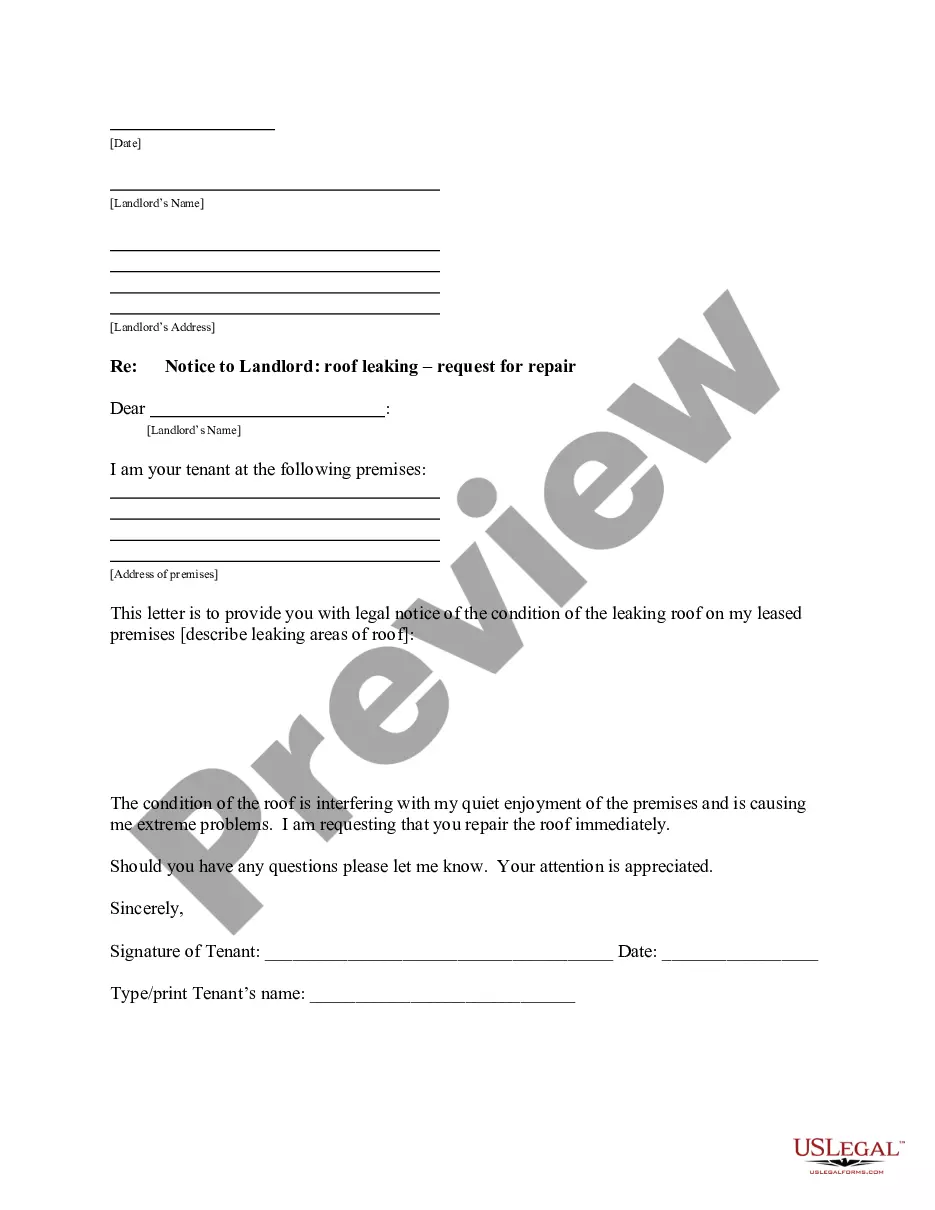

This form is a sample letter in Word format covering the subject matter of the title of the form.

Loan Paid In Full Letter Template With Debt Collector In Fairfax

Description

Form popularity

FAQ

The key is to be thorough in your request for debt verification. In your letter, ask for details on: Why the collector thinks you owe the debt: Ask who the original creditor is, and request documentation that verifies you owe the debt, such as a copy of the original contract.

Sample Demand Letter for Payment I am writing to remind you of the outstanding payment for Invoice No. X, dated Invoice Date, in the amount of Amount Due. As of today, Date, this payment is Number of Days days overdue. Despite our previous reminders sent on Dates, we have not yet received this payment.

In a Nutshell A 609 letter is a tool that helps you request information about items on your credit report and address errors. It's named after Section 609 of the Fair Credit Reporting Act (FCRA), which allows consumers to access all data used to calculate their credit score.

A debt validation letter is a document from a debt collector providing information about a debt you may owe. Collection agencies are required by law to provide validation notices and give you time to dispute the debt.

Its called a verification of debt letter. write to them and ask for verification of debt (preferably itemized). send it by certified mail with return receipt (where they attach a little postcard to the back and stamp it when it gets delivered). they have 30 days to reply with proof.

What things should be included in the Full and Final Settlement Letter? Settlement Amount: Clearly state the finalized amount to be settled. Settlement Cheque: Provide details regarding the issuance of the settlement cheque. Resignation/Termination Date: Specify the date on which the employee resigned or was terminated.

The Nuts and Bolts of a Demand Letter Gather complete information before you start writing. Describe your injuries and medical treatment. List your medical expenses, lost wages, and non-economic damages. Make a settlement demand. Include a deadline for legal action if you want to, but don't bluff.

Here are the steps you can take: Send a written request: Draft a formal letter to the debt collector requesting debt verification. Include your name, address, and account number associated with the debt. Clearly state your intention to verify the debt and request all relevant information and documentation.