This form is a sample letter in Word format covering the subject matter of the title of the form.

Sample Letter Payoff Mortgage File For Bankruptcies In Dallas

Description

Form popularity

FAQ

A Debt Agreement discharge means the debts which were included in the agreement have now been settled. Your creditors will no longer seek compensation for these debts. The debts you may have to continue paying after your Debt Agreement are your secured debts and debts to the Commonwealth, such as: Centrelink debts.

The notice informs creditors generally that the debts owed to them have been discharged and that they should not attempt any further collection. They are cautioned in the notice that continuing collection efforts could subject them to punishment for contempt.

Discharge (of debts) refers to the process in bankruptcy court, when a debtor is no longer liable for their debts, and the lender is no longer allowed to make attempts to collect the debt. The court will issue a decision to discharge debts.

Discharge Letter means a document issued to the Service User by the lead Healthcare Professional or Care Professional of the service responsible for the Service User's care or treatment for the Service User to use in the event of any query or concern immediately following discharge, containing information about the ...

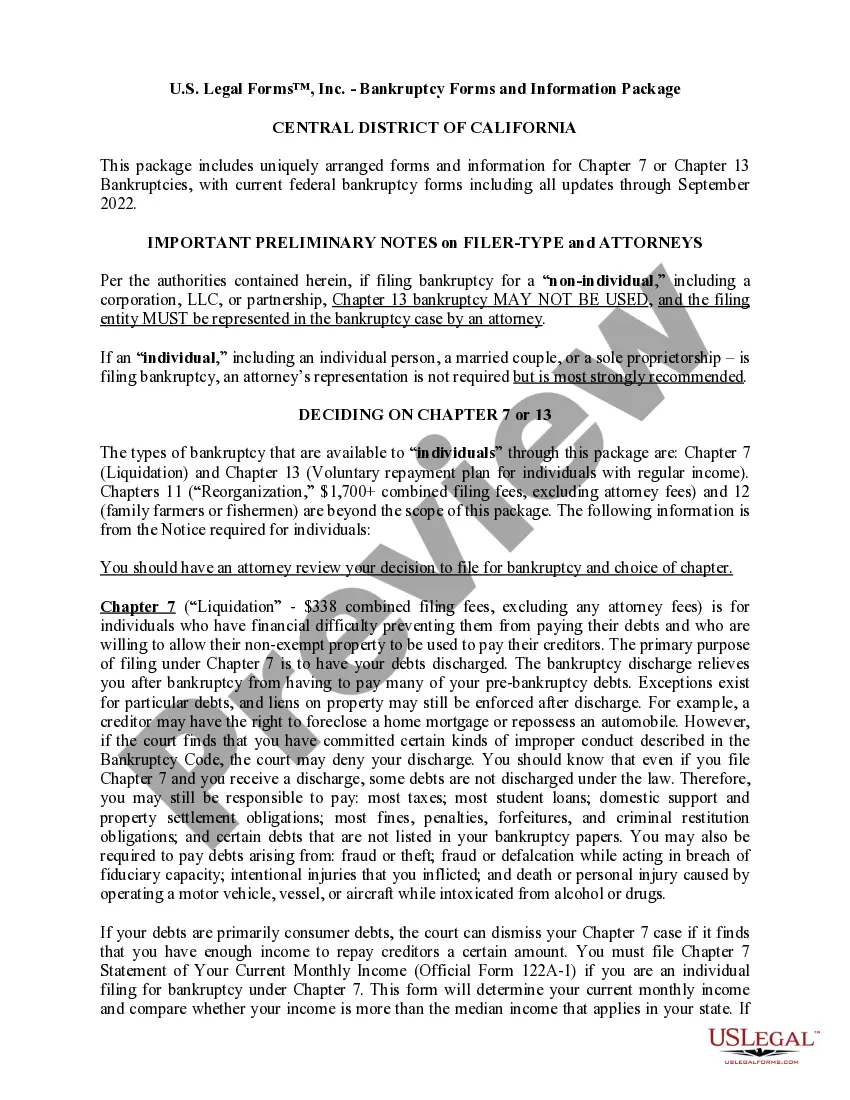

A Chapter 7 bankruptcy can take four to six months to do, from the time you file to when you receive a final discharge – meaning you no longer have to repay your debt. Various factors shape how long it takes to complete your bankruptcy case.

A Chapter 7 bankruptcy is typically removed from your credit report 10 years after the date you filed, and this is done automatically, so you don't have to initiate that removal.

The discharge is the order from the court forgiving you from certain debts. Once your discharge is granted, your creditors can no longer attempt to collect from you for the debts that were discharged. Remember, not all debts are dischargeable in bankruptcy.

A bankruptcy drops off your credit report after 10 years if you file for Chapter 7 bankruptcy, or after seven years if you file Chapter 13 bankruptcy. As long as it stays on your credit reports, a bankruptcy can hurt your credit scores, but its impact on scores lessens over time.

For most filers, a Chapter 7 case will end within a day or two of receiving your "debt discharge" or the order that forgives qualified debt. In most instances, your case will be over about four months after filing the bankruptcy paperwork.

One to two years after a bankruptcy filing, consumers have an average credit score of 571. That's 29 points lower than two to three months after bankruptcy. Meanwhile, the average credit card balance reaches $2,038. That's 376.2% higher than it was at around two to three months after filing.