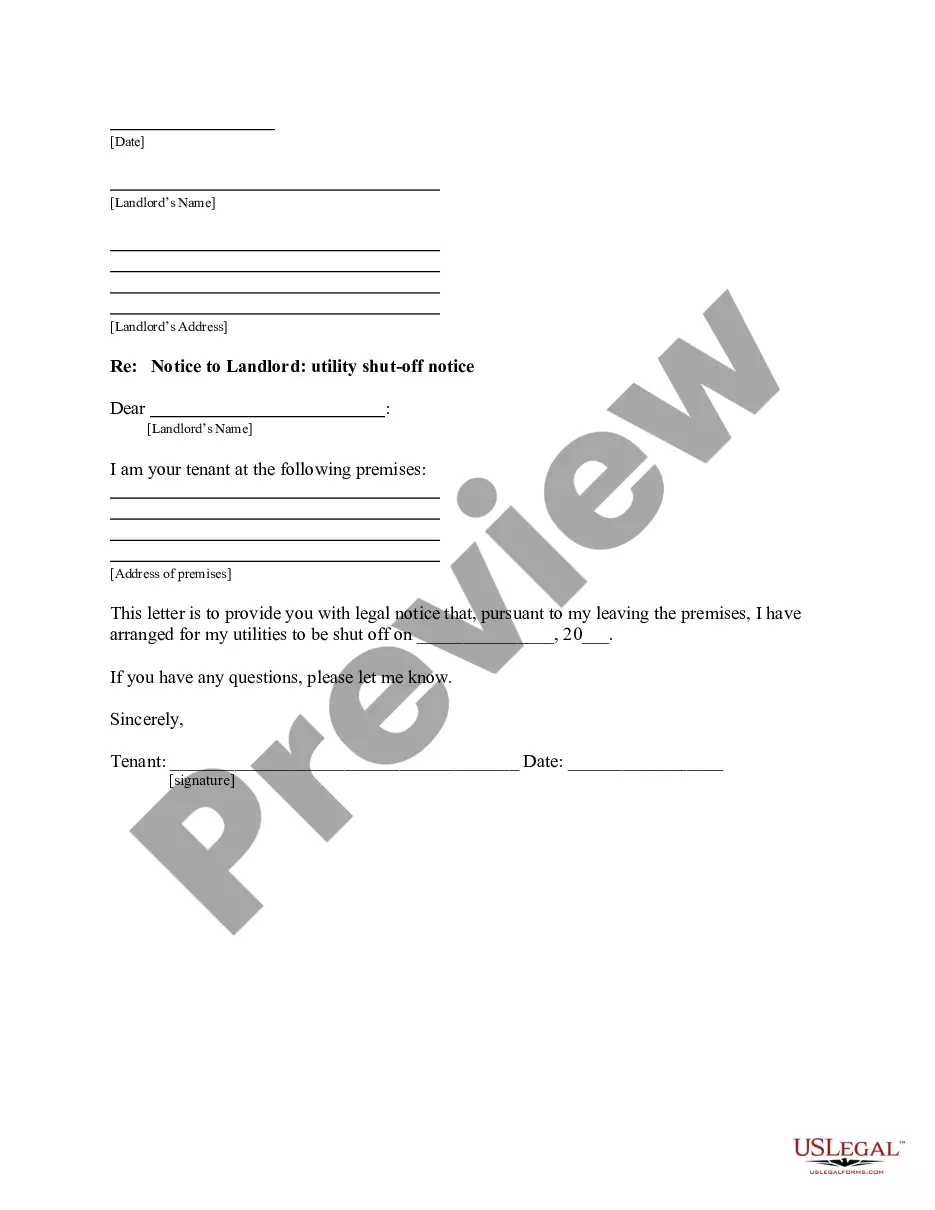

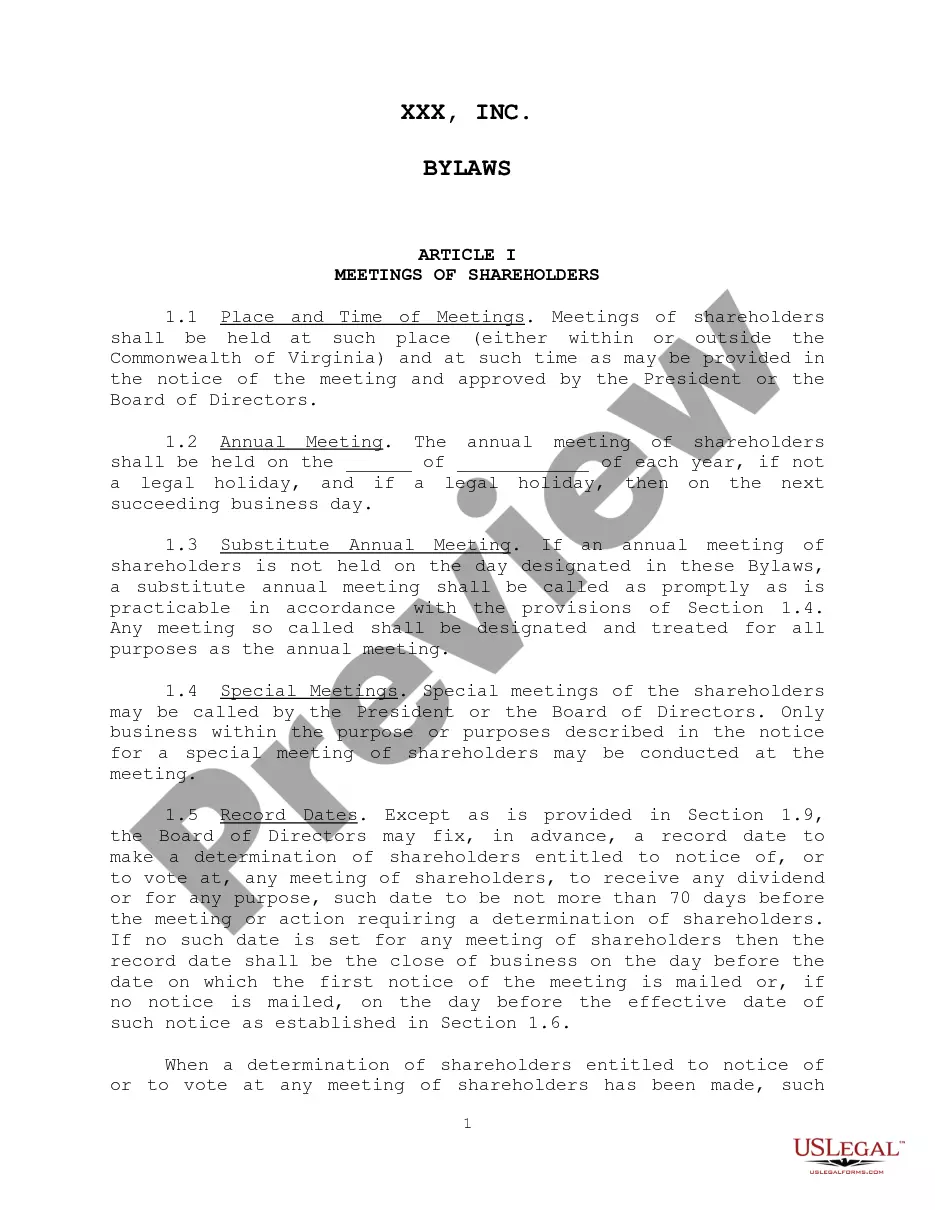

This form is a sample letter in Word format covering the subject matter of the title of the form.

Payoff Letter Template With Interest In Dallas

State:

Multi-State

County:

Dallas

Control #:

US-0019LTR

Format:

Word;

Rich Text

Instant download

Description

Form popularity

FAQ

First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

The formula for calculating simple interest is A = P x R x T. A is the amount of interest you'll wind up with. P is the principal or initial deposit.

TILA requires that a mortgage lender or servicer send ''an accurate payoff balance within a reasonable time, but in no case more than seven business days'' after receiving the borrower's request. 15 U.S.C. § 1639g.

More info

To request a payoff quote, please complete the payoff quote form. This form is intended for 3rd parties acting on behalf of Mr. Cooper customers.What is a Payoff Agreement? A payoff agreement is an informal contract in which a creditor agrees to accept the balance of a debt owed as full payment. Creating a payoff letter is essential to any loan or mortgage repayment process. Our free templates and this guide can help you get started. How to fill out the Payoff Request Letter Templates? This is an example of a payoff letter used in a syndicated loan transaction. This payoff letter (including the defined terms such as Lenders,. Mortgage Payoff Letters are essential documents in the process of finalizing a property transaction.