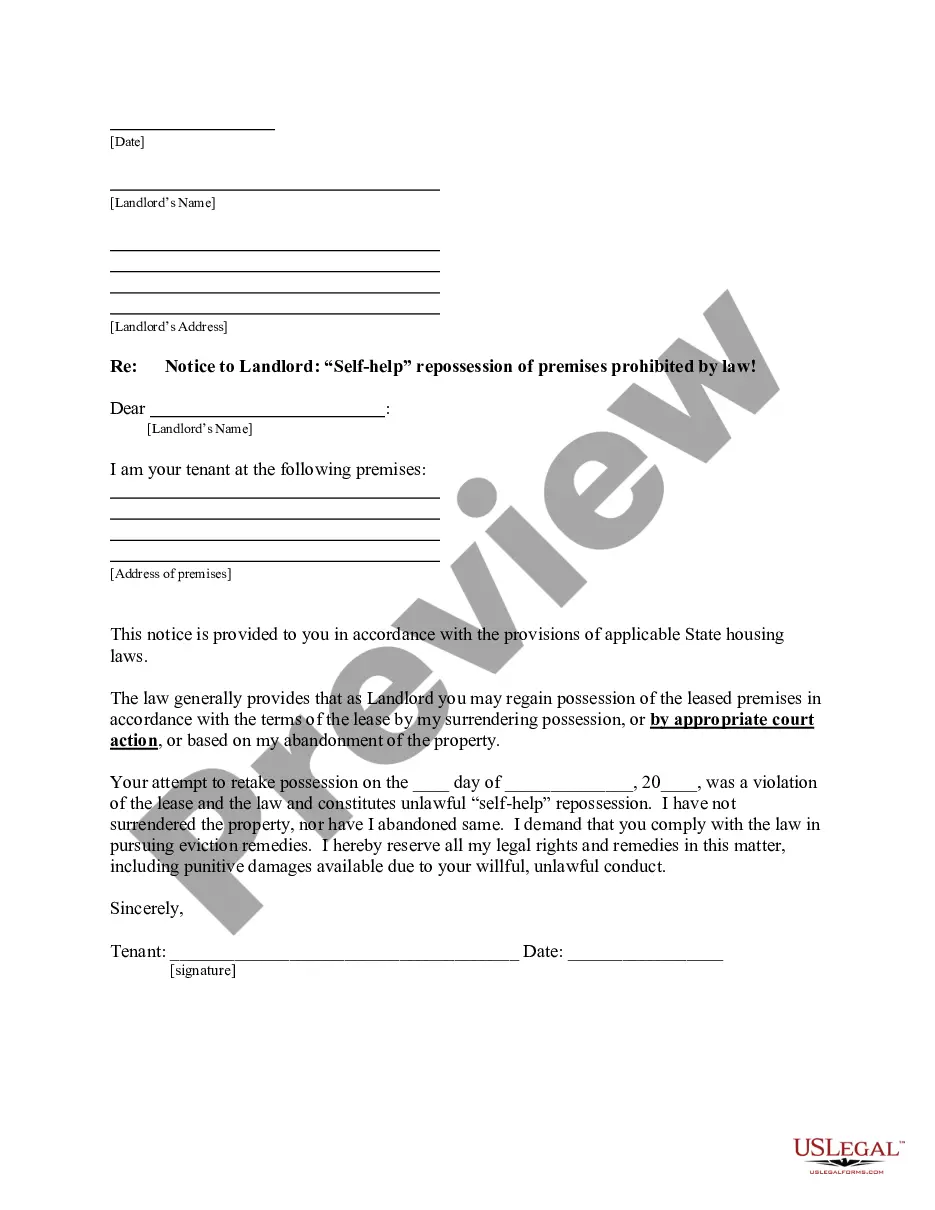

This form is a sample letter in Word format covering the subject matter of the title of the form.

Loan Payoff Letter Example With Credit Card In Franklin

Description

Form popularity

FAQ

1ˢᵗ Franklin Financial offers loans up to $15,000.

You may be asked to write and provide a letter to explain the recent inquiries on your credit report for up to 120 days. Letters of explanation for credit inquiries serve to clarify the reason behind each inquiry on your report. They reassure the lender of your ability to repay and that you are a responsible borrower.

A Payoff Letter memorializes a debtor and lender's agreement regarding a debt obligation's early payment and termination. Typically, upon satisfaction of its terms, the Payoff Letter terminates the underlying debt instrument and releases the debtor from most continuing obligations.

An explanation letter at work is a formal printed letter or e-mail written to explain something that occurred, to answer an inquiry, or to provide any missing information. Clients, contractors, team members, or students may write this type of letter to provide information and inform other individuals about situations.

In December 2006, First Franklin was sold to Merrill Lynch for $1.3 billion (~$1.89 billion in 2023), at a time when the shakeout in the subprime mortgage lending market had started to begin.

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online.

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online.

First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.