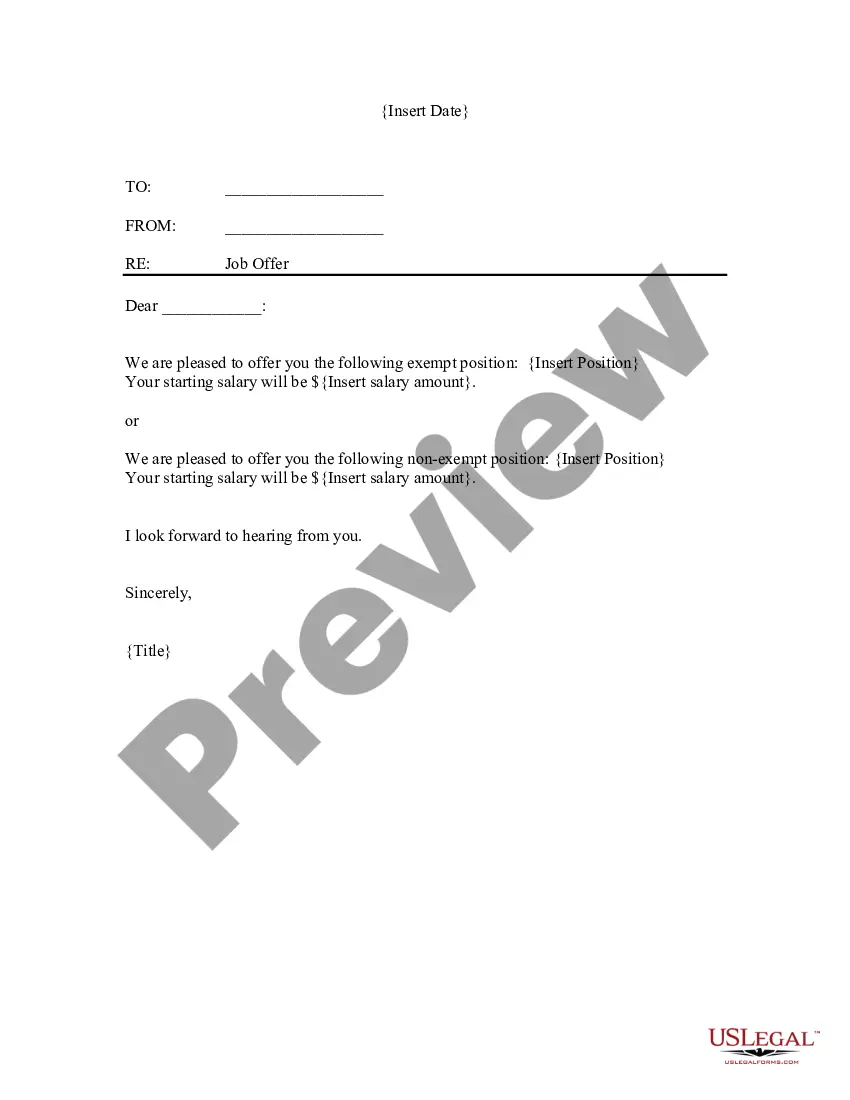

This form is a sample letter in Word format covering the subject matter of the title of the form.

Sample Letter Payoff Mortgage Contract For Deed In Dallas

Description

Form popularity

FAQ

A standard three-day cancellation clause—Many real estate contracts give either party to the right to terminate for any reason within 72 hours of signing the contract. The denial of financing—As a general rule, real estate agreements are contingent upon the buyer obtaining financing.

You must cancel the transaction in writing. You must send the signed and dated cancellation form to the seller at the address provided by the seller. You must send the form no later than midnight on the third business day after the transaction.

“Executory Contracts” include contract for deed, lease-purchases, and lease-options. Texas law did not outlaw these methods: contract for deed, lease-purchases, or lease-options, but it has made them perilous for those still interested in trying to use them.

In order to cancel a contract for deed, a seller needs to complete a form called a notice of cancellation of contract for deed, and have the notice personally served on the buyer.

Can I cancel the contract for deed? Yes, but there may be time limits. Cancelling for any reason: When you sign, the seller must inform you of your right to cancel for any reason within 14 days of signing. If you cancel, the notice must be written, signed, dated, and include the date of cancellation.

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.